A 2025 post-mortem before we look ahead

Looking back on 2025, we reflect on the third year of exceptional returns in US and global equities. Over the past three years, global equities have delivered more than 18% per annum, led by the US market with returns averaging above 20% per annum. This year, however, the story has shifted. Returns have broadened, with European and emerging markets taking the lead on the equity return leaderboard.

The real story of 2025 has been better than expected economic growth, leading to stronger earnings growth across broad geographies. Additionally, the promise of stronger investment in AI infrastructure has sparked a period of Formula One like announcements in the race to build a better chip, AI model, and datacentre economics.

When we revisited our expectations for risks and opportunities from a year ago, our clear miss was the delay to an economic recovery in New Zealand. We had sat in the camp which expected a gradual emergence of investment and economic growth in the first half of 2025, when in fact the picture deteriorated. While right now the New Zealand economy feels better set for growth, it has taken larger interest rate cuts, and more time for business and consumer confidence to find a base.

In contrast, we thought that US tariffs would be a bigger challenge for the world economy. While that did appear to be the case for a period in the second quarter, bilateral trade deals have watered down the worst-case scenarios. AI-related capital expenditure, an expansionary US fiscal position, and US rate cuts have emerged as offsets, allowing US growth to be stronger than expected.

One of the more disappointing aspects of sector performance and discussion in 2025 has been the outcomes and narrative coming from the US healthcare sector. The change in US vaccine policy toward a “shared decision making” framework has undermined herd immunity baselines, impacting the ability to forecast demand and hospital outcomes. It’s also been a tough year for the broader healthcare sector.

On a brighter front, datacentre developers and owners continue to benefit from the scaling in demand. While energy bottlenecks signal near-term constraints, capex investment continues to ramp into 2026. AI looks more set to be a multi-year influence on markets, bubble or no bubble.

Today, the consensus remains constructive on equities. Global growth looks set to muddle along at an almost satisfactory 3% pace, with a very much K-shaped winners and losers narrative. The most recent earnings reports have broadened an upgrade cycle, with smaller and mid-cap companies seeing some trickle down into revenue and margins.

Scanning external research and fund manager surveys tells us that:

- Investors largely think that the global easing of interest rates is near complete or at least perhaps largely priced into forward yield curves.

- Fixed income investors see steeper yield curves as an opportunity to take advantage of longer maturities but also wary of global fiscal positions.

- Investors are cautiously constructive on global equities - not alarmingly so - but the mood of recent positive earnings reports is keeping a small overweight position.

Top 10 Risks and Opportunities for 2026:

1. The new Fed Chair does not find favour with the bond market

Jerome Powell's current term as the Chair of the Federal Reserve is set to end in May 2026. It is likely that the Senate will approve whoever President Trump proposes. It’s also likely that the new Chair will be vocal, and that their influence will be considerable. However, there will still be a strong majority of FOMC voters who will not want to see Fed credibility undermined and will not automatically support the rate cuts that Trump has been advocating. The market is not currently expecting the Fed to lose its way, with inflation expected to stay between 2.25% and 2.5% over the next 10 years. There is a risk, however, that Fed decisions are not seen as credible, which could lead to higher bond yields, a weaker USD, and flow-on effects to other markets.

2. Fiscal deficits are viewed as increasingly unsustainable

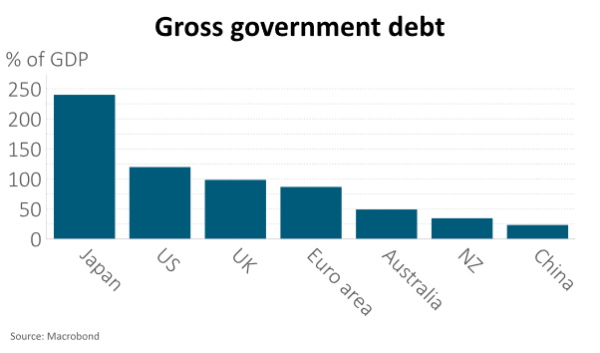

Across a handful of large economies ongoing fiscal deficits and climbing debt-to-GDP ratios have been in focus. The US, UK and France are among the worst offenders, with a degree of risk premia priced into their respective government bond yield curves. Politicians are aware of the market’s ability to act as a policeman and punish poor policy, but financial markets aren’t necessarily a top priority for politicians. Mistakes can be made, sending shock waves through financial markets.

New Zealand is in a fortunate position with a relatively low debt-to-GDP ratio. Perhaps the most uncomfortable position is across the Local Authority sector, where infrastructure investment and the associated debt may test rate payers’ tolerance for ongoing hefty rate increases.

Globally, the offsetting opportunity is that the US can both cut interest rates and manage the bond market, generating a fresh upsurge in financial markets and boosting bonds, equities and almost everything else.

3. Private credit concerns return

Private credit has evolved from a niche strategy into a structural pillar of global finance, now exceeding $3 trillion in assets. Its rise reflects a decade of regulatory tightening on banks, investor demand for yield, and private equity’s appetite for bespoke financing. In October 2025, lending standards in the private credit market came under scrutiny when First Brands, a US auto parts maker, failed amid concerns of fraud at the company. At the time, Jamie Dimon, CEO at JP Morgan, famously said, that “when you see one cockroach, there’s probably more.” In that moment, markets focused on valuation opacity and lending standards in the private credit market, where growth has been rapid and liquidity abundant. Bull market confidence has historically sown the seeds of poor-quality lending.

Concern has reduced recently as this event was seen as fraud-driven and specific to a small number of firms. However, sector concentration adds fragility: private credit exposures remain heavy in real estate, construction, and cyclical industries, areas sensitive to higher rates and slowing growth. Perhaps the US economy will prove more resilient on the growth front into 2026, and rates may stay low, reducing the probability of near-term stress conditions.

Harbour’s take is that the risk-reward in US high yield and private credit looks challenged on both valuation and potential stress grounds. However, we think contagion risk to listed markets is low, given the notable lack of bad lending on bank balance sheets.

4. Bonds deliver the best risk-adjusted returns in 2026

Global bonds have struggled in recent years, with rising yields and curves that were generally flat or inverted as central banks fought inflation following Covid. The situation today is very different. Inflation is largely under control, growth is slowing, and central banks are mostly cutting interest rates. Despite this bond yields remain at relatively elevated levels and curves are steep. The 10-year US Treasury yield, for example, is around 4% - comparable to levels seen prior to the Global Financial Crisis. With equity market valuations historically high, bonds may provide the best risk adjusted returns over the next few years, and could see an allocation from both cash and equities.

In New Zealand, with the RBNZ Official Cash Rate potentially staying at or near 2.25% throughout 2026, investors have a strong incentive to consider longer-term bonds. Yields on 5- to 30-year bonds are 1-3% higher. Traditionally, the end of rate cutting cycles are favoured as a time to reduce fixed interest exposure. However, the numbers suggest that an elongated period of low and stable cash rates would support preferring bonds to cash. The caveat is that a rapid acceleration in the economy or higher and sticky inflation would imply a need to hike the OCR, putting this strategy at risk.

5. Australian banks have another strong year

Three of the major Australian banks delivered another year of outperformance in 2025, despite operating against a backdrop of high valuations. This resilience has been underpinned by earnings certainty - a prized attribute in a market facing persistent downgrade pressures. Investors have rewarded stability, even as underlying profitability growth remains limited and core sector ROEs have remained around 9–13%.

Looking ahead, the outlook is more nuanced. Consensus forecasts point to low single-digit EPS growth for the bank sector, as net interest margin tailwinds from prior rate hikes have largely peaked and competitive deposit pricing continues. Cost inflation remains sticky, with technology investment and compliance spend outpacing revenue growth, limiting operating leverage. Very low loan impairments have been one leading factor in the outperformance of the bank sector. However, if loan losses normalise from historically low levels, another tailwind may vanish. The real story has been that the banks have strong capital positions, and for the most part are well provisioned on potential loan losses.

Source: Bloomberg, Harbour Asset Management

6. Earnings upgrade cycle gains momentum in New Zealand

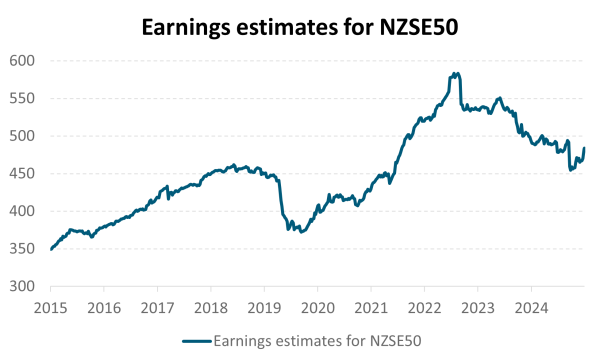

The evidence is mounting that 2026 could represent the start of a new, sustained earnings upgrade cycle for New Zealand equities. The chart of 12-month forward earnings estimates for the NZSE50 may tell the story: after an extended period of weakness and downgrades, we are now seeing a nascent uptick in forward earnings expectations for the aggregate equity market. This inflection is not occurring in isolation but is supported by both improving macroeconomic conditions and a positive shift in corporate sentiment.

First, the macro backdrop is turning more constructive. New Zealand’s economic growth outlook has improved, with GDP forecasts for 2026 being revised higher. The Reserve Bank’s lowering of the Official Cash Rate may provide a tailwind for both consumer demand and corporate profitability. Importantly, this recovery is broadening across sectors, with aged care, logistics, healthcare, and select industrials reporting improved trading conditions.

Second, company guidance is increasingly positive. Several key NZSE50 constituents - such as Fisher & Paykel Healthcare, Mainfreight, a2 Milk, Vulcan Steel, and Scales - have recently upgraded their earnings outlooks. Mainfreight, for example, appears to have reached an inflection point after a multi-year downgrade cycle, while the aged care sector is benefiting from both operational improvements and valuation catch-up potential.

Third, market structure is supportive. Large caps, which have lagged mid and small caps for two years, are now poised to participate in the recovery. The earnings upgrade cycle has turned, with more companies revising guidance upward than downward for the first time in several years.

Source: Bloomberg, Harbour Asset Management

7. US mid-term elections challenge equity returns

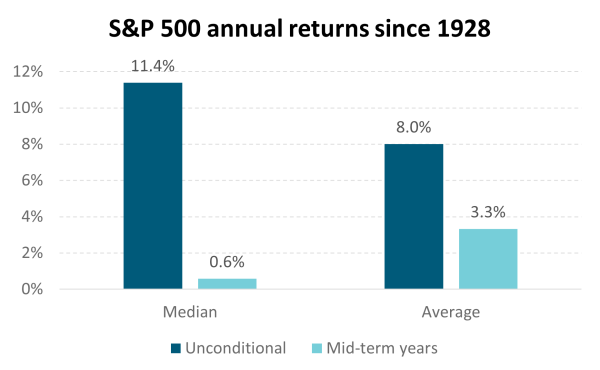

Mid-term election years have historically been challenging for US equities, and 2026 looks no different. Political uncertainty often weighs on risk appetite, with volatility tending to rise as polls tighten. Prediction markets currently signal that Republicans may lose control of the House, introducing a layer of unpredictability around policy direction. If President Trump faces pressure in the polls, his stance on controversial measures – such as exerting influence over the Federal Reserve – could shift markedly. A constrained administration might temper aggressive proposals. However, the opposite is also possible - a push to accelerate policy before losing legislative control. Beyond Washington, markets will watch for implications on fiscal priorities, trade relations, and regulatory tone. Heightened uncertainty could see global investors favour defensive sectors and quality bonds. At the same time, any sign of policy gridlock could strengthen expectations for slower US growth and a softer dollar, factors that ripple across global asset allocation.

Source: Bloomberg, Harbour Asset Management

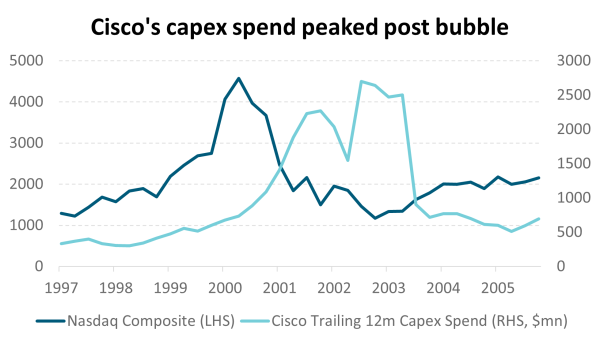

8. The AI trade – not as simple as a capex story

Hyperscaler spending on AI infrastructure has surprised to the upside for several years, with annual capex growth running well above 20% since 2023. Until mid‑2025, markets rewarded these outlays handsomely, driving sharp gains in mega‑cap technology shares. That dynamic is shifting. Investor nerves are increasingly evident – even modest disappointments in quarterly spend now trigger outsized share price reactions. History offers perspective: during the dot‑com era, network capex continued well after the equity bubble burst, as firms such as Cisco pressed ahead with strategic investment. A similar pattern may emerge here. Rolling over in capex may not be the signal that the AI party is over. Instead, watch for other stress points: recession fears, a pause in rate cuts, leverage peaking, or the next generation of AI models failing to impress. To us, the AI analogy is now like a Formula One season, with the potential for a change of winners based on technologies – chips, AI-model superiority and the differential demand forecasts of future capex requirements. These factors, rather than capex alone, could mark the turning point for the AI trade.

Source: Bloomberg

9. Momentum in the renewable energy transition continues

Renewable energy remains one of the most compelling structural growth themes. The green economy, which spans energy, waste, water, and pollution management, would rank as the fourth-largest global sector by market capitalisation. It is growing at a 15% compound annual rate, second only to technology. Falling costs for solar, wind, and battery storage - driven by China’s scale production - are making renewables increasingly competitive. Rising demand from industry, transport, and data centres, alongside corporate climate commitments, is reinforcing this trend.

For investors, exposure to renewable infrastructure, storage technologies, and distributed energy solutions offers long-duration cash flows, and in some cases, inflation-linked returns. Risks include regulatory uncertainty, political shifts, and grid connectivity challenges, which could delay projects and compress returns.

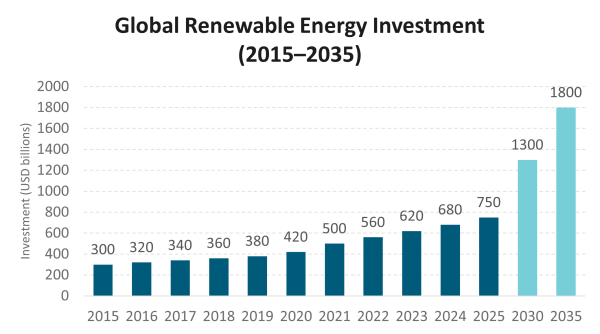

Global renewable energy investment has surged from about $300 billion in 2015 to an estimated $750 billion by 2025. Looking ahead, forecasts from the International Energy Agency (IEA) and BloombergNEF indicate continued acceleration, reaching roughly $1.3 trillion by 2030 and $1.8 trillion by 2035. This trajectory reflects strong policy support, falling technology costs, and growing corporate climate commitments. Together, these factors are positioning renewables as a dominant force in the global energy transition.

Sources: IEA World Energy Investment 2025; BloombergNEF Energy Transition Investment Trends 2025

10. The strength of copper will persist

By late 2025, copper prices have surged to around US$11,500 per tonne, driven by structural themes such as electrification and infrastructure investment. Tight inventories and supply constraints reinforce copper’s role as a bellwether for global growth and the energy transition. In 2026 will the strength of copper fade or persist? Global commodity specialists, including UBS, Goldman Sachs, BNP Citigroup, forecast copper prices reaching US$12,000 per tonne by mid-2026. This outlook is supported by mine supply deficits, bullish consumption trends, and policy tailwinds from global decarbonisation efforts. These dynamics position copper as a core beneficiary of the transition to renewable energy and electrification.

Major miners such as Rio Tinto are signalling disciplined growth strategies. They are targeting ~3% annual production increases through 2030, while continuing to optimise portfolios and cost structures. This operational discipline, combined with structural demand for copper and other critical minerals, underpins continued outperformance for resource-linked equities.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.