- Market pricing on lower tranches of credit has tightened meaningfully

- In some cases, collateral (investor protection) has at the same time fallen

- Harbour continues to favour stronger rated credit exposures with, in our view, better future risk-return characteristics

Black-listed after the GFC, investor demand for securitised (asset-backed) debt has recently increased significantly, driving notable changes in pricing, and, in some cases, structure across the market. That demand has driven us away from lower tranches.

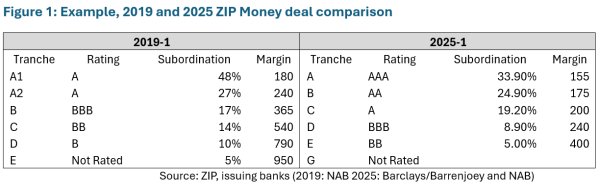

As an investor in ZIP Money’s 2019 Australian issuance, we were struck by how much conditions have evolved in last week’s deal. In 2019, ZIP issued a deal where an A-rated tranche had 48% loss capital beneath it and was priced at a margin of 1.80% over bank bills. In contrast, last week’s deal’s top tranche is rated AAA, has 33.9% subordination, and is priced at 1.55% above bank bills. The change is even more pronounced in the lower tranches, where BB-rated notes have seen protection drop from 14% to 5%, with pricing compressing from cash plus 5.4% to 4.0%. The underlying collateral is largely unchanged.

Relative to six years ago ratings agencies have lowered the subordination (collateral) required to achieve ratings. For instance, armed with more historical Buy-Now-Pay-Later (BNPL) data to model the subordination required to achieve a BBB rating on a recent ZIP money deal has been lowered from 14% to 8.9%. This is so for every level of rating familiarity with BNPL and greater ratings agency comfort has in turn played a role in attracting more investors. These combine to make ZIP Money, and other BNPL peers, a striking case study. Yet, the tightening in pricing is evident across all lower tranches of all securitisations, not just BNPL credits.

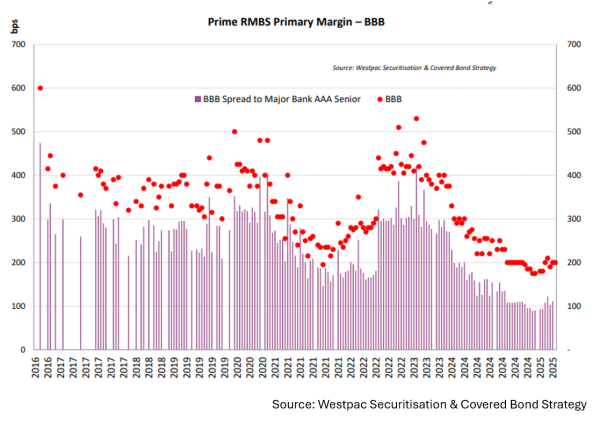

The following chart for Prime RMBS sourced to Westpac shows dot plots of the coupons in absolute terms for all Australian mortgage-backed bond issues since 2016 (as a spread to a reference rate in basis points). The bars represent the additional compensation for a BBB tranche relative to a AAA tranche. Investors now get significantly less reward for taking on greater risk levels compared to an almost decade long average.

Over the last decade credit quality has held up well in New Zealand and Australia despite a softer macroeconomic backdrop, making it difficult to argue that macro conditions alone justify such a significant tightening. For non-bank lenders, and BNPL providers in particular, lower funding costs are improving the profitability of business models reliant on wholesale debt markets. Still, the pricing of recent deals in our opinion does not reflect renewed investor enthusiasm for BNPL; rather, it is a function of broad-based demand for securitised product.

Many Australian non-banks have New Zealand operations, creating overlap in both issuers and investors across the two markets. As a result, New Zealand pricing is influenced by Australian market developments, though it is not completely aligned. Currently, New Zealand offers marginally better spreads.

In our view, the opportunity to participate (or invest) in lower-rated tranches has passed for now. So too with BNPL debt. For some time, we have moved up the capital stack (investing in higher rated securities with more collateral) and have exited BNPL credits. Given the BB tranche of ZIP Money’s deal was 6.4x over-subscribed, this is not the prevailing market view.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.