- Results ahead of expectations

- COVID-19 continued to hit sales & costs, offset by pricing power for some

- Structural growth stocks continued to beat expectations

- Several capital raisings to bridge COVID and support growth

- Notable increase in focus by companies in improving their Environmental, Social and Governance (ESG) standings

- Net positive upgrades to profit forecasts post results with high single digit earnings growth expected for the next few years

The profit reporting season for the September 2021 period saw New Zealand stocks deliver results that were ahead of conservative expectations. In terms of numbers of results, beats against expectations were slightly ahead of misses. Results continued to reflect the impact of COVID on in-person services and retailing, supply chains and accelerating structural changes; COVID, no matter which variant, is continuing to impact profitability for longer than expected. Many companies highlighted higher labour, shipping and raw material costs, but a number highlighted they were passing on higher costs to consumers and customers. Several companies outlined strategies to offset COVID disruptions. A small number of companies raised additional new equity capital to bridge the impact of COVID and support growth.

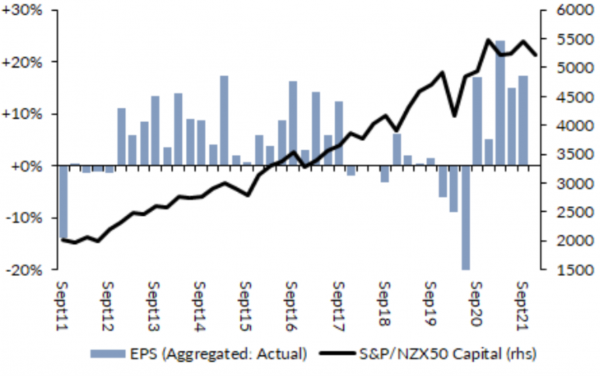

Post result season, overall, New Zealand earnings forecasts were slightly increased. Three-year forward, capitalisation-weighted, average annualised earnings per share (EPS) growth expectations for the New Zealand market are currently +9.7% (+7.1% at a median level). Current expectations for financial years 2022 and 2023 are for median EPS growth of +3.1% and +10.0% respectively. Figure 1 highlights that the New Zealand market continues to run ahead of earnings growth, but our research suggests earnings expectations may be conservative, with companies continuing to provide conservative profit outlook statements (if they are providing them at all).

Figure 1: Normalised EPS growth for the NZ equity market, 6-month on previous corresponding period

Source: Forsyth Barr, December 2021

While overall results were positive, there was significant variance between sectors and stocks, with the capitalisation-weighted upgrade driven by a small number of large capitalisation stocks.

Large capitalisation beneficiaries of COVID disruption reported better-than-expected results. Mainfreight reported a very strong result, benefitting from a COVID-influenced freight super cycle and strong underlying business momentum, gaining market share in all key regions. Comments from Mainfreight suggest momentum has continued post balance date. Consensus market earnings forecasts for Mainfreight were upgraded post results. F&P Healthcare continued to benefit from COVID-related demand for its hospital respiratory products. F&P Healthcare’s result was ahead of market expectations, contributing to a post-result earnings upgrade.

Fast growth healthcare and technology stocks delivered strong revenue growth but showed some growth pains. Pacific Edge delivered a result that was slightly below expectations, despite lower costs. COVID has impacted Pacific Edge’s rate of revenue growth with in-person access to medical professionals in US hospital systems, which is key to supporting the use of Pacific Edge’s testing system, limited by COVID access constraints. The slower revenue growth contributed to a downgrade to earnings forecast post result for Pacific Edge. Serko announced a result that was below expectations, reflecting the impact of lockdowns on travel, and announced a $85m equity raise to fund growth. The combination led to an earnings downgrade. Pushpay missed expectations with COVID restrictions meaning its team could not connect with faith groups in person, contributing to lower customer growth. Donation-processing volumes and average donation per customer also decreased. Lower revenue and higher wage costs contributed earnings forecast downgrades for Pushpay.

The retirement village and aged care sector was hard hit by lockdowns, contributing to higher care costs and lower unit sales. Care costs were up across the sector, with operators incurring higher lockdown personal protection equipment, testing and security cost without a corresponding lift in government funding. Nursing and care costs continued to increase rapidly as district health boards continued to poach staff, with higher pay rates at a time when there were limited health professionals coming in from overseas, and aged care providers paying up to retain staff. Ryman Healthcare missed expectations with lockdowns in Victoria and Auckland impacting on expected build rates and unit sales, with potential residents unable to visit villages due to lockdowns. Rymans’s earnings forecasts were downgraded post results. Arvida delivered a better-than-expected result, with sales remaining robust outside of locked-down Auckland. Arvida’s earnings forecasts were reduced, reflecting the impact of its new equity issuance to support the acquisition of the Arena portfolio. Oceania delivered a profit result that was better than expected, despite headwinds from the lockdown of Auckland. Care cost inflation led to a downgrade in Oceania’s earnings forecasts post results. We see upside to aged care and retirement village earnings as Auckland and Melbourne re-open allowing renewed sales of units.

Infrastructure stock Infratil reported first half year earnings which met market expectations, albeit guidance was trimmed on the back of higher corporate costs following recent acquisitions, contributing to a post-result downgrade in earnings forecasts. Napier Port reported a result that was well ahead of expectations reflecting better trade growth and good management of infrastructure expansion, with Napier’s earnings forecasts upgraded post result.

Real estate investment trusts and securities (REITs) delivered fair results, despite the impact of provisions for rental abatements required under the New Zealand Government’s legislation mandating that landlords abate a fair proportion of rent to reflect COVID restrictions. Industrial property owner Goodman Property beat expectations and the potential for ongoing industrial property rental growth contributed to post result earnings upgrades. Kiwi Property’s result was slightly below expectations, but lower-than-expected rental support for retail mall tenants (with retailers less impacted by Auckland lockdowns with the rest of NZ open) contributed to an upgrade to forecast earnings. Argosy delivered a result in line with expectations and forecasts were upgraded reflecting upside to rental growth for its industrial property portfolio. Stride’s result was below expectations, driven by higher corporate costs associated with its delayed office fund launch and retail mall rental abatements. The combination of the weaker result and a $120m capital raise to provide financial support, until the office fund is launched, contributed to a cut in forward earnings forecasts for Stride. Daily needs retail REIT Investore delivered a result that was impacted by provisions for rental abatements and earnings forecasts were trimmed to reflect this. We see the potential for New Zealand REITs to deliver solid single-digit earnings growth over the next few years after a period of asset recycling and COVID lockdowns impacting rental income.

There was a notable lift in company sustainability commitment through the reporting season. Several businesses announced board level sub-committees and the addition of dedicated sustainability/ ESG management resource. Importantly, several businesses announced a commitment to better measurement, measurable targets and action plans to meet the targets. In our view, this commitment reflects the accelerating impost of decarbonisation and changing consumer views, as well as pressure from investors, including Harbour.

Our research continues to show that earnings drive equity market returns. In our view, there is upside to New Zealand equity market earnings forecasts. Earnings expectations remain low: where company management has provided future profit guidance it is conservative, reflecting COVID uncertainty. Where there is no company guidance, stock broking analysts have conservative expectations reflecting risks around COVID’s impact on revenue growth and higher costs. As companies work through their COVID disruption strategies, we see potential for companies to beat expectations. We also see upside risks to profit margins, as the re-opening of economies reduces shipping friction and costs, and producer price inflation levels out as supply catches up with demand.

As the emergence of the Omicron COVID variant has reminded investors, there is some way to go before conditions get back to ‘normal’. But for those companies with pricing power and structural growth drivers, there is potential to keep beating conservative earnings forecasts, supporting equity returns.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.