- As the US economy continues to improve, the US Federal Reserve (Fed) seems close to reducing its pace of bond purchases as part of its quantitative easing (QE) programme.

- Different to the “taper tantrum” of 2013, however, a reduction in purchases is widely expected and is not being associated with imminent interest rate hikes.

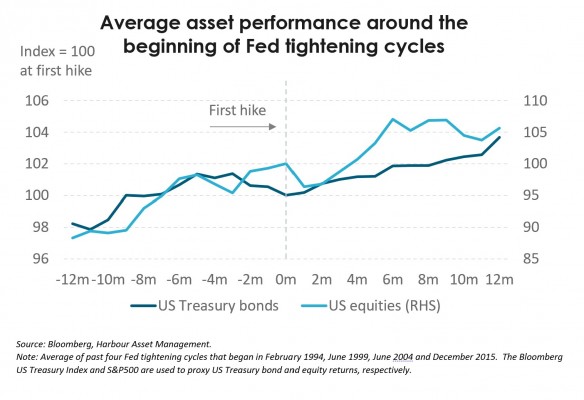

- US Treasury bond returns tend to be mixed prior to interest rate hikes but US equity markets generally fare much better.

- That’s not to say it will necessarily be smooth sailing for financial markets. Risks exist in many directions, but a well broadcast tapering may not be the largest concern.

We think the Fed is close to reducing, or tapering, its pace of bond purchases as part of its quantitative easing (QE) programme. The Fed is currently purchasing US$120bn of US Treasury and mortgage-backed securities every month. In a speech at the annual Jackson Hole Economic Symposium last week, Fed Chair Jerome Powell highlighted that the US economy had made “clear progress” towards maximum employment. The Fed has stipulated that “substantial further progress” towards its dual objectives of stable prices and maximum employment is needed to start reducing monetary stimulus. With that condition clearly met for inflation, recent focus has been squarely on the labour market.

The US has replaced almost three quarters of the jobs lost following COVID-19. Recent job growth has been vigorous, averaging more than 800,000 jobs per month since May 2021. Economists expect this pace to have continued in August. Economic growth continues to be supported by an ongoing vaccine rollout allowing re-opening and for households to deploy the large amount of savings accumulated since COVID-19 hit. The US economy is estimated to be currently growing at an annualised rate of 7%. With potential GDP growth around 2%, spare capacity is quickly being removed – paving the way to more persistent inflation pressure and higher interest rates.

This is not 2013. Many investors will remember the May 2013 “Taper Tantrum” caused by, then Fed Chair, Ben Bernanke’s unanticipated signaling that asset purchases would be reduced at some point in the future. In the month that followed, US 10-year Treasury yields increased more than 0.5% and the S&P 500 dropped almost 6%. The current situation differs in two important ways:

- The market widely expects tapering to soon be announced, most likely at the Fed’s 23 September meeting; and

- Tapering is not being associated with imminent interest rate rises, something Powell endeavored to emphasise in his Jackson Hole speech. Most analysts anticipate asset purchases to be wound down over the next 12-15 months and rate hikes to begin around the end of 2022. Markets price a 60% chance of a 0.25% interest rate rise at the December 2022 meeting.

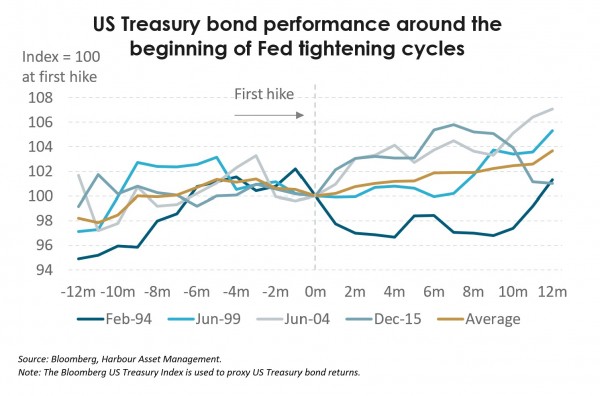

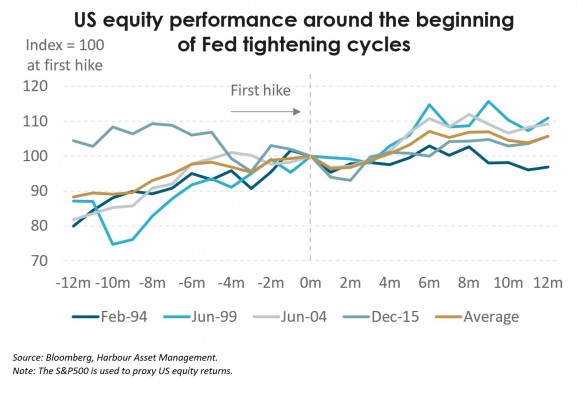

US Treasury bonds returns tend to be mixed prior to interest rate hikes but US equity markets generally fare much better. In the 12 months prior to the beginning of the past four Fed tightening cycles, the average total US Treasury return was less than 2%, while US equities increased more than 10% (see chart below). In the 9 months prior, US Treasury returns were flat, on average, versus an average 10% gain for equities. In the final 6 months prior to the first hike, US Treasuries lost about 1%, on average, while equities gained 2%.

That’s not to say it will necessarily be smooth sailing for financial markets. The charts below show the wide spectrum of outcomes experienced around the beginning of previous Fed tightening cycles. Currently, risks exist in many directions, but a well broadcast tapering may not be the largest concern.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.