The future of wealth is shaped by a new generation of investors - bringing new thinking, expectations, and standards. Across this four-part series, Harbour delves into the evolving landscape and strategies for generating customer value, poised to be the primary catalyst for both present and future transformations in the sector.

In part two, Executive Director, Ainsley McLaren, discusses the opportunities that lie in understanding the investment needs and behaviours of women throughout their financial journey.

Women are increasingly taking charge of their financial futures, redefining societal norms, and embracing opportunities in fields traditionally dominated by men. In fact, as recently as the 1980s, women struggled to take out a loan or have a credit card in their own name without a male family member agreeing to co-sign.

One arena where women are carving out a space for themselves is investing, as they assert their presence and prowess as astute investors.

This is despite being up against more challenges than their male counterparts: women earn less on average and take more time out of the workforce for family reasons, they are living longer than men with less retirement savings, they are more risk averse (which means they can end up with lower returns), and, overall, women have lower financial wellbeing and confidence compared to men.

As an industry, the opportunity lies in addressing these challenges and developing a better understanding of the investment needs and behaviours of women throughout their financial journey. By providing tailored advice and access to financial products and services geared towards a more equitable and inclusive playing field, we can further bridge the gender gap in financial wellbeing.

Retirement readiness

While conventional gender roles are evolving, with increasing diversity in family and household dynamics, enduring traditions have led to many women falling behind men in terms of retirement savings and readiness.

According to research conducted by ASB Bank, despite a pay gap of 9%, women are actually 2% financially better off day-to-day than men. Saving more, and spending less, women tend to be more resourceful with the money they have, but they are collectively missing out on around $750 million in retirement.[1] This isn’t just because they are taking more time out of paid work and/or contributing less to KiwiSaver, but because they aren’t capitalising on their savings for the long term.

Women’s investing perspectives pay off

When women do invest, they see results. With a generally lower risk tolerance than men, women often choose to adopt a more conservative investment strategy[2] (whereas men tend to engage in more frequent and speculative trading). Preferring to stay on course, with a long-term perspective, many women tend to focus on stability and sustainable growth rather than short-term gains. This perspective aligns well with proven investment strategies that emphasise patience, diversification, and risk management. Women's cautious and analytical approach can lead to more consistent and stable returns over time. In fact, an analysis in the US of more than 5 million investors over 10 years finds that, on average, women outperformed men by 40 basis points per annum (or 0.4%).[3]

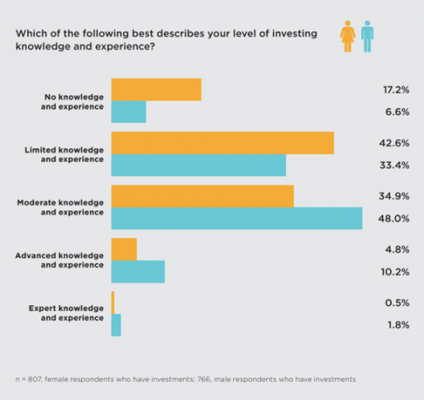

While this is encouraging, most women don’t see themselves as investors, with 60% saying they have either limited or no investing knowledge and experience (compared to 40% of men)[4] and they often lack the confidence to select investments that align with their goals or plan for their financial needs in retirement.

Source: FSC – Money & You, Women and Financial Wellbeing in New Zealand

Redefining traditional norms

Confidence in financial decision-making can be hindered by societal norms. Historically, the investment landscape was dominated by men, meaning generations of women were only exposed to financial skills through household budgeting, and were not taught how to control finances, engage with banks or investment providers, or undertake family financial decisions themselves.

But more recently, organisations, educational institutions, and advocacy groups have recognised the need to equip women with the knowledge and skills to navigate the complex world of finance. There has been a rise in online educational platforms in New Zealand and around the world specifically targeted at addressing these issues and breaking down investment barriers for women. This movement is enabling women to confront stereotypes and societal norms, as more venture into the share market, and various investment platforms. This access to investments is helping many younger women to build capability to make informed decisions and manage portfolios effectively – but there is still a long way to go in getting women of all ages comfortable with investing.

Financial advice for women

Most women say they would like to be more active in their finances, including investment decisions. So, what holds them back? 65% of women say they’d be more likely to invest, or invest more, if they had clear steps to do so. Moreover, 77% of women believe that if they had a financial adviser to help them invest, they’d be more confident about their financial future – yet fewer women receive financial advice than their male counterparts. [5]

The reality is 90% of women will have to make financial decisions alone at some point in their lives as they potentially outlive their husband or inherit personal wealth from their parents. But, reportedly, 80% of widows switch financial advisers within a year of their husband's death.[6] Why? Because in most cases the adviser has dealt solely with their husband for years and has not acquired the skills they need to effectively deal with women clients. This may be less reflective of younger generations, but as New Zealand’s ageing population accelerates, the needs of this demographic are worth considering.

As cautious and analytical investors, women tend to ask more questions, and need more information to feel assured in their investment decisions. Building connection and trust in financial advice is key to empowering women on their journey to financial freedom.

Women are more likely to invest responsibly

Women are also leading the charge in socially responsible investing or impact investing. Their analytical, long-term investment approach means they are more inclined toward investments that align with their values, such as companies with strong environmental, social, and governance (ESG) practices. A survey in the US[7] found that women are more than twice as likely as men to say it is extremely important that the companies they invest in integrate ESG factors into their policies and decisions. The survey also found that 74% of women were interested in increasing their share of ESG investments in their current portfolios and were significantly more likely than men to have an interest in learning more about ESG investing.

With increased financial literacy, strategic investing approaches, and a commitment to ethical practices, women are not only building wealth for themselves but helping to shape a more equitable and sustainable financial future for all. It is imperative for government, financial institutions, and advisers to continue to look at ways to encourage and empower women to thrive in the world of investing.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.

[1] Women better off day to day but miss out on $750 million at retirement: ASB reveals New Zealand’s financial wellbeing gender divide

[2] Strong Evidence for Gender Differences in Risk Taking - ScienceDirect

[3] FidelityInvestmentsWomen&InvestingStudy2021.pdf

[4] Money and You - Women & Financial Wellbeing in NZ (fsc.org.nz)

[5] FidelityInvestmentsWomen&InvestingStudy2021.pdf

[6] Advisorpedia - Why 80% of Women Leave Their Advisors When They Lose Their Husband

[7] RBC Wealth Management women-are-leading-the-charge-for-environmental-social-and-governance-esg-investing-in-the-us-amid-growing-demand-for-responsible-investing-solutions