Key points

- It was a strong month for global markets. The MSCI All Country World Index (ACWI) returned 3.5% in New Zealand dollar terms, and 5.4% in New Zealand dollar-hedged terms. Returns were strong across all sectors, with consumer discretionary standing out at 9.9%. There was a general shift towards cyclical sectors with industrials and materials rounding out the top 3.

- Australasian markets also rallied, with the S&P/NZX 50 Gross index (with imputation credits) advancing 0.9% and the S&P/ASX 200 Index adding 1.8% in AUD terms (and 2.4% in NZD terms). Equity markets were supported by a combination of inflation data continuing to fall to levels where central banks are close to pausing interest rate increases, and economic growth data and company updates that were better than expected.

- The New Zealand bond market was weak, the Bloomberg NZ Bond Composite 0+ Yr Index declined -1.1%. This negative move was, in part, reflective of the global market that has been unwinding expectations that central banks might quickly start cutting rates as evidence of peaking inflation continues. Also pushing New Zealand yields higher has been sensitivity around increasing government bond issuance as government spending increases while tax revenues are declining.

Key developments

Better-than-expected economic data in Australia and the US supported a broad recovery in equity markets over the month. While technology stocks continued to lead markets higher, the emergence of the view that an economic soft landing is possible – slowing economic activity and lower inflation, without a sharp increase in unemployment – contributed to a wider range of equity sectors generating positive returns later in the month. The soft-landing scenario also contributed to New Zealand Government 10-year bond yields increasing 34bps to 4.62% and Australian Government 10-year bond yields increasing 42bps to 4.02% over the month, reflecting higher terminal central bank official cash rate expectations. Despite the negative impact of higher government bond yields on valuation multiples, the better-than-expected economic and company update news forced investors to buy equity risk.

The combination of lower inflation data points that reduced the risk of Reserve Bank of New Zealand (RBNZ) official cash rate increases, and better-than-expected company updates, supported a broad rally in the New Zealand equity market over the month. Importantly, consumer inflation expectations fell sharply from 4.8% to 4.3%, which may explain the improvement in consumer confidence, and may take pressure off the RBNZ to lift rates aggressively, which, in turn, reduces risk to New Zealand equity market valuations.

The New Zealand equity market was led up by positive returns from the information technology sector (positive updates from Vista and Serko), the real estate sector (Precinct and Goodman Property up on lower interest rates), utilities (positive monthly generation data from Meridian and Contact Energy, well-supported capital raise from Infratil), selected health care shares (F&P Healthcare, positive news flow for Ryman and Summerset) and selected industrials (better-than-expected updates from Fletcher Building and Mainfreight). Share price underperformance, reflecting company specific news from Pacific Edge (tests not covered by US CMS funding), Ebos (contract loss), Freightways (earnings downgrades on cost and volume headwinds), and a2 Milk (further weakness in Chinese infant formula demand) detracted from the New Zealand market’s performance.

After a surprise 0.25% increase in cash rate target to 4.1% by the Reserve Bank of Australia (RBA) early in the month, Australian economic data released over the remainder of the month also provided a better mix for equity market returns. The Australian Consumer Price Inflation (CPI) index for May slowed to 5.6%, below consensus market expectations of 6.1%, but remained well above the RBA's target, whilst Australian retail trade for May grew 0.7% month on month (MoM), ahead of consensus expectations of +0.1%. While the deceleration in the Australian CPI is helpful, the RBA is balancing a higher terminal cash rate and weaker consumer against stronger population growth. The better-than-expected retail sales data may reflect heavy discounting by retailers. Discretionary spending may slow with rising cost of living pressures; while the Australian ANZ-Roy Morgan Consumer Confidence Index increased 2.5 points to 74.9, it remains subdued, with confidence in 'future financial conditions' at its weakest since March 2020.

What to watch – Chinese growth has stalled – implications for ANZ?

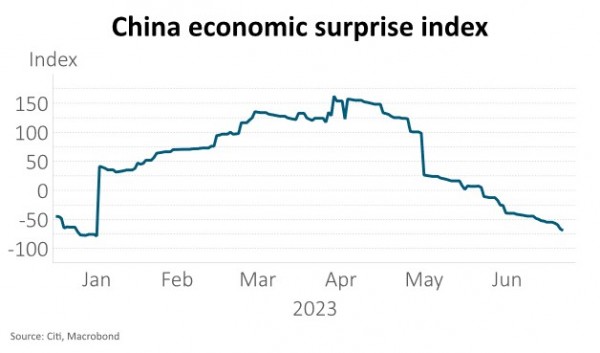

Chinese growth has stalled. Real estate and consumption are the key areas of weakness. Real estate investment has fallen more than expected. New housing starts, property sales and house prices are dropping. For consumption, spending on goods and food has failed to sustain the growth seen in Q1. Economists have been making sizeable revisions to their growth forecasts for this year from around 6% to less than 5.5%. It now falls to policy makers to determine whether the "around 5%" growth target this year will be beaten. Policy stimulus is likely to be multipronged, involving interest rate cuts, reductions in banks' reserve requirements, lending to support infrastructure investment and targeted policies to activate consumer spending. There are no guarantees, however, as the government has increasingly shifted its focus to the quality of economic growth.

Market outlook and positioning

The NZIER New Zealand Quarterly Survey of Business Opinion (QSBO) released in early July showed a soft New Zealand economy that is getting softer. Businesses’ own activity expectations fell to -17 which suggests activity may bounce along the bottom for the rest of this year. Importantly, the inflation and labour market indicators have slumped. Difficulty in finding labour has reduced with difficulty in finding unskilled labour falling from -37 to just -10. Labour as the major factor constraint has diminished further. Capacity utilisation has slumped to 87.1 (GFC levels) from 94.0. Selling price expectations fell, with a net 48% of businesses expecting to raise prices down from 61% a quarter ago and a peak of 77%. The QSBO suggests that the RBNZ’s inflation forecasts are right and New Zealand is moving rapidly towards maximum sustainable employment. For New Zealand equities, the QSBO should reduce the earnings and valuation risk associated with further RBNZ official interest rate increases but does highlight the risk for companies who are dependent on New Zealand economic activity.

The US economy is proving to be surprisingly resilient. While CPI inflation has more than halved, helped by goods disinflation and falling energy prices, core inflation remains sticky. Much of this relates to a still-tight labour market that is keeping services inflation high, including rents. The US unemployment rate is close to all-time lows at 3.7% and average hourly earnings are running above 4% y/y. One of the Fed's favourite indicators of labour market slack, the number of job openings per unemployed person, increased to 1.8 in April – well above pre-COVID levels of 1-1.25 and arresting the decline seen in Q1. Inflation persistence may necessitate further rate hikes by the Fed. The Fed's June forecasts implied two more 25bp hikes this year, but the market only prices a touch more than one. Most worrying is the large amount of rate cuts the market prices for next year (130bps) that may not eventuate if core inflation is slow to return to the 2% target.

With consumer inflation expectations normalising, and long-term inflation expectations remaining anchored, we see reduced equity market valuation multiple risk from aggressive central bank moves. Equity market valuation multiples are full – the New Zealand equity market at a 21x prospective price to earnings (PE) multiple is 5% above its 5-year average (excluding January 2020 to June 2022), and the Australian market at a 15.2x PE is trading at a 4% premium to its long-term average of 14.6X. Research by Citi indicates valuation alone has not been a good indicator of medium-term market direction. For the US S&P 500 index, weekly data since 1949 shows that the S&P 500 PE tends to de-rate by less than -1x on average in the next six months when multiples break above 20x (where it currently sits). Interestingly, 40% of the time the S&P 500 index moves higher from a 20x starting point. But higher valuation multiples are associated with lower subsequent returns - since 1950 the S&P 500 has delivered an average forward 12-month return of 5.4% from a starting PE of 20x plus.

Within equity growth portfolios our strategy continues to position for a range of scenarios and to be selective. We can see an equity market with more backing-and-filling after solid gains, with our views more driven by earnings expectations. We continue to favour investments that have their own idiosyncratic return drivers and are less dependent on strong economic activity. The recent rally in AI-related investments highlights that secular trends take time to be reflected in returns, and require a degree of patience to navigate periods of underperformance, but when they do get momentum, they can be powerful economic forces. We continue to focus on appropriately valued investments that benefit from secular tailwinds including technology dispersion, de-carbonisation, and demographic changes. And we have a bias to quality, well-capitalised businesses that are less vulnerable to a tightening in financial conditions.

Within fixed interest portfolios, the recent rise in yields in the domestic bond market has been at odds with the economic developments that we have been observing. With increasing signs of a slowdown in the private sector of the New Zealand economy, via weaker corporate profitability, increasing mortgage payments arrears, and a less stretched labour market, one might expect bond yields to be declining. Instead, they have been rising in line with global moves, essentially reflecting a long-standing history of high correlation between the markets. Our sense at present is that, while the macroeconomic cycle in New Zealand is playing out roughly in line with the economic cycle in developed economies, the New Zealand data is softening ahead of a similar development we expect to see globally. This is no great surprise, as the RBNZ started hiking interest rates earlier than most and went more aggressively as well. Our judgement is that with the RBNZ signalling that they have completed their rate hike cycle, subject to data that would force a change, the market will start to develop a greater conviction that OCR rate cuts can be anticipated. With the market not pricing any chance of a cut before May 2024 and at no stage through to 2027 falling below 4%, we see value in the market at present. We would not be surprised to see the economy to continue to weaken over the next 6 months and for the market to take yields lower.

The Active Growth Fund is defensively positioned. The rally in share markets has seen equities trade at a narrow forward-looking risk premium relative to history, even considering recent falls in bond yields. While this is not a short-term indicator, it does temper our medium-term outlook for equities. That said, we are excited about the prospects for growth equities going forward which were challenged in 2022 battling with yields which were up significantly. With central banks well into their tightening cycle, the headwinds for growth equities may shift from bond yields to more idiosyncratic drivers making the operational performance of companies the key driver of returns. We are overweight fixed interest duration relative to our benchmark.

Within the Income Fund strategy continues to reflect some caution towards equity markets and an increasingly positive attitude towards fixed interest. In equity markets some better performance has occurred and we have taken profit on an increase in global equities that we added in May. Overall equity exposure is now 26.5%, which is 5.5% below our neutral weighting. One aspect of the lower equity weighting is based on how attractively we are seeing fixed interest at present. The average yield on the fixed interest holdings is currently 6.7%. In synch with our view on fixed interest, we have lifted the duration of the fixed interest holdings from 3.5 years at the end of May to 4.25 years in early July. Over this time period the yield on the 5-year interest rate swap has increased from 4.5% to 5%.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.