- Our recent visit to China has changed our view of the structural impediments facing our largest trading partner.

- Demographic changes are impacting consumers’ medium-to-long-term outlook of the economy and they are adjusting their spending as a result.

- The a2 Milk Company gave us a flavour last month of the impact from deteriorating demographics on the youngest age cohort.

After a multi-year COVID hiatus, we finally visited China again in May and June this year (see our Investment Horizon paper for details) and came back with a changed view of the structural impediments facing our largest trading partner.

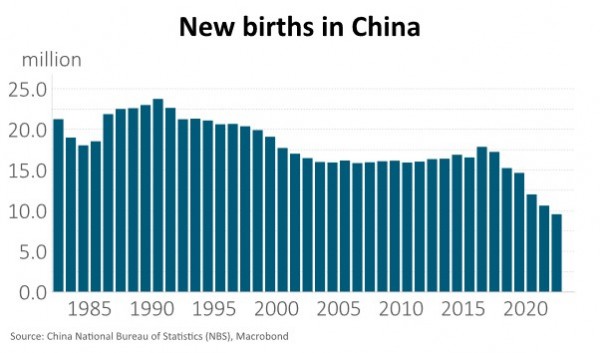

The demographic challenges facing China are likely to lead to a sharp increase in China’s dependency ratio as low birth rates, coupled with a fast-aging population, add pressure to the debt-fuelled investment-led growth engine of China’s economy. However, our more concerning observation was how demographic changes are impacting consumers’ medium-to-long-term outlook of the economy and their subsequent adjustments to spending. It was confronting to see such a dramatic negative shift in sentiment, but the fact that the population has stopped growing and is headed into a multi-decade long decline is only now starting to be felt. Households are coming to terms with the implications of having to set aside more savings and consume less to support family members as they age. The property-rich households are mulling the fact that a shrinking population may need fewer construction projects, impacting property prices, GDP growth, and future demand for steel.

Whilst there are both cyclical and structural factors at play, it is our belief that structural change, led by a tough demographic profile, may become a lasting feature of the Chinese economy. Investors and capital allocators could benefit from considering these changes, and The a2 Milk Company gave us a flavour last week of the impact from deteriorating demographics on the youngest age cohort.

On Monday 21 August, a2 Milk reported a solid result of its 2023 financial accounts. However, it was the outlook into 2024 and beyond that saw a2 Milk’s share price trade down 12% on the day of the result. The birth rate in China has declined to such an extent that even near-perfect execution by a2 Milk’s infant formula division is struggling to offset the low number of babies being born.

a2 Milk is still optimistic that there could be a post-COVID catch up in births before settling at a steadier level on the back of positive policy initiatives. It could be that policy measures to increase the birth rate may be ineffective given the increasing social burden young people already carry from having to support up to eight aging adults caused by the changing demographics; and a cultural preference for a one-child household (caused by decades of strict family planning policies). This poses a significant challenge to how investors might need to think about a2 Milk’s longer-term prospects.

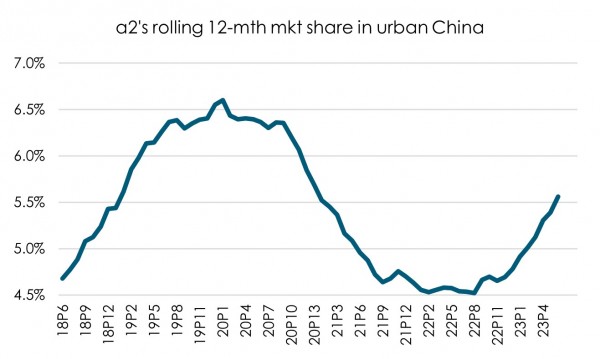

There is no taking away from a2 Milk the excellent work they have been doing in influencing factors within their control. They have taken significant market share from multi-national and domestic Chinese competitors alike, as well as from many infant formula brands leaving the industry when they have failed to regain their licences to operate in the Chinese market.

Source: Kantar, Harbour

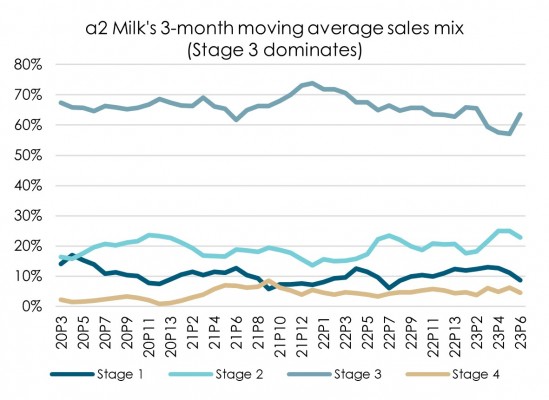

We might be over-emphasising the structural headwinds for a2 Milk when the weak outlook may instead be due to cyclical problems. For instance, next year is the Year of the Dragon, which is seen as a highly preferred year to have a baby. If the birth rate was to revive in 2024, it is important to still be aware that a2 Milk’s product mix is heavily skewed to its hero product (Stage 3 toddler formula), and it is likely to take several years for recent weak birth numbers to roll through a2 Milk’s sales profile.

Stage 3 formula is technically recommended from the age of 12 months, but unlike in New Zealand where toddlers tend to move onto liquid milks at that age, Chinese toddlers are often served Stage 3 powdered milks for years after turning 12 months; and from a recommended age of 4 years, a2 Milk has its Stage 4 product available. Combining Stage 3 and Stage 4, they account for approximately 70% of a2 Milk’s sales volume. Hence, the full impact of recent weak births has not been fully felt by a2 Milk and could linger for some time still.

Source: Kantar, Harbour

Demographics are notoriously hard to influence unless free and open migration is an available policy tool. With China having a relatively closed border, migration is not an option, and the demographic crystal ball gazing is therefore easier than in more open economies. Having experienced decades of structural growth, with incredible wealth generation lifting hundreds of millions of people out of poverty, it seems we may be entering a period of changing structural conditions in China, which may have broad implications for trade-exposed nations and companies alike.

There is a good chance that a2 Milk is the canary in the coal mine, giving us a flavour of the challenges that lay ahead. We have also observed the recent absence of Chinese demand in the global dairy trade auctions, which has led Fonterra to revise down its forecast milk price twice in the space of two weeks. Whilst we are optimistic that tourism package tours can resume to New Zealand, the revival of Chinese tourists has been lacklustre to date, which we think is symptomatic of a more cautious Chinese consumer.

Some of the weakness we’re seeing is undeniably cyclical and should recover in time, but a large portion appears structural. The balancing act between the business cycle and long-term forces are important to consider when investing and allocating capital. Whilst we see strong prospects for certain industries in China, like green energy, technology, and electric vehicles to thrive in the years ahead, we believe structural challenges may become more obvious going forward and change the potency of stimulus that has served China so well over recent decades.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.