ESG (Environmental, Social and Governance) considerations play a central role in Harbour’s investment philosophy.

Harbour is a market leader for integrating ESG research into our investment process.

ESG considerations are important for two reasons:

As a responsible corporate citizen, with a fiduciary duty to our clients, we have an obligation to consider all types of risk. This includes the environmental, social and governance risks associated with the companies we invest in.

As active investors, we believe that ESG risks and opportunities are often not fully reflected in the market price for securities. We are able to use this knowledge to invest to achieve better outcomes for our clients.

At Harbour, we employ a strategy of integration and company engagement. This means our team researches companies we invest in and actively checks for any environmental, social or governance (ESG) risks that may apply to them. It helps our Portfolio Managers develop an understanding of each company, and influences not only whether we invest in companies, but also how much. It helps us to unearth companies which may be great opportunities for long term growth, as well as companies with potentially hidden risks.

We are able to use our role as a shareholder to engage with company leadership, highlight any concerns we may have and use our influence to encourage better behaviour.

We also apply a baseline of exclusions to the funds which employ our ESG strategy, to remove companies whose business activities may lead to significant harm in society. Exclusions cover areas such as tobacco, nuclear explosives, cluster munitions, anti-personnel mines, pornography and controversial firearms. We explain how these exclusions are applied in our Environmental, Social and Governance Policy, available above.

Our annual Corporate Behaviour Survey researches how companies rate on issues like:

Environmental

-

Carbon emissions

-

Energy use

-

Waste

-

Environmental policies and risk management

Social

-

Health and safety

-

Modern slavery

-

Stakeholder relations

-

Diversity

Governance

-

Board composition

-

Executive remuneration and incentives

-

Ethics

-

Anti-competitive practices

Harbour has been a UNPRI signatory since 2010.

Harbour is also a member of the RIAA.

You can read about Harbour's approach to corporate responsibility here.

Policy Submissions

Harbour’s engagement program not only focuses on constructively working with companies in our investment universe, but also contributing to public policy/regulatory consultations to positively influence policy settings relating to ESG considerations.

Climate Statements

Read our climate-related disclosure (CRD) documents for the Harbour Investment Funds Scheme.

| Link to Climate Statements |

| Climate-related disclosure (CRD) 30 June 2025 |

| Climate-related disclosure (CRD) 30 June 2024 |

Stewardship

We demonstrate our responsible investing philosophy and fiduciary duty by keeping active in our investments through our extensive engagement programme and proxy voting process.

Engagement Strategy

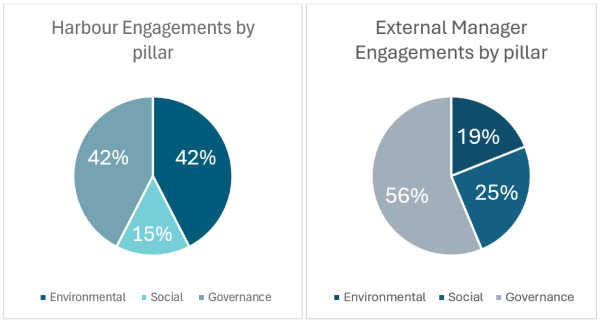

Our engagement over the year continued to focus on climate change and key social issues such as human rights and health and safety. The main driver of our climate engagement agenda was discussing the first year of mandatory reporting where most NZ listed companies were captured. Engagement on social issues, particularly human rights, was largely focused on violations related to geopolitical conflicts while discussions closer to home involved issues such as health and safety and Te Ao Māori consideration.

Climate disclosure engagements revealed that there was broad consensus over how costly and resource intensive the exercise had been to produce these reports and how it had detracted from other sustainability work. Potential reforms to the regime have subsequently been proposed in a public consultation from the Government which we submitted on. As a follow up, we also engaged with policy representatives at MBIE along with industry peers to express our views of the impact of the regime on our sector and how the settings could be improved. In terms of engagements with companies on actual climate action, we found that despite the general ESG backlash driven by the new US Government, most companies we spoke with remained committed to their targets and were progressing their decarbonisation initiatives to meet them.

Regarding social issues, engagement on upholding human rights were mainly centred on companies in our global funds with exposure to geopolitical conflicts, particularly the Israel – Palestine occupation. This followed the development of our new human rights framework that involved refining our escalation approach where engagement and/or divestment played a greater role. In some cases, we attempted to engage companies that were identified as having some involvement in the conflict that resulted in human rights violations to raise our concerns and inform them of the outcome of our risk assessment. Domestically, there was minimal change in company practices to address modern slavery given there was no regulatory catalyst. Conversations tended to be more idiosyncratic and sought further insight for those companies where it was more of a material issue due to the nature of its industry and/or geographic exposure. Other social engagements involved querying companies on health and safety issues where we noticed concerning trends in employee injury rates or specific incidents highlighted in annual disclosures.

Our engagement strategy also continued to capture companies with contentious governance issues such as Board composition and executive/director remuneration particularly around company AGMs. There were a higher number of companies this year with contentious remuneration resolutions and several conversations were had with company Chairs justifying these proposals given concerns over the size of bonus packages and the lack of transparency over the performance criteria used to award them.

Engagement Breakdown

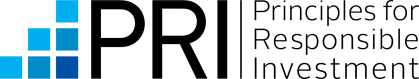

During the reporting period we conducted 33 ESG related engagements on ad hoc issues in addition to the engagements we conduct annually as part of our Corporate Behaviour Survey process.

We have also measured the engagements conducted by our external managers utilised in our global and multi-asset funds with pillar breakdowns provided below. There were 1418 total engagements across these managers with a higher proportion focused on governance compared to our in-house engagements that had a balanced proportion with environmental issues.

There were a variety of different ESG issues covered in these engagements and, in some cases, they involved multiple interactions with the company. As part of our engagement strategy, we engaged with thirteen companies on climate change and five on social aspects including modern slavery and health and safety. We continued to engage on AGM resolutions relating to compensation through seven executive/director remuneration engagements and four on director elections. There were also six engagements on miscellaneous ESG issues such as querying regulatory investigations and promoting improved sustainability disclosure.

Outcomes from these engagements were generally constructive with many of the companies receptive to our concerns and in some cases taking action to improve on the issues identified, as demonstrated through the case studies below. We acknowledge that some of these issues are long-term in nature and take time to enact change. We are both patient and confident companies will eventually make the appropriate adjustments, but we will continue to monitor and liaise with them until these are made.

Case Study 1:

We participated in a collaborative engagement with the GM of Sustainability at a NZ materials company along with our peers to discuss the company’s climate strategy. Although the company has been making gradual progress in reducing its emissions, we wanted to seek clarity over its strategic direction given the recent senior management and board changes and review of its science-based target.

Outcome: In our view it was a positive engagement where we learnt that the company is currently undergoing verification of a more ambitious (1.5 degree aligned) target that has been endorsed by the board and management. A greater level of detail in the company’s climate disclosure was also encouraged by our group going forward, particularly at the business division level which they stated would be taken into consideration for its reporting later this year.

Case Study 2:

We engaged with an Australasian financial company following the announcement that the Australian Securities and Investment Commission had launched an investigation into market manipulation as well as media speculation that its NZ business was under investigation by the NZ Financial Markets Authority (FMA). We acknowledged the investigations may be at an early stage and full information may not be publicly available but requested if they could share any detail on its response to date and any changes the company planned to implement.

Outcome: The company responded that they were not aware of any investigation by the FMA and that no one in its NZ business was connected to the matters under investigation at its Australian business. However, following the media speculation, the NZ business did still review a number of its processes and associated controls to ensure these were still fit for purpose.

Case Study 3:

We engaged our external manager T. Rowe Price to discuss a Canadian utility company’s involvement in supplying components used for tritium production in the US nuclear weapons program. Independent research confirmed a strong link, raising questions about exclusion criteria.

Outcome: T. Rowe Price conducted further due diligence and based on new evidence, added two entities to their Nuclear Weapons Exclusion List, replacing one investment with another in their Global Impact Equity strategy. The ownership structure and contract details were clarified, showing that the majority equity investment in one company is exclusively linked to a specific investment entity, and another entity is now held for impact and decarbonisation purposes.

Summary

On the whole, engagement over the year has been dominated by the first round of mandatory climate disclosures with the conversations centred on how companies have responded to the requirements and what they thought about the effectiveness of the regime in general. Although climate disclosure was the primary sustainability topic discussed, there were still other issues covered during engagements including governance concerns, health and safety, and customer hardship.

Going forward, we expect climate disclosure to continue to be a key focus as companies turn to some of more difficult reporting aspects such as transition plans that were optional to provide in the first year. We may also see more attention paid to other emerging sustainability topics like the role of nature and biodiversity as well as the risks of generative artificial intelligence use.

In addition, we will continue to engage companies as any material ESG issues arise, particularly on contentious areas proposed during company AGMs. This also includes maintaining our dialogue with companies that we have identified as lagging in an issue such as Board independence, remuneration or ESG disclosure, by constructively working with them in the long term to achieve the best outcomes for shareholders.

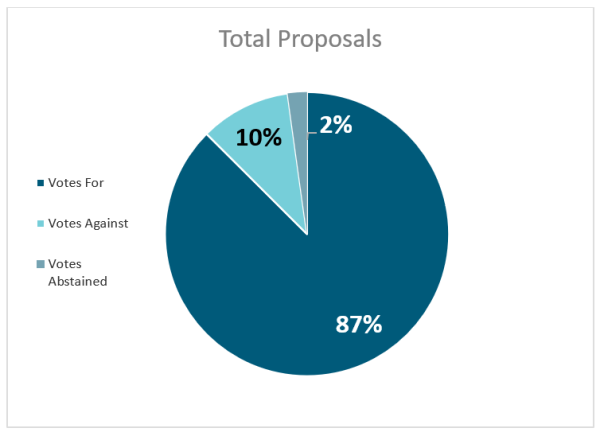

Click here to see Harbour's voting statistics for 2024

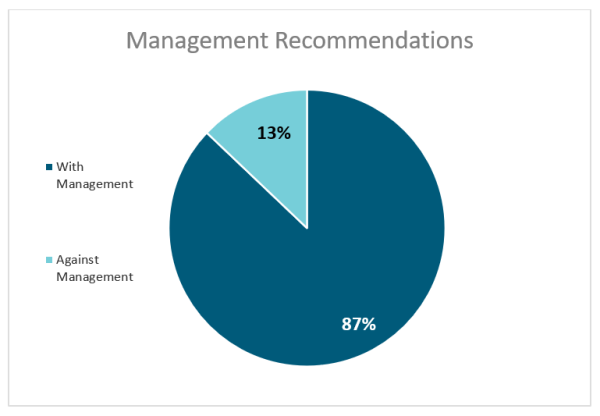

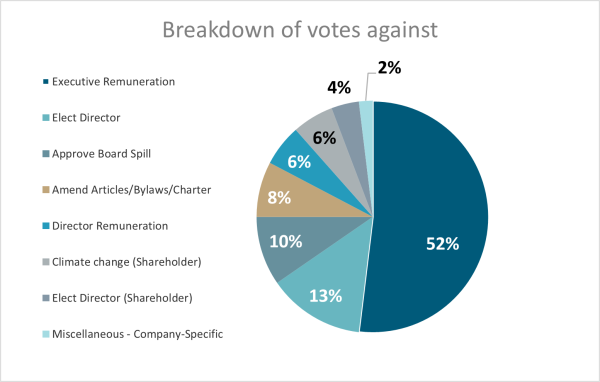

The most prevalent voting resolutions that were contentious over the year related to executive remuneration followed by the election of directors. There was a similar amount of shareholder resolutions filed compared to the previous reporting period for companies in Harbour funds with these largely focused on climate change.

On executive remuneration, an example where we voted against management recommendations was for an Australian real estate company regarding multiple resolutions to approve the bonuses paid to executives. This was due to the significant level of bonuses paid over the year when there was a fatality reported. In addition, the magnitude of the long-term incentive payment continues to be excessive relative to peers. The resolution still passed in the end receiving 65% shareholder support.

There were more director elections opposed by Harbour compared to the last reporting period with most of these due to the lack of independence or as a signal for poor remuneration practices. There was also a couple of shareholder endorsed director candidates in one case that we did not deem as justified to be appointed and therefore voted accordingly.

Climate change resolutions were proposed by shareholders but were often not put to the meeting given they were conditional on the resolutions to amend constitutions which did not carry. Regardless, our voting intentions tended to be against these proposals given requests for climate action or information where in many cases companies were already making solid progress. Examples included the major Australian banks who have joined the Net Zero Banking Alliance, set near term targets in their lending portfolios (sector specific) and committed to the phasing out of financing fossil fuel production.