- ASB increased all its fixed mortgage rates yesterday, including the highly popular one year rate by 0.36% to 2.55%. We expect other major banks to follow, likely marking the end of a multi-year decline in New Zealand mortgage rates.

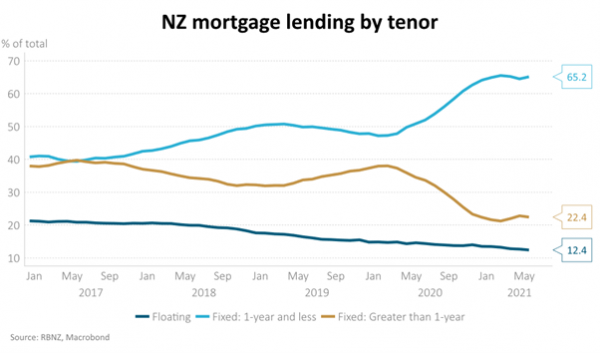

- Many households will soon be exposed to these rates as almost 80% of outstanding mortgages are either floating (12%) or fixed for less than one year (65%).

- Further increases in mortgage rates are likely as the economic expansion supports a removal of monetary policy stimulus and higher bank funding costs.

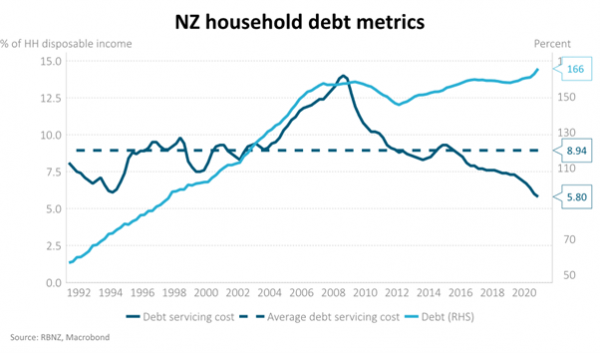

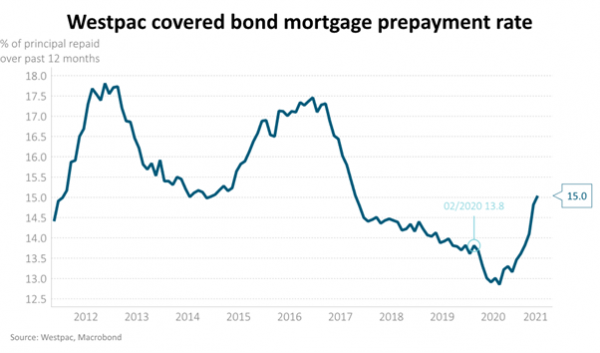

- We think households in aggregate can manage higher rates. Debt servicing costs are historically low and there is some evidence that mortgage holders are currently paying off a greater proportion of principal, implying a buffer to rising rates.

The New Zealand mortgage rate decline of the past 7 years looks to be over. ASB announced yesterday that it would raise mortgage rates across all tenors, including the highly popular one year rate by 0.36% to 2.55%. Historical precedent suggests the other major banks will follow. Many households will soon be exposed to these mortgage rates as almost 80% of outstanding mortgages are either floating (12%) or fixed for less than one-year (65%), see figure below.

Further increases in mortgage rates are likely as our positive economic outlook augurs for a reduction of monetary policy stimulus and higher bank funding costs. The Reserve Bank of New Zealand’s (RBNZ) objectives of 2% inflation and maximum sustainable employment are close to being met. Core inflation is 2% and headline inflation is likely to have increased to almost 3% year on year in Q2. Measures of capacity utilisation in the manufacturing and building sectors are close to all-time highs. Record-high job vacancies suggest the unemployment rate will continue to fall from an already low 4.7%. The RBNZ hiking cycle should begin later this year and is likely to be larger than markets expect.

However, debt servicing costs are at multi-decade lows, and we think households in aggregate can manage higher rates. It costs the average household just 5.8% of its disposable income to service its debt, versus an average of 8.9% for the past 30 years (see figure below). In addition, data from the Westpac covered bond portfolio, which includes c.$4bn of residential mortgages, suggests that mortgage holders are currently paying off 15% of principal per annum, versus 13.8% prior to COVID-19, implying a buffer to rising rates (see figure below).

Furthermore, 1-year mortgage rates at about 2.5% are:

- About 3.5 percentage points lower than the last high in 2014;

- Lower than the average outstanding mortgage rate of 3%, suggesting borrowers can still roll on to lower mortgage rates; and

- Meaningfully lower than the 6.25% mortgage rate that banks use to assess a borrower’s ability to repay, implying the risk of repayment difficulty of default remains low.

We think mortgage rate rises of 1.5-2.0% are quite feasible over the next 1-2 years. This is likely to equate to a debt servicing cost in line with the average of the past 30-years.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.