- Competitive pressures in both business and consumer banking are driving operational, credit, and pricing shifts. Mortgage broker aggregation continues to be a source of pricing competition.

- Technology and AI are central to banks’ transformation agendas, but progress varies widely.

- Private credit and non-banks are reshaping the commercial lending market, possibly prompting some banks to re-evaluate risk appetite for business lending.

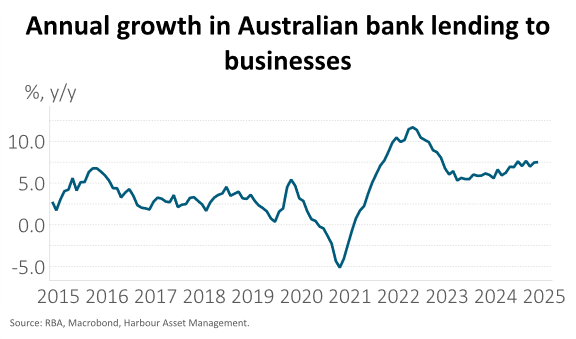

- Loan loss risk remains very subdued. However, the almost double-digit growth in business lending may be setting up the next loan loss cycle.

- Private equity and venture capital is funding transformational change with a focus on security and client led data insights.

Business Lending: Rising Competition, Narrowing Margins

Australian banks face intensifying competition in the business lending segment, particularly from non-bank lenders and private credit providers. This pressure is compelling traditional banks to recalibrate their credit risk strategies.

Margin compression continues, with tighter lending spreads as the competition comes from commercial loan brokers, challenger banks (Judo and Macquarie), and better data insights. However, business borrowers increasingly value speed, service, and certainty over marginal price differences, making these service differentiators key battlegrounds.

Banks are investing heavily in streamlined credit processes and automation to maintain market share. This includes simplified documentation for getting a business loan and broader acceptance of lease-based or income-based lending criteria. After five or more years of more constricted business lending, risk appetite is evolving. For example, Westpac’s (WBC) willingness to lend on lease-only documents, and Judo’s delegated credit authority, reflect a shift toward flexibility. National Australia Bank (NAB) continues to show commitment to the commercial broker channel and more sector-specific underwriting strategies. Deals exceeding A$5 million continue to attract stronger pricing competition. With stronger price competition, changes to loan terms or covenants often determine lender choice.

Consumer Banking: Data-Driven Growth and Emerging Threats

The consumer banking market is similarly competitive. There are different views on the current housing market, perhaps reflecting regional differences, and the ongoing patience of buyers waiting for rates to fall.

Mortgage lending remains heavily discounted for owner-occupiers, but investor lending is rising as borrowing conditions improve and property market confidence returns. WBC and Macquarie (MQG) are outperforming peers in share of new housing loan originations. Macquarie uses daily data monitoring through broker channels and NextGen gateway insights to guide pricing and volumes. They are achieving a run rate of 15% share of brokered home loan flows in 2025, which is clearly continuing to place competitive pressure on the home loan market.

We learnt from Smartmove Mortgage Advisers that potential borrowing demand indicators are strengthening. They reported a 25% YoY increase in completed “fact finders” in June, suggesting loan growth momentum could be building. Brokers said that product flexibility and pricing remain top consumer priorities, followed by processing speed and mobile lending options. Banks with multiple offset accounts and streamlined refinance offerings (e.g., WBC at 5.45% for >$500k loans) are currently outperforming peers like ANZ and NAB in the volume of home lending.

Data insights and AI are important for processing, however the major banks indicated that AI exploration is currently only in its early stages. Broader AI use remains in infancy but may accelerate with shared industry platforms.

Technology & AI: Unlocking Efficiency and Scale

Banking sector technology transformation continues as a large cost for the major banks. Westpac (project Unite) and ANZ (with the Suncorp merger) have significant investment ahead. Core system modernization and AI integration are widely recognized as essential but challenging. Success needs to be calibrated in years, not quarters, while cost pressures in technology continue.

Some banks still struggle with legacy infrastructure and fragmented systems, limiting speed-to-market and innovation capacity. Perhaps we are biased, but CBA and Macquarie appear as standout performers. Macquarie’s completion of their core banking transformation in just 12 months has been cited by numerous companies we talk to as being particularly impressive. The lack of complex legacy systems made transformation pathways easier. For Macquarie, a level four core banking system means real-time consumer transactions and data. This supports asynchronous, AI-powered services (e.g., account opening with no human involvement).

AI has shown strong promise in cost reduction and operational efficiency. Macquarie has seen a 5% decrease in banking and financial service costs and has now migrated 99% of workloads to the cloud.

The critical dependency on clean data and central data lakes is a recurring theme. Macquarie’s “horizon one” (prompt training and data centralization) is expected to conclude by the end of 2025, setting the stage for broader process transformation in 2026. Meanwhile, experimentation with AI agents is increasing, with expectations that these will support core banking, credit policy interpretation, and eventually consumer-facing advisory roles. Hallucination rates in AI models have been dramatically reduced, improving reliability.

Source: ChatGPT generated.

Risk Landscape: Commercial real estate, loan losses, and regulation

Despite positive topline metrics (book growth, net interest margins), macro risks and loan loss cycles remain a key consideration for bank earnings and capital adequacy.

Expected Credit Loss (ECL) accounting (AASB9) may have severed the very direct link between asset quality trends and reported bank earnings, masking emerging pockets of risk. There is a major divergence in provisioning across the bank sector, again potentially a source of future divergence in how risk spills into earnings.

The Australian Tax Office’s (ATO) aggressive pursuit of A$34bn in SME debt—especially in construction and hospitality—alongside a circa 11% penalty interest rate (no longer tax-deductible from September 2025), is likely to increase small business insolvencies. We were cautioned to watch credit loss trends in this narrower sector of business lending, albeit there is no broad concern about credit losses nor the Australian economy.

Australian banks' loan books remain skewed to well-collateralized housing, which benefits from constrained supply and strong immigration-led demand. This has kept home loan losses minimal (e.g., 0–1 bp across majors in 1H25). Banks like ANZ and WBC may be more vulnerable due to depleted COVID-era collective provisions, compared to CBA and NAB which have retained larger buffers.

Growth in Commercial Real Estate (CRE) lending—traditionally a cyclical risk—is increasing among both banks and private credit funds. Private credit’s opaque risk management and weaker provisioning raise concerns of hidden vulnerabilities.

The next wave of innovation is about the ecosystem and AI agents

Private equity investment strategies continue to offer a window into the next wave of innovation in financial services. The focus for banks and wealth managers is on enterprise AI, risk tech, and scalable fintech platforms, aligned with internal transformation goals. There is growing emphasis on AI agent development, human-like digital assistants (e.g., DID), and fraud/AML detection tools—technologies that may soon become integral to retail and business banking operations. Examples include:

- BioCatch: Behavioral biometrics for fraud prevention; deeply embedded in digital banking flows.

- Fincom: AML and sanctions screening; integrated with Nasdaq’s Verafin.

We also noted TA Associates’ recent foray in Australia, buying a stake in Veridian Financial Group, which has pulled together asset management, financial advice, and a large mortgage broker. When we asked about the rationale for this collection of financial assets, it seems to come down to gaining data insights and setting up a financial ecosystem for technology scale. Competition and technology seem likely to lead to more overarching client focused behaviours across banking, finance and wealth.

Conclusion: A Sector at a Strategic Crossroads

Australian banks are navigating a complex convergence of market dynamics: digital transformation, heightened competition, evolving customer expectations, and emerging risk exposures. The key strategic levers include:

- Modernizing systems and scaling AI to drive cost efficiency, product agility, and improved compliance.

- Recalibrating risk strategies to compete in commercial lending.

- Leveraging broker channels and data to maintain momentum in mortgage origination.

- Investing in innovative ecosystems to build strategic moats in fraud detection, compliance, and customer service.

The next 12–24 months will be pivotal. Banks that can combine operational excellence with innovation agility—and who manage risk with foresight—are best positioned to thrive in this dynamic environment.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.