Key points

- The MSCI All Country World Index returned 1.3% in New Zealand dollar terms, and -1.9% in New Zealand dollar-hedged terms. At the sub-sector level, we saw a continuation of last month’s thematic with defensive sectors (utilities, materials) lagging as investors rotated into the more interest rate-sensitive sectors such as information technology and financials.

- The New Zealand equity market (S&P/NZX 50 Gross with imputation) returned -0.6% over the month. Consumer discretionary was the best performing sector over the month led by a strong performance by Kathmandu which delivered a better-than-expected profit outlook. On the other hand, materials were the worst performing sector dragged lower by Vulcan Steel post a weaker than expected profit result.

- Both New Zealand and global bonds delivered negative returns over the month with the Bloomberg NZ Bond Composite 0+ Yr Index down -1.5% and the Bloomberg Global Aggregate Index (New Zealand dollar-hedged) down -1.7%.

Key developments

Equity markets gave back some of the January month gains with an increase in bond yields (New Zealand Government 10-year bond yields increased 0.4 percentage points to 4.57% over the month) impacting negatively on the valuation of equity cashflows (particularly for higher growth, long duration stocks, where cashflows are further out) and pushed price to earnings (PE) multiples lower. The potential need for central banks to lift official interest rates or keep them higher for longer, to suppress economic activity and hopefully inflation, also increased the earnings risk for cyclical stocks that are more sensitive to economic activity.

Recent data have challenged the global disinflation narrative. The US labour market has remained unexpectedly tight and, combined with a resilient service sector, has translated into persistently high inflation. US core inflation is running at a 5% annualised pace, based on the previous three months of data. Global activity is benefitting from China's re-opening. Europe particularly, with business surveys suggesting the manufacturing sector is expanding again. With the inflation target at 2% for most central banks, they can’t yet declare victory. The US Federal Reserve and European Central Bank decisions both emphasised the need for further tightening and that policy will likely need to remain restrictive for some time to ensure inflation has been tamed.

In New Zealand, the Reserve Bank of New Zealand (RBNZ) lifted the Official Cash Rate (OCR) by 50bp to 4.75% on 22 February and its updated forecasts showed that it continues to anticipate a 5.5% peak in the OCR, albeit in Q3 rather than the Q2 implied by the previous November 2022 Monetary Policy Statement (MPS) forecasts. The short story is that, despite some early signs that the pressure on prices is easing, inflation remains too high, and the labour market is too tight for comfort.

What to watch

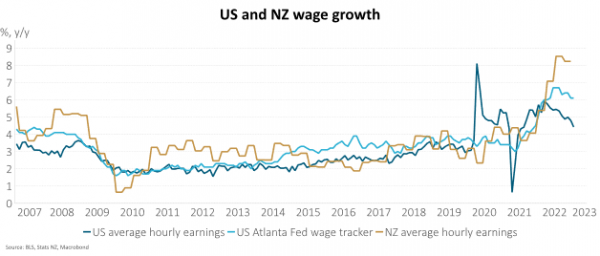

Supply chain normalisation and lower commodity prices won't be enough to return inflation to target, labour markets need to loosen. Shipping costs have returned to pre-COVID levels and energy prices have fully retraced the increases associated with Russia's invasion of Ukraine. Housing related costs should fall as house prices decline and higher interest rates continue to bite. But tight labour markets are continuing to create too much wage inflation for service sector inflation to drop sufficiently. In the US, for example, average hourly earnings are still growing at more than 4% y/y and the Atlanta Fed wage tracker is above 6% y/y.

Market outlook and positioning

The equity market has recovered a long way from the October 2022 lows. Bond yields have stabilised, growth has been better than expected and, until recently, most inflation indicators have pointed down.

It is possible that economic growth starts to slow through the next few months. However, China and Europe are showing better growth – with the end to zero-COVID and a large drop in energy prices lifting demand. This may mean a further rotation out of US stocks and the US dollar continues, while investors are also drawn back into elevated investment grade credit yields.

The irony is that stronger economic growth and some disappointment in inflation data may point to investors questioning whether this is a better mix than slower economic activity and a further decline in inflation. The former mix could suggest that the US Federal Reserve may lift rates a lot further to cool both the economy and dampen inflation.

Our base case is still for a near term moderation in inflation, globally and in New Zealand. And the lead for lower inflation still seems likely to come from falling goods prices and lower energy costs, while later in the year housing related costs should also fall. Locally, the inflation picture may be more mixed with the tragedy of cyclone Gabrielle impacting the capacity of the economy.

But, turning back to the global picture, what is clear from company earnings reports is robust outcomes for revenues were more than matched overall by rising costs. This mix has not been toxic to date for equities as downgrades for earnings expectations have been milder than expected. Outlook statements have tended to be a lot more cautious, especially for retailers and homebuilders. This seems to be a consistent picture across developed markets as the lagged impact of higher lending costs impacts household disposable incomes.

Ideally markets would experience better inflation data as economies slow somewhat, and corporate earnings expectations are tempered. The inflection we would all like to see is a clearer message from central banks that they are done raising interest rates. Unfortunately, it seems that, in the near term, the ideal mix of slowing demand and further falls in core inflation may be just out of reach.

It is possible that equity markets look through the narrow gap for both inflation and growth, and if positioning in markets was as short (or bearish) as it was at the beginning of 2023, it may have been the more likely path of least resistance of markets. Instead, it seems possible that a period of volatility lies ahead, where investors perhaps use this time to establish portfolios both in more reasonably priced defensive growth sectors (we think large parts of the healthcare and technology sectors), and also look beyond the US into both Europe (on valuation grounds) and emerging Asia (looking for value and growth).

Within equity growth portfolios we remain active, taking profits in investments when markets get ahead of fundamentals and adding on weakness where supported by stock specifics. Within the portfolio we continue to maintain a mix of investments in enduring growth stocks (including quality defensive growth stocks in the healthcare sector that can sustain and grow returns through a period of slower cyclical economic activity), selected cyclical growth stocks (including financial stocks that have pricing power to deliver higher earnings in a period of higher inflation and increasing interest rates) and stocks that benefit from secular trends including demographic change, digitisation, industry disruption, decarbonisation (greenablers) and deglobalisation.

Within fixed interest portfolios we have taken the view, at this stage, that the floods in north-eastern New Zealand will require a considerable increase in infrastructure spending in the years to come. We expect that the need to rebuild roads, fix water-related infrastructure and replace housing will be a focal point of political and policy debate as we approach the Government's budget in May and the election in October. This development has scope to provide considerable challenges for fixed interest markets. It is possible that we see an increase in issuance of New Zealand Government Stock, while the RBNZ is less likely to be able to cut rates meaningfully in the future, as inflation risks persist. With these risks in mind, we are being careful about buying longer-dated bonds, other than inflation-indexed bonds. These New Zealand-specific risks also suggest that New Zealand bonds underperform other markets. This is already partly priced into the market. We have also seen an increase in the supply of corporate bonds. Some of this is coming at relatively attractive pricing levels, both in terms of outright yields, but also in terms of spread to government bonds. Having been underweight credit for several months, we are adding to positions now.

Within the Active Growth Fund the portfolio is defensively positioned. The rally in share markets has seen equities trade at a narrow forward-looking risk premium relative to history. While this is not a short-term indicator, it does temper our medium-term outlook for equities. That said, we are excited about the prospects for growth equities going forward which were challenged in 2022 battling with yields which were up significantly. With central banks well into their tightening cycle, the headwinds for growth equities are likely to shift from bond yields to more idiosyncratic drivers making the operational performance of companies the key driver of returns. We recently added a global bond fund managed by PIMCO to the portfolio. The recent increase in bond yields has provided an attractive entry point to this asset class with running yields close to 6% for a high-quality portfolio with an average credit rating of AA.

Within the Income Fund we have retained a relatively cautious approach for some time now. Fixed interest markets are becoming more attractive, with the average yield on New Zealand investment grade corporate bonds nearly at 5.5%. Ongoing tight monetary policy is largely priced into the market. Equity markets are less compelling, but importantly do not carry the same risk as they did 12 months ago. The dividend-generating sector of the Australasian equity market is now priced fairly expensively, so we are being careful about exposure in this sector and are less inclined to be adding to exposure at present.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.