Key market movements

-

Global equities continued their momentum from the previous month, posting a solid return of 2.8% in unhedged NZD terms, and 3.8% for NZD-hedged investors. Information technology and communication services once again led performance for the month, while the consumer sectors lagged.

- Locally, the New Zealand equity market performed well with the S&P/NZX 50 Gross Index (including imputation credits) delivering a 1.5% return, whilst Australian equities were also positive with the S&P/ASX 200 Index up 1.4% (+1.6% in NZD terms).

- NZ bond returns were positive in June (+0.7%), measured by the Bloomberg NZ Bond Composite 0+ Yr Index. Global bonds also provided positive performance with the Bloomberg Global Aggregate Bond Index (NZD-hedged) returning 0.9%. At the end of the month US 10-year Treasury yields had declined 17 bps to 4.23%.

Key developments

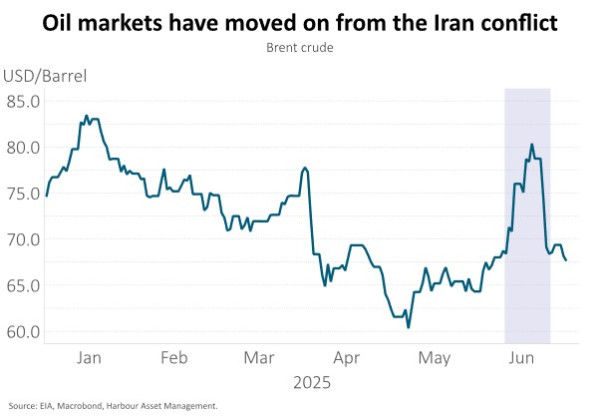

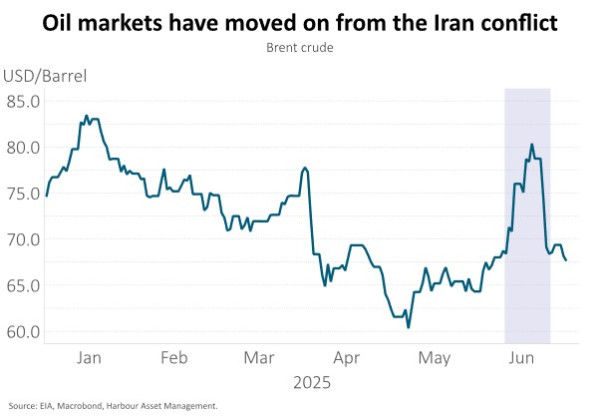

With the first half of 2025 behind us, global equity markets extended their rebound from the lows of early April as geopolitical tensions receded, and trade negotiations progressed between the US and China. The announcement of a ceasefire between Israel and Iran ended twelve days of conflict and helped calm fears of a broader regional war. Oil prices, which had spiked to $80 a barrel during the conflict, retreated to around $65 as the ceasefire held. Earlier in the month, markets were encouraged by developments on the US - China trade front, where two days of negotiations in London produced a framework agreement for de-escalating trade tensions between the world's two biggest economies. By month-end, both the S&P 500 and NASDAQ reached fresh record highs, with US equities buoyed by continued momentum in artificial intelligence and stellar performance from semi-conductor companies like Nvidia and Broadcom.

On the monetary policy front, the US Federal Reserve (Fed) kept interest rates on hold amid growing debate over the inflationary impact of tariffs and concern about the sustainability of growing US government debt levels. Elsewhere, several central banks took a more dovish stance. The Swiss National Bank cut its policy rate to 0% in response to falling inflation and a strong currency. Norway surprised markets by reducing its rate to 4.25%, its first cut in five years, while the Bank of England held steady but signalled a gradual easing path.

Subdued economic activity in New Zealand continued to weigh on earnings expectations for some listed companies, with earnings downgrades over the month for cyclical companies such as Fletcher Building and Kathmandu. However, with companies focusing on strategies to improve returns and the economy showing signs of a gradual recovery, a more supportive earnings backdrop could begin to emerge for the cyclical segments of the market. The announcement of a takeover offer for Tourism Holdings also underscored the attractive valuations present in parts of the New Zealand share market, as merger and acquisition activity re-emerged.

The Australian share market continued to benefit from a resilient Australian economy, and a flight-to-defensive sectors triggered by an uncertain global environment. Australian inflation continued to ease, with the headline CPI slowing to 2.1% year-over-year and the trimmed mean falling below the Reserve Bank of Australia (RBA) midpoint target. Meanwhile, disappointing employment figures point to a loosening labour market. This combination of softer inflation and weaker labour conditions has strengthened expectations for further rate cuts from the RBA, which has supported Australian share market valuations.

What to watch

The conflict between Israel and Iran caused a temporary spike in oil prices in June before a truce was agreed. Israeli and US attacks on Iran nuclear facilities saw Brent crude oil prices increase almost 20% before retracing on the announcement of a truce. The situation is still fragile, however, and any increase in oil prices may make central bank deliberations more complicated, particularly in those countries such as the US where inflation expectations are not anchored at target.

Market outlook and positioning

US tariffs remain an important force to consider for the global economy. It's widely expected that these will push up inflation and lower growth in the US. Economists expect US core inflation to rise to almost 3.5% this year, from 2.8% last year and US GDP growth to drop below 1%, from 2.5% last year. For the rest of the world, it is likely to lower both growth and inflation, if supply chains are not disrupted. Economists expect global growth to moderate to 2.7% this year, vs. 3.3% last year and global inflation to drop to 3.9%, vs. 5.7% last year.

The Fed left rates unchanged at 4.25-4.50% as widely expected, adopting a wait-and-see approach until the impact of tariffs becomes clearer. The Fed's base case, which Powell reiterated in his subsequent testimony to Congress, is that the inflation impact of tariffs will be temporary and once it gains confidence on that, further rate cuts are likely. Markets price more than two 25bp rate cuts this year and 125bp to the end of 2026.

Trump's "One Big Beautiful Bill Act" was passed by the House in early July. Markets remain wary about the degree to which it will add to US debt with the non-partisan Congressional Budget Office estimating it will increase US Debt by US$3.3trn over the next 10 years, though tariff revenue may provide a partial offset.

The New Zealand economy had a decent Q1 but appears to have hit an air pocket in Q2. GDP grew 0.8% in Q1, vs. market expectations of 0.7% and the Reserve Bank of New Zealand (RBNZ) forecast of 0.4%. Indicators for the current quarter, however, suggest the economy has slowed sharply with drops in the manufacturing and services PMIs that are both now in contractionary territory. Filled jobs are down 0.2% for the first two months of the quarter after a flat Q1 and Job ads continue to decline, suggesting the unemployment rate is likely to rise further. The housing recovery has also slowed with house price growth moderating and days to sell lengthening amid lower sales. The primary sector remains a bright spot but pass through to the broader economy has been limited as farmers have so far favoured paying down debt and increasing cash balances.

With a likely pickup in inflation in Q2, that may push inflation expectations further away from target, we expect the RBNZ to leave the OCR unchanged at 3.25% in July. Market pricing largely reflects this with just 5bp of cuts priced for the meeting. Further ahead, financial markets expect one to two more 25bp rate cuts later this year, broadly in line with the RBNZ's own forecasts. This seems appropriate given the large amount of spare capacity in the economy that, despite an improving agricultural economy, is likely to act as an ongoing disinflationary force and a government that remains committed to fiscal restraint.

Within equity growth portfolios, the strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to focus on companies delivering earnings per share growth, particularly where that earnings growth has the potential to be higher and last for longer than consensus expectations allow for. We continue to see the secular (less dependent on economic activity) tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. Portfolios are overweight relative to the benchmark in investments with secular tailwinds in the defensive growth healthcare sector and the higher growth information technology sector, where supported by strong cashflows. Portfolios are also overweight in selected materials and financial shares that benefit from structural change and have pricing power. Portfolios also remain underweight in the lower growth utilities, telecommunications, real estate and infrastructure sectors.

In fixed interest, we have a market in something of a holding pattern, with a modest amount of rate cuts to come from the RBNZ and a global market adding a risk premium to US long-dated bonds because of concerns over the sustainability of the US fiscal deficits. Our key judgements are that the RBNZ may cut the OCR more than currently expected and keep rates low for longer. While the agricultural sector has been faring very well and mortgage rate cuts will help some households, we struggle to see any meaningful engine for growth, especially while households still face cost of living pressure. Our second view, which we have less conviction in, is that the market is pricing in enough global fiscal risk at present to justify a modest overweight holding in New Zealand long-dated bonds. The yield pick-up between a 30-year bond, at 5.20%, compared to 3.25% for a 1-year bond is considerable.

Within the Active Growth Fund, we continue to be mindful of short-term risks to the continuing equity market rally. As a result, while maintaining our neutral weighting to equities we are focussed on near term earnings outcomes. We remain wary of valuations which point to below average long-term returns, however earnings momentum remains strong. We are mindful of output from our research partners who have downgraded expectations for equity performance in the medium-term, based on investor sentiment and positioning indicators which are not as extreme as they have been, as well as near-term event risk. Currency wise, we are hedging more of our global equity holdings currency exposure back to NZ dollars than the benchmark. The USD is richly valued on long term fair value models and many of Trump’s policies have the potential to be US dollar negative, increasing the risk of capital flows away from the US dollar.

In the Income Fund, we have continued with a strategy of holding virtually all of the fund's equity allocation within the Australasian market. This captures the more defensive character of the New Zealand market, which is most compatible with the Fund's investment style. Within fixed interest we continue with a strategy of being concentrated in the 1-to-5-year maturity range, due to our view that the RBNZ will ease rates further, with 2.5% being a realistic expectation in our opinion. Corporate bond markets have performed quite well, and credit spreads are now moderately tight for many issuers. There have not been many new issues, but we have engaged where this has been the case. Private credit and high yield sectors have been stable and are lifting the Fund's running yield in a useful way.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.