- Investors should gradually gain confidence in most assets, as pessimism in the outlook for the economy gives way to understanding that highly restrictive monetary policy has done its job.

- Despite the range of risks for financial markets, falling inflation has certainly been a positive factor for broad investment returns. Up until recently equity markets have also enjoyed a period of generally better than expected corporate earnings announcements.

- Investors refer to the narrow scope of the recent rally in the global markets, pointing to the ‘Magnificent seven’. These are the seven large tech companies associated with especially benefiting from AI adoption, expected to deliver 20% earnings growth for the June 2023 quarter, compared with a fall for the rest of the market on average.

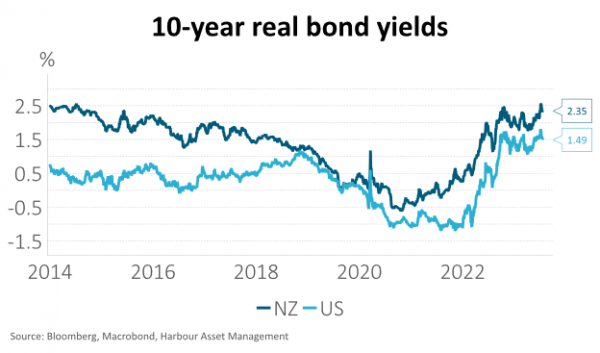

- Real bond yields (yields adjusted for future inflation) are probably as high as they have been for a decade. If inflation continues to trend down, as central banks remain resolute in taming price inflation, yields on bonds today imply a reasonable medium-term return.

The first half of 2023 gave global investment markets plenty to worry about, from a rolling US banking crisis to slowing growth in China. Markets were also divided about the fears of a global recession and the persistence of inflation. Slower global growth forecasts spread fears of much lower corporate earnings which had been elevated through the times of loose monetary policies and excess consumer demand. Despite the resolution of banking failures, investors also considered the fragility of parts of the global private credit and real estate sectors with worries about contagion spreading into the balance sheets of banks more generally.

It seemed for a time that these risks and influences would collectively place a much larger risk premium on all asset classes. And yet little of those further fears have come to pass. Possibly because the peak in inflation has dominated all other influences. A decline in quarterly and many annual measures of inflation has provided much better news for markets. Whether evidence of a peak in inflation reflects solving supply chain issues, or a material reduction in consumer demand (especially in China, and to a lesser extent Europe), seems not to matter to markets. Questions regarding the persistence of higher inflation still remain, but there is an asymmetry in financial markets with the more regular recent lower headline inflation surprises celebrated more than the negative reaction to any disappointing inflation data. This financial behaviour suggests an unusual set up for further rejoicing around financial market trading desks if inflation data continues to generally print lower.

Despite the range of risks for financial markets, falling inflation has certainly been a positive factor for broad investment returns. Up until recently equity markets have also enjoyed a period of generally better than expected corporate earnings announcements. Earlier this year markets were set up for disappointment. Most strategists had earnings forecasts down by double digits for 2023, reflecting both the fears of recession and a normalisation in operating margins as costs (particularly wages) were rising faster than selling prices. Instead, first quarter earnings in the US positively surprised by almost 7%, and even in New Zealand and Australia, earnings results were generally better. But very recently more cyclical company results are increasingly tinged with some disappointment and even more caution in outlook statements. Perhaps the early call of many global strategists to recommend underweight positions in equities is coming of age. But equally it is always hard to find a catalyst for an episode of risk. And right now, investor positioning seems to be cautious already, with plenty of cash in portfolios ready to re-invest should we get a pull-back in equity prices. Bull equity markets are born on pessimism, and we have had enough of that in 2023. Moreover, history suggests that a peak and then fall in inflation rarely sets up conditions for a new bear market. But if nothing else, the last decade has started to disprove intrepid investor John Templeton’s concern for the phrase – “This time it’s different”.

In some ways it is very different. Take the recent rally in global equities. A large proportion of recent equity market returns may reflect the fundamental influence that inflation has peaked. However, it is also hard to disentangle market exuberance regarding the potential of generative artificial intelligence (AI) that may accelerate future profit growth. Investors refer to the narrow scope of the recent rally in the global markets, referring to the Magnificent Seven. These are the seven large tech companies associated with especially benefiting from AI adoption. These seven companies are expected to deliver 20% earnings growth for the June 2023 quarter, compared to a fall for the rest of the market on average. Last week, to prove the point that AI might pay, Microsoft announced that their AI-powered Copilot service will cost users another $US30/month on top of the $US36/month business users already pay for the Microsoft 365 platform. And can you imagine using Excel, Word or Powerpoint without generative AI? Perhaps, but if Apple, Google and others also develop revenue models with AI developments, the monetisation of the current hype over AI could possibly justify the rally in share prices. Another perspective could be that current higher equity valuations simply reflect optimism that inflation has peaked and will limit the need for highly restrictive monetary policy and the risk of an earnings destructive recession.

What seems more apparent is that peaking inflation carries a more attractive relative outlook for investing in bonds. Real bond yields (yields adjusted for future inflation) are probably as high as they have been for a decade. If inflation continues to trend down, as central banks remain resolute in taming price inflation, yields on bonds today imply a reasonable medium-term return. There is likely a sufficient cushion in real bond yields to even cater for investors concerned with more persistent inflation, and a yet further rise in short-term interest rates. The attraction to bonds is perhaps most marked in economies with a weaker economic backdrop. New Zealand was one of the first countries to meaningfully tighten monetary policy, and the Reserve Bank of New Zealand is one of the first to draw the line on something more than a pause in the cycle. To labour the key point, bond yields on investment grade debt generally appear attractive to most investors. Compare investing in bonds a year ago with absolute nominal yields closer to 1% than the 4-5% available today. If implied medium-term inflation expectations are right, and five and ten year inflation averages around 2-3%, the real return on bonds may provide a substantive anchor for all portfolio returns.

Perhaps, with the benefit of hindsight, it is a case of understanding that this investment cycle really isn’t that different; as inflation peaks investors will gradually gain confidence in most assets, as pessimism in the outlook for the economy gives way to confidence that highly restrictive monetary policy has done its job.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.