Markets, much like fashion, are never fixed. What is in vogue today can be overlooked tomorrow, only to return in style a few seasons later. The same applies to equity investing. Value, growth and quality all rotate in and out of favour, shaped by the macro backdrop and investor sentiment.

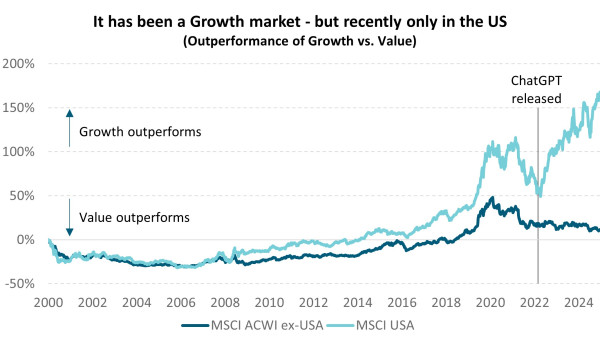

Over the past year, the market’s wardrobe has shifted noticeably. Historically we have seen a high degree of correlation between regional performance of Growth vs. Value – this has changed since the advent of ChatGPT. Value has been in vogue globally, particularly outside the United States. Quality, usually the reliable staple, has been left on the rack. Growth, meanwhile, has dominated in the US, thanks to a handful of technology giants tied to the artificial intelligence boom.

For investors, the lesson is familiar. No single style defines the market forever. Understanding how the cycle rotates helps portfolios stay balanced and resilient.

Value’s Comeback: The Vintage Piece

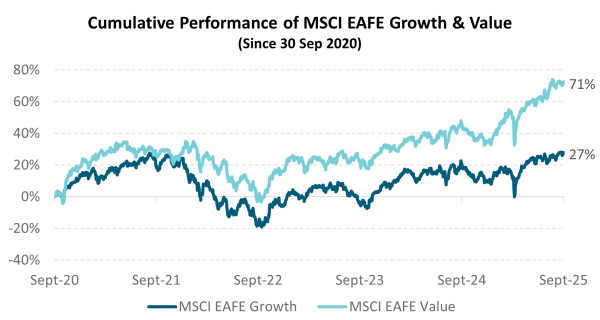

Every wardrobe has a classic piece that keeps coming back. In markets, that role belongs to value. After years of underperformance, value has re-emerged. This resurgence has been strongest outside the US, where lower valuations and cyclical exposures provided the right conditions. In the last five years, value has outperformed growth across Europe, Australasia and the Far East (EAFE).

The drivers are clear: Inflation stayed higher for longer, nominal GDP growth lifted, and central banks signalled a shift toward easing. Investors began favouring companies with tangible assets, steady cashflows and more modest starting valuations.

Source: Harbour Asset Management, Bloomberg. MSCI EAFE is MSCI Europe, Australasia and the Far East.

This recovery shows why value deserves a permanent place in portfolios. Like a vintage jacket that cycles back into fashion, it may not always be in the spotlight, but when conditions shift it can quickly become indispensable.

Quality Under Pressure: The Trusted Basic

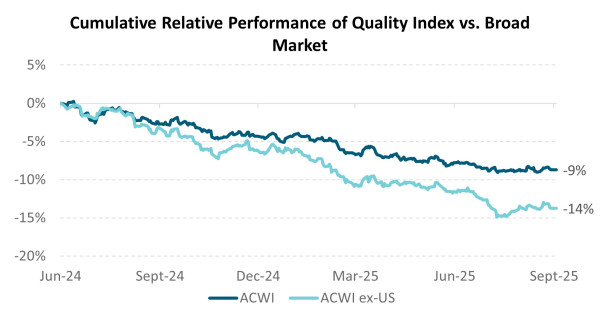

Quality stocks are the wardrobe essentials. They may not be the flashiest items, but when markets turn volatile, their reliability tends to stand out. High returns on equity, consistent earnings and strong balance sheets have long made them the defensive choice.

Recently, however, quality has struggled. Market leadership has narrowed dramatically, with the Magnificent Seven1 technology names dominating returns. Many quality companies, despite their stability, have been left behind.

Source: Harbour Asset Management, Bloomberg. Chart shows the relative performance of MSCI ACWI Quality vs. MSCI ACWI, and MSCI ACWI ex-US Quality vs. MSCI ACWI ex-US.

History suggests this setback is temporary. Typically, after poor periods of relative performance quality has always come back strong. After the global financial crisis, quality led the recovery as investors rewarded stability. During Covid, the same pattern repeated. Essentials do not always stand out, but they prove their worth when conditions become uncertain. For global portfolios, keeping quality in the mix is less about timing and more about resilience.

Growth’s Narrow Leadership: The Catwalk Star

But since the launch of ChatGPT in late 2022, the AI boom has driven a marked divergence, with US growth surging ahead (light blue line trending upwards) while other regions have rotated back toward value (dark blue line trending downwards).

Source: Bloomberg, Harbour Asset Management. Chart shows the cumulative outperformance of growth stocks versus value stocks in the MSCI ACWI ex-USA and MSCI USA indices.

As with any trend on the catwalk, concentration brings risks. Valuations in parts of US growth are stretched, and regulation or shifts in sentiment could quickly alter the look. Growth will always be a powerful driver of returns, but portfolios need to be careful not to rely solely on a handful of names.

The AI Effect: Accessories or Main Outfit?

Artificial intelligence has become the defining theme of global markets. Despite value’s outperformance in ex-US, the current market is still widely considered a “growth market” due to the large weight of the US in benchmark indices. Growth managers have found it difficult to add value when performance in their domain has been limited to such a narrow thematic. In 2024, the Magnificent Seven contributed nearly half of the MSCI ACWI’s return. This is an unusual level of dominance.

Concentration is a broader issue. The ten largest stocks in the MSCI ACWI make up 25% of the weight – a level we haven’t seen for a long time. Nine are US companies, and nine are AI-adjacent. While AI is an important driver of long-term innovation, investors need to ask whether it is a lasting foundation or simply an accessory that is currently drawing all the attention.

Lessons for Investors: Building a Complete Wardrobe

- Diversification is essential. No style leads forever. Portfolios that blend value, growth and quality are better equipped to handle transitions.

- Patience matters. Styles can stay out of favour for years before coming back. Selling too soon risks missing the rebound.

- Geography counts. Growth has been strong in the US, but far weaker elsewhere. Regional diversification helps reduce reliance on one market.

- Beware concentration. With global indices heavily reliant on a handful of companies, spreading across styles reduces exposure to single-stock risks.

- Macro is key. Interest rates, inflation and monetary policy all shape which styles are in fashion. Understanding the backdrop helps frame expectations.

Looking Ahead: Next Season’s Trends

What does the next season hold?

- Value may continue to benefit from easing monetary policy, slower growth and ongoing tariff uncertainty. Its lower valuations offer a cushion if markets wobble.

- Quality is unlikely to remain overlooked for long. If volatility rises or earnings dispersion widens, investors will turn back to the steady comfort of strong franchises.

- Growth will remain central, especially with AI still in its early stages. But selectivity and valuation discipline will be critical, given how much optimism is already priced in.

Like any wardrobe, the mix matters more than the single piece. Portfolios that carry all three styles are better placed to adjust as cycles turn. For investors, the key is not predicting next quarter’s leader but keeping a balanced wardrobe of styles that can adapt as the market shifts.

1) Magnificent Seven refers to Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Tesla.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.