- Slowing global demand, led by a stalling Chinese economy, has seen New Zealand’s commodity export prices fall sharply in recent months.

- Weaker export revenues will likely weigh on economic activity, supporting our view that further Reserve Bank of New Zealand (RBNZ) rate hikes are not necessary and causing a further deterioration in the fiscal accounts that may require additional bond issuance.

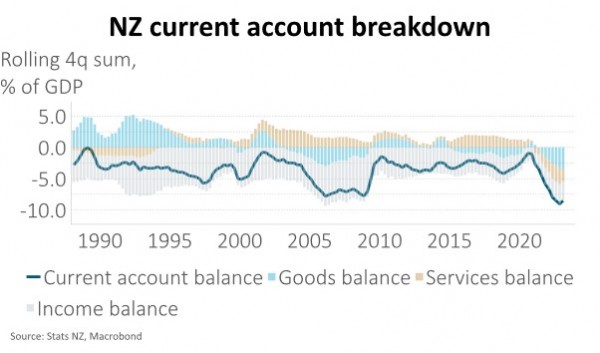

- Export weakness is also likely to slow improvement in the current account balance, prolonging New Zealand’s heightened reliance on the rest of the world and placing further pressure on NZ to provide greater appeal to the marginal foreign investor via a weaker NZD and/or higher long-term bond yields.

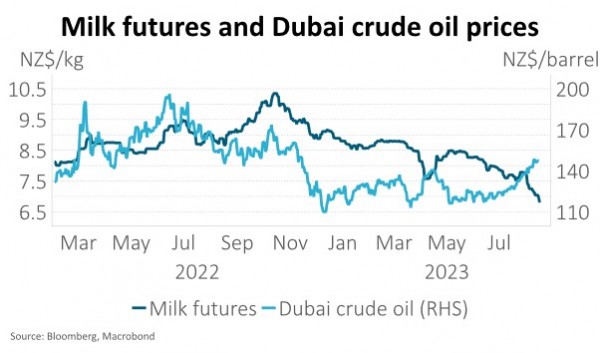

Slowing global demand has seen New Zealand’s commodity export prices fall sharply in recent months. In early August, Fonterra reduced its 2023/24 season milk price forecast by $1 to a mid-point of $7 per kg of milk solids. With Fonterra collecting milk amounting to 1.5 billion kilograms of milk solids each year in New Zealand, this equates to 0.4% of GDP before indirect economic effects are considered. Some economists suggest the broader impact on the economy could be as much as 4-5 times the direct effect. $7 per kg of milk solids is also 15% lower than last season’s price of $8.20 and below most estimates of a breakeven rate.

Milk futures prices have dropped more than 30% since their October 2022 peak. Prices of dairy products sold via the Global Dairy Trade auction platform have fallen sharply in the past two months with the aggregate price index down more than 10% in NZD terms. Dairy is our largest export, making up 30% of total goods exports or $22bn per year. Other key export prices have also been under pressure from slowing demand, including lamb and log prices. Meat and wood exports make up 12% and 7% of total goods exports, respectively. Unfortunately, farm costs have been moving in the other direction, putting pressures on the agricultural economy.

A combination of ongoing geopolitical risk and Organisation of the Petroleum Exporting Countries (OPEC) production cuts have seen crude oil prices increase more than 20% in NZD terms over the past two months. The recent removal of government fuel subsidies has added additional upward pressure to fuel costs for New Zealand households and businesses. Fertiliser prices are yet to fully reflect the decline over the past year and debt servicing costs are higher.

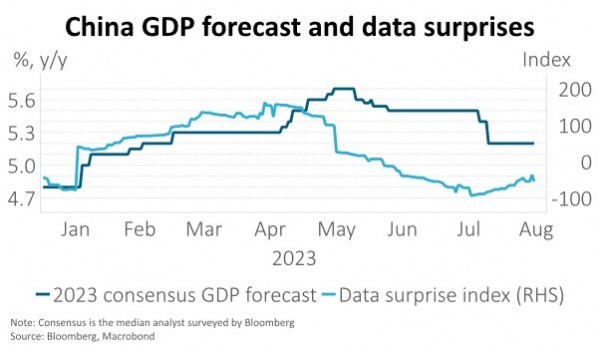

Weakness in global demand has been led by a stalling Chinese economy which is particularly meaningful for New Zealand as it’s our largest export destination. China buys almost a third of our goods exports and Chinese tourists accounted for c.12% of total short-term visitors prior to Covid; they currently account for just 2%.

Worryingly, Chinese consumption is a key area of recent economic weakness, in addition to the ailing property sector. Economists have been making sizeable revisions to their China GDP growth forecasts for 2023 from close to 6% to nearer 5%. It now falls to policy makers to determine whether the “around 5%” growth target this year will be beaten.

Policy stimulus is expected to be multipronged, involving interest rate cuts, reductions in banks’ reserve requirements, lending to support infrastructure investment and targeted policies to activate consumer spending. There are no guarantees, however, as the Government has increasingly shifted its focus to the quality of economic growth.

Weaker export revenues will likely weigh on economic activity, supporting our view that further Reserve Bank of New Zealand (RBNZ) rate hikes are not necessary. The direct impact of lower export prices and volumes is meaningful with goods exports equating to almost 20% of GDP. This becomes larger once indirect channels are considered. With lower revenue and higher input costs, exporters are likely to seek to reduce use of fertiliser and supplementary feed. Investment and maintenance of plant and machinery is also likely to be postponed. Larger farms may also seek to reduce the number of employees to lower labour costs.

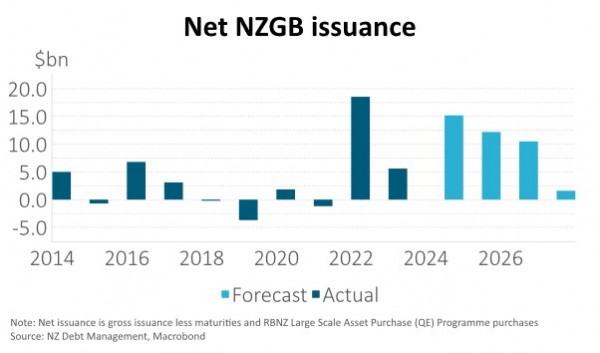

Slower economic growth is likely to cause a further deterioration in the fiscal accounts and may require additional bond issuance, in the absence of reduced government spending. Tax revenue was already running more than $2bn (or 2%) behind Treasury forecasts for the fiscal year to May. Ongoing disappointment in tax revenue may require greater debt issuance and add to an already large government borrowing requirement. This task is made more difficult as the RBNZ is no longer buying government bonds but instead actively selling $5bn a year back to the Treasury and not reinvesting maturing bonds. As a result, the latest Debt Management update that accompanied the May Budget showed net issuance (gross issuance less maturities and RBNZ purchases) over the coming four years is larger than the preceding four years. Relative to interest rate swaps and comparable global bonds, NZ government bonds have already seen increased sovereign risk premium being built into the yields as global investors respond to the deteriorating fiscal position, but more may be required.

Export weakness is likely to slow improvement in the current account balance. We wrote in April about New Zealand’s vulnerability relying on foreign financing. The most obvious example of this was the historically large current account deficit of 9% of GDP in Q4 last year. The current account balance improved marginally in Q1, to 8.5% of GDP but with export revenue so weak, we remain in the zone for a downgrade to our sovereign credit rating. For many, the base case for a current account improvement over the coming year is for tourism revenue to recover and import demand to decline as the domestic economy slows. While we agree with the idea that import demand will moderate, weakness in China and the global economy more generally, challenges the idea of a meaningful pickup in tourism. A higher reliance on the rest of the world may place further pressure on New Zealand to provide greater appeal to the marginal foreign investor. A weaker currency is the most common release valve in these situations but weakness in underlying assets, e.g. higher bond yields, is also possible. In the longer run, the combination of more debt being financed at higher interest rates poses a significant challenge for the economy, leaving the private sector with the burden of earning enough to avoid a decline in the nation’s prosperity.