The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed interest, credit and equity markets.

- Global equity markets delivered strong returns in May, up 1.6% in US dollars. Cyclical stocks continued to outperform, helping lift the Australian market by 2.3%. New Zealand shares underperformed, down 3.2% over the month.

- Bonds delivered a negative return, with the Bloomberg NZ Bond Composite Index down -0.7%.

- US economic data have been mixed over the past month and should benefit over the coming year as consumers spend a portion of the US$1.8trn of excess savings built up since COVID-19. US job growth unexpectedly moderated in April and the unemployment rate increased. CPI inflation was surprisingly high at 4.2% year on year.

Key developments

Global and local data remained strong, consistent with an economic recovery and continued vaccine rollout. A surprise to markets during the month was the higher-than-expected US inflation data, which saw the pro-cyclical reflation rotation continue within equity markets with investors moving from higher growth and bond yield-sensitive investments to economic recovery-sensitive investments. This saw the MSCI All Country Value index, outperform the Growth index by 3% over the month. Overall, global equity returns were strong with the MSCI All Country World Index up 1.6% in USD (+0.1% in NZD).

The New Zealand equity market (S&P/NZX 50 Gross with imputation) finished the month down 3.2%. Earnings downgrades from a2 Milk and Fisher and Paykel Healthcare were the main drivers. The Australian equity market (S&P ASX 200) once again outperformed, rising 2.3% for the month (1.1% in NZD). Australian market returns were led by continued strength in the financial and healthcare sectors with the laggards being technology, utilities and energy sectors.

The New Zealand economic recovery has accelerated in recent months as retail sales have recovered, service sector sentiment has improved, and the labour market unexpectedly tightened. Strong global demand, particularly from China, and higher commodity prices are helping the export sector. A continuation of these dynamics, amid ongoing fiscal and monetary policy support, should sustain economic growth over the next year. This also increases risks that higher inflation over coming quarters, driven largely by temporary factors, becomes more persistent as wage growth increases and inflation expectations adjust higher.

The strength of New Zealand’s economic recovery saw the Reserve Bank of New Zealand (RBNZ) adopt a more hawkish tone in its May Monetary Policy Statement. Publishing plans to start hiking the OCR in Q3 next year and implement a further 1.25% of hikes to Q2 2024. This saw the New Zealand Government 10-year bond yield rise from 1.65% to 1.80% over the month, leading to negative bond returns.

What to watch

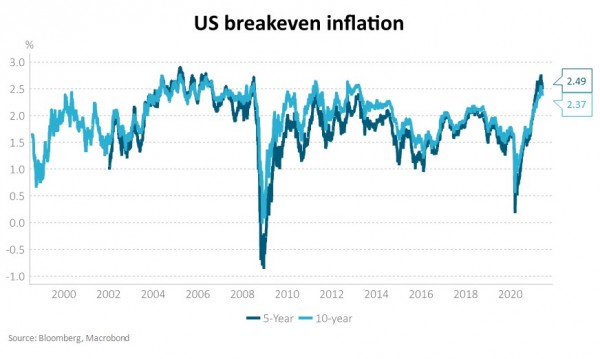

Inflation breakevens: Higher near-term inflation is now well-priced by global markets with inflation expectations now at post-GFC highs. The focus is now shifting to the prospect of this being sustained via increased wage growth. Large global central banks continue to discount this prospect and remain committed to ongoing stimulus as employment remains well below desired levels. The US, for example, has 8 million fewer jobs than prior to COVID-19.

Market outlook and positioning

Economies across the globe have entered a cyclical recovery and the global vaccine-driven reflationary recovery continues to be a key influence on capital markets. Investors may continue to allocate capital to more economically sensitive investments in the near term as vaccine rollouts allow economic re-opening. Supply chain friction is contributing to near-term inflation, and the speed of recovery is rightly giving central banks reason to pause in providing additional stimulus, which in combination may continue to see investors wary of upside risk to bond yields.

Equities often struggle to digest large and fast increases in rates, which have historically triggered shifts in the equity/bond correlation. The equity/bond correlation has been structurally negative over the past two decades, in line with record low inflation. Research by Goldman Sachs indicates US inflation above 2% has usually resulted in a more positive correlation (as bond yields go up equities go down). The US Federal Reserve’s reaction function to inflation is one of the key determinants of this change. Inflation’s potentially transitory nature, a supply-constrained labour market recovery, and the Fed’s commitment to data rather than forecast dependence, may mean the US Fed remains dovish for now. The Fed’s move to a less stimulatory stance – with the RBNZ leading the way in recent weeks - may trigger increased equity market volatility.

Within equities, May was not a great month for structural growth stock performance, with stocks including F&P Healthcare, a2, Ryman, Xero and Afterpay delivering negative returns. We view the wholesale rotation away from structural growth stocks as an opportunity to carefully increase investment in selected stocks. The rotation away from tech stocks due to rising interest rates may provide better entry points to increase investment in stocks with strong, multi-year compounding growth outlooks which we think can continue to perform well. A key exception to this rotation was the “satisfactory” result delivered by Mainfreight, a company that continues to deliver strong revenue and profit growth across all divisions.

Within fixed interest, our investment strategy has not changed materially over the last 8 months. We have held the view that bond yields are likely to rise, and this had led us to hold a short duration position for longer-dated bonds and to hold inflation-indexed bonds. The rationale for the view has shifted through time. In October last year we essentially took the view that a stronger economic recovery was unfolding, which soon became supported by the positive vaccine development news. The starting point was very low bond yields and we judged that the RBNZ would not need to cut the OCR into negative territory. As time has passed, the economic rationale has shifted towards inflation concerns and the anticipation of rate hikes.

The Active Growth Fund holds an overweight position to global shares, with less in New Zealand shares. This is partially to provide the Fund with exposure to more cyclical investments and due to valuations looking less full globally relative to domestically. The Fund continues to tilt to strategies that are less benchmark-aware or are positioned to continue to benefit from structural tailwinds.

The Income Fund’s overall equity exposure, at 29%, is a little below the neutral weight of 32%. Our equity team notes that, after the positive earnings season, several of our favoured equities prices have lifted. In the near term, there is not an obvious catalyst for additional strong performance. Accordingly, we are happy to be patient and have scope to add exposure in the event of a pullback in prices.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.