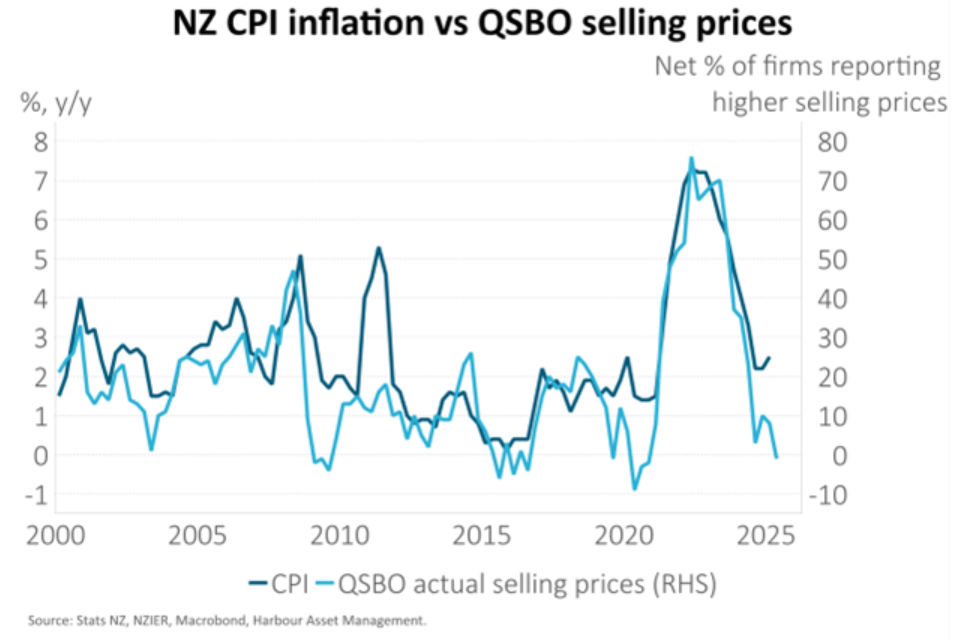

- The big surprise from today’s Quarterly Survey of Business Opinion (QSBO) was that firms reported a further reduction in their ability to lift prices, despite higher costs - likely appeasing the RBNZ’s concern of higher near-term inflation.

- The underlying driver is a better appreciated dynamic – weak demand and large amounts of spare capacity, as flagged by the PMIs dropping in to contractionary territory.

- While there is hope of improvement from the business community, current conditions are weak and it seems clear to us that this economy needs more help. We wouldn’t rule out the RBNZ cutting rates at its meeting next week – especially given the QSBO’s weaker inflation pulse. Regardless of whether the RBNZ cuts next week or not, we think more easing is required and expect the OCR to reach 2.50% later this year.

The big surprise from today’s QSBO was that firms reported a further reduction in their ability to lift prices, despite higher costs - likely appeasing the RBNZ’s concern of higher near-term inflation. This should come as music to the RBNZ’s ears as it has become increasingly worried about a pick up in inflation and the risk that inflation expectations push higher, above its 2% target. Despite a net 44% of firms reporting higher costs in Q2, a net 1% reported cutting prices and a net 2% expect to cut prices in Q3 (see chart above). The Survey also provides a challenge to Stats NZ selected price indices (which cover around 45% of the CPI) for the first two months of the quarter that had suggested annual inflation may approach 3%.

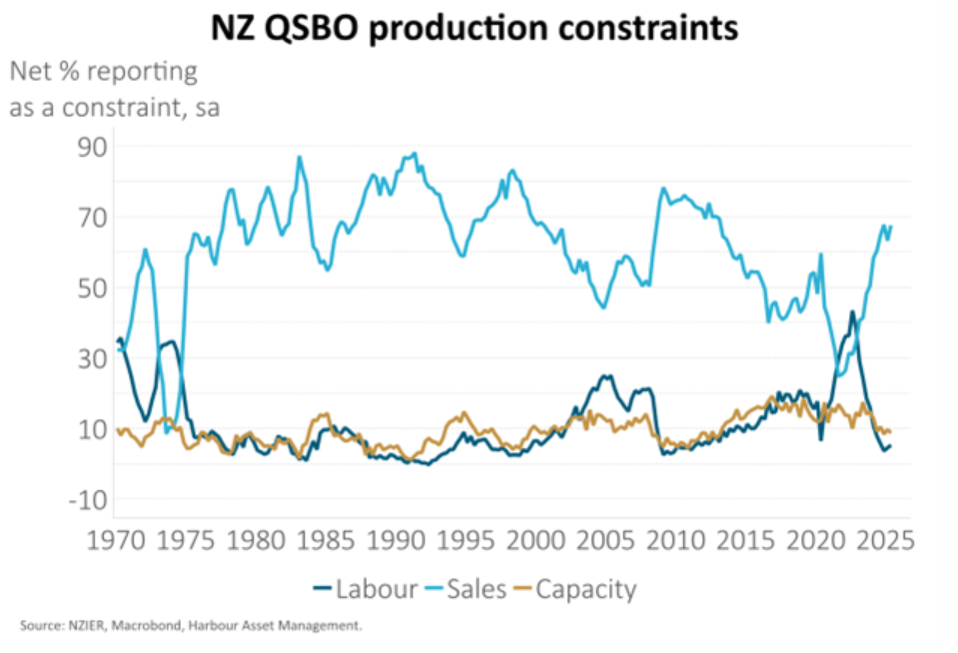

The underlying driver is a better appreciated dynamic – weak demand and large amounts of spare capacity. A net 23% of firms reported a drop in activity in Q2, vs. 21% in Q1, consistent with the PMIs that recently dropped in to contractionary territory and suggests an economy that is currently going nowhere (see chart above). The lack of demand was also obvious in growing spare capacity and almost 70% of firms citing a lack of sales as the key constraint to production (see chart below).

While there is hope of improvement from the business community, it seems clear to us that the economy needs more help and we wouldn’t rule out the RBNZ cutting rates at its meeting next week. Business confidence and expectations of own activity increased in Q2 but part of this may reflect a view that “things surely can’t get worse!”. For the RBNZ the QSBO has confirmed that there is a large amount of spare capacity in the economy and it is creating a strong disinflationary force. Without quickly lowering interest rates to a stimulatory level, we think the risk of undershooting the 2% inflation target is rising.

The market appears to be taking a view that a cut next week is too soon, pricing just a 20% chance of a cut in rates. Much of this view appears to relate to the less-dovish-than-expected May MPS, where the RBNZ stated in the press conference that it had no easing bias, and one MPC member voted for the OCR to remain unchanged. However, the QSBO represents new information to the MPC and adds to the case to cut soon. In the event of no change to the OCR, the tone is likely to be more decidedly dovish, not to mention the chance of some MPC members expressing a preference to lower the OCR. Regardless of whether the RBNZ cuts next week or not, we think more easing is required and expect the OCR to reach 2.50% later this year.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.