Key market movements

- Global equities rose strongly in September, with the MSCI ACWI up 5.3% in unhedged NZD terms and 3.6% NZD-hedged, as the US Federal Reserve resumed its rate-cutting cycle. Easing monetary policy and resilient earnings supported broad-based gains.

- New Zealand equities advanced 3.0%, buoyed by expectations of further RBNZ rate cuts and signs of stabilisation in the housing market. Australian shares fell 0.8% in local terms, though a weakening New Zealand dollar lifted NZD returns to +2.1%.

- Bond markets posted modest gains as yields eased. The Bloomberg NZ Bond Composite Index rose 1.3%, while the Bloomberg Global Aggregate Bond Index (NZD-hedged) added 0.6%, supported by softer global growth data and dovish central bank signals.

Key developments

The global backdrop shifted meaningfully in September as the US Federal Reserve cut its policy rate by 25bps to 4.0–4.25%, its first reduction of the year. Softer labour market data and muted inflation prints helped convince policymakers that growth risks now outweigh inflation concerns. Markets now expect two more cuts by year-end and the Fed Funds rate to fall below 3% in 2026. The move supported risk assets, though debate remains about how rapidly the Fed should ease given still-elevated prices and fiscal uncertainty.

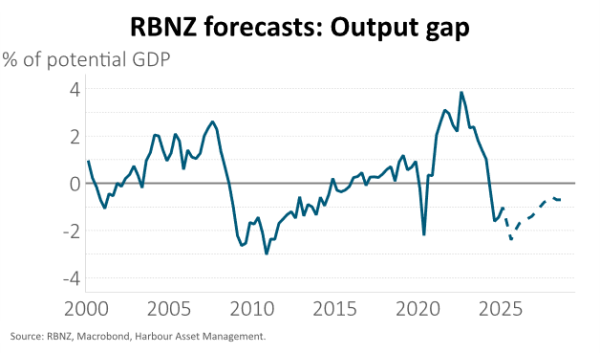

In New Zealand, the economy contracted 0.9% in Q2, much weaker than expected, highlighting broad-based softness across industries. Household demand and business investment remain subdued, with the RBNZ’s output gap likely widening to around -2%. With inflation already within target, the data reinforce the likelihood of further monetary easing. The risk of missing the 2% inflation target on the downside next year is now material and the market prices the OCR to fall below 2.5% in 2026.

The domestic housing market remains a key transmission channel for policy. House prices were flat in August after two months of decline, while sales volumes fell to their lowest in a year. Several banks have reduced mortgage rates in recent weeks, and these lower financing costs may finally be sufficient to stabilise prices. A gradual recovery in housing could ease pressure on consumption, though weak population growth and high unemployment remain headwinds.

New Zealand equities delivered solid gains in September, supported by falling yields and renewed investor appetite for quality and dividend-paying stocks. Larger-cap defensive names led performance, while small caps and cyclical companies continued to lag amid weak economic data. The electricity sector review outcome reduced regulatory uncertainty, providing a modest boost to generator-retailers. Investor engagement has improved, and sentiment is increasingly influenced by expectations that rate cuts will underpin corporate earnings recovery into 2026.

Global equity markets rallied on the prospect of lower policy rates and resilient corporate earnings. The technology sector regained leadership, led by AI-related infrastructure and semiconductor names, while healthcare and consumer discretionary stocks lagged. In the US, weaker employment data outweighed tariff uncertainty, with investors encouraged by signs of disinflation. European and Asian markets also advanced as economic activity steadied and trade sentiment improved. Overall, global equities ended the quarter with strong gains and broadening participation beyond the large-cap technology leaders.

What to watch

The Reserve Bank’s new GDPNow model suggests the economy is operating well below potential, with the output gap estimated around -2.3% in Q2 – a level not seen since the GFC. This widening gap reflects subdued domestic demand and weak business investment, even as export revenues remain solid. Historically, such levels of spare capacity have coincided with significant monetary easing cycles. With inflation already back within target and the OCR only at a neutral level, the data reinforce expectations that the RBNZ will continue lowering the OCR through 2025.

Market outlook and positioning

Global growth continues to moderate, but markets are taking comfort from a well-telegraphed easing cycle by central banks. The US Federal Reserve’s September rate cut marked the start of a gradual pivot toward easier policy, with two further reductions likely before year-end. Inflation remains above target but is easing, while a softer labour market has shifted focus to employment support. These dynamics suggest policy settings will turn stimulatory in 2026, providing a supportive backdrop for risk assets even as fiscal sustainability concerns linger.

In New Zealand, recent weak GDP and sentiment data have reinforced the case for additional RBNZ easing. We expect the OCR to fall below 2.5% as the Bank seeks to close the output gap and avoid undershooting its 2% inflation target. Lower rates should gradually feed through to a recovery in household demand, housing activity, and business investment. Fiscal policy remains constrained, so monetary easing will be the primary lever supporting the economy through 2025.

Across Australasian equity markets, near-term earnings expectations remain subdued but the backdrop is improving. Rate cuts should reduce funding costs and support valuations, particularly for rate-sensitive and dividend-yielding companies. Management commentary at recent investor days points to stabilising conditions across logistics, housing, and retail sectors, while cost control and productivity gains continue to underpin profitability. We see potential for modest upgrades to 2026 earnings guidance as economic momentum improves from a low base.

Global equities are supported by resilient corporate earnings and optimism that lower borrowing costs will extend the business cycle. Market breadth has widened, with investors rotating into small- and mid-cap stocks after a period of large-cap technology leadership. While valuations in some segments remain elevated, earnings momentum in AI-linked infrastructure, semiconductors, and healthcare innovation continues to attract capital. Europe and Asia are also seeing a rebound in investor confidence as trade policy uncertainty eases and industrial activity stabilises.

Within equity growth portfolios, our strategy remains patient and selective – positioning for a range of scenarios while focusing on quality growth. We continue to emphasise companies delivering sustained earnings per share growth that can exceed market expectations. Secular tailwinds such as digitisation, disruption, de-carbonisation, and demographic change continue to underpin earnings resilience. Portfolios remain overweight in investments with these structural drivers, particularly within the defensive growth healthcare sector and the higher-growth information technology sector, where strong cashflows support valuations. We also hold overweight positions in selected materials and consumer staples companies benefiting from structural change and pricing power. Within financials, portfolios remain underweight in banks where valuation multiples leave limited room for an earnings slowdown, and underweight in the lower-growth utilities, communications, infrastructure, and real estate sectors.

In fixed interest, the Reserve Bank has cut the OCR to 3% and the market now prices a move deeper into easy territory. That may prove sufficient to encourage a strong economic recovery. Long-term bond yields have also shifted lower, but to a lesser extent. Fiscal concerns and ongoing supply of government bonds seem likely to continue. We can envisage the market contemplating the idea that the rate cutting cycle is now fully priced in, even though we won't know what is ultimately needed until next year. Accordingly, we have reduced the extent to which we are positioned for lower yields. What does remain attractive is embedded in the shape of the yield curve, where longer-dated yields are considerably higher than where cash rates are likely to be taken to. Accordingly, we will retain a bias towards adding to duration on any moves higher in yield.

Within the Active Growth Fund, we have recently moved our Australasian equity exposure to modestly overweight as our confidence in the NZ economic recovery grows, helped by lower interest rates and ongoing export sector strength. We remain modestly overweight global equities where earnings momentum continues to be supportive, and we think there is room for markets to price additional Fed rate cuts that would take policy to stimulatory levels. We have funded our overweight equity positions via an underweight to domestic fixed interest and cash. With the RBNZ rate cutting cycle well priced and NZ bond index yields below 4%, the investment case for domestic fixed interest has become less compelling. We remain overweight global bonds. They offer not only attractive yield levels in our base case of moderate global growth, but also valuable portfolio protection should economic conditions deteriorate. Currency-wise, we remain long NZD vs. foreign currencies. The USD remains expensive on long-term valuation metrics, and many of Trump’s policies carry downside risk for the dollar through potential capital outflows.

In the Income Fund, we see better prospects coming from equities, given that the NZ fixed interest market now prices in OCR cuts that should provide supportive over time. This is particularly the case for tax-paying investors. We have added listed property shares, reduced interest rate sensitivity and hold very modest currency positions.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.