Key market movements

- Global equities were positive again in October, with the MSCI ACWI up 3.7% in unhedged NZD terms and 2.7% NZD-hedged. Easing trade tensions between the US and China and a solid third quarter earnings season supported gains.

- New Zealand equities advanced 1.9%, buoyed by easing monetary conditions and early signs of an economic recovery. Australian shares delivered a smaller gain of 0.4%, with their unemployment rate climbing to a 4-year high.

- Bond markets posted modest gains over the month. The Bloomberg NZ Bond Composite Index rose 0.8%, while the Bloomberg Global Aggregate Bond Index (NZD-hedged) added 0.7%, supported by easing yields offsetting a slight widening in credit spreads.

Key developments

October’s market backdrop was shaped by central bank caution and thawing geopolitical tensions. The US Federal Reserve delivered a second consecutive 25bp rate cut, but Chair Powell signalled that further easing is “far from” guaranteed. Labour market data remains mixed, with Challenger reporting the highest monthly job cuts in 22 years, while ADP showed modest gains. The US government shutdown has delayed key data releases, creating uncertainty. Meanwhile, Presidents Xi and Trump’s meeting in South Korea led to a 12-month suspension of trade restrictions, supporting risk sentiment.

The domestic economy showed early signs of recovery in October. The unemployment rate rose to 5.3%, likely marking the peak in labour market weakness. Hours worked increased for the first time in over a year, and business confidence reached its highest level since February. Lending growth at BNZ and Westpac suggests improving credit conditions. Market pricing now anticipates an OCR low near 2%, with the RBNZ expected to maintain accommodative settings well into 2026. While household cashflow challenges persist, green shoots are emerging in retail and construction.

Sentiment across the New Zealand equity market improved, supported by AGM season updates and signs of a cyclical recovery. Companies like Fletcher Building, Auckland Airport and Vulcan Steel saw increased investor interest, reflecting confidence in interest-rate sensitive sectors. Freightways reported strong quarterly results, with revenue up 8.6% and net profit rising 22.5%, reinforcing operational resilience. Ryman Healthcare and other cyclical names also benefited from stabilising demand. The recovery remains uneven but easing monetary conditions and strong export incomes are beginning to influence expectations.

Global equity markets remained buoyant, led by strong Q3 earnings from most of the giant tech firms. The strength in the technology sector helped Nvidia to become the first company to reach a US$5 trillion market capitalisation. Against this backdrop, growth stocks extended their outperformance over value stocks. Japan’s TOPIX led performance as equity markets welcomed the election of Sanae Takaichi as prime minister, viewing her expansionary fiscal and monetary policies as supportive for growth.

What to watch

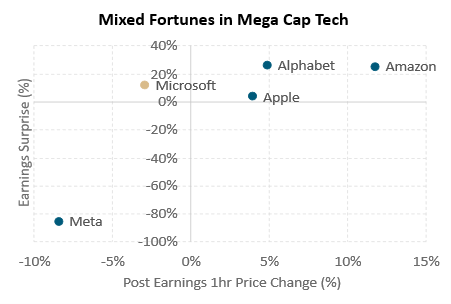

Mega-cap tech earnings delivered a mixed bag of investor reactions, despite strong headline results. Overall, investors responded positively to upbeat guidance, particularly around AI infrastructure and cloud demand. Amazon led the pack, rising 11.7% in the hour post-announcement, followed by Alphabet (+4.8%) and Apple (+3.9%). Meta was the clear underperformer, dropping 8.5% in the first hour post-market due to a US$16bn tax charge. Investors are increasingly focused on forward-looking statements, not just historical earnings. With hyperscaler capex surging (tracking 64% growth in 2025 versus a 22% forecast) valuation support hinges on credible AI monetisation.

Source: Bloomberg, Harbour Asset Management

Market outlook and positioning

Global equity markets have continued their impressive rally underpinned by a benign macroeconomic backdrop and confidence about ongoing growth. The technology sector is leading the gains, fuelled by unprecedented capital expenditure from the hyperscaler firms. However, the divergence in share price reactions highlights that investors are now demanding credible paths to future growth. With valuations in some sectors now looking stretched, there’s a growing debate about whether we’re entering bubble territory. So far, market gains have been grounded in underlying earnings growth, not just speculative fervour.

The RBNZ cut the OCR by 50bp to 2.50% in October, acknowledging spare capacity and subdued inflation pressures. Market pricing suggests further easing is likely, with the expectation of a further 25bp cut in November. The Q3 QSBO confirmed weak demand and limited pricing power, while ANZ’s business confidence survey showed improvement. The housing market remains soft but is expected to respond to lower mortgage rates over summer. An export-led recovery is gaining traction, with dairy lending up NZ$1.6bn since April, supported by Fonterra’s strong payout and upcoming capital return. The NZ share market is pricing in an earnings recovery, with consensus upgrades ahead of the November reporting season.

The Australian economy continues to show resilience, though a higher-than-expected CPI print prompted markets to reassess the likelihood of further rate cuts by the Reserve Bank of Australia. While the RBA remains cautious, the strength in commodity exports and solid household and business balance sheets provide a buffer against tighter financial conditions. Consensus earnings revisions turned positive for the first time in months, driven by upgrades in the mining and banking sectors. We expect the Australian share market to return to its long-run average earnings growth of 8.5% per annum, assuming inflation moderates and global demand remains firm.

Within equity growth portfolios, our strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to focus on companies delivering earnings per share growth, particularly where that earnings growth has the potential to be higher and last for longer than consensus expectations allow for. We continue to see the secular (less dependent on economic activity) tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. Portfolios remain overweight in investments with secular tailwinds in the defensive growth healthcare sector and the higher growth information technology sector, where supported by strong cashflows. We are also overweight in selected materials and consumer staples shares that benefit from structural change and have pricing power. Within financials the fund is overweight diversified financial shares. The portfolio remains underweight in the lower growth utilities, communications, infrastructure and real estate sectors.

In fixed interest, our key economic assessment at present is that despite considerable rate cuts over the last year, activity and confidence are still subdued across most of the economy. We place a lot of weight on the view that households face ongoing cashflow challenges, with only limited scope for relief for many people. Hopes for a recovery lie mostly via the dairy sector, or that over summer the housing market can improve. With market pricing anticipating a fall in the OCR towards 2%, there is likely to be only limited scope for market yields to decline from here. As a result, the two-year phase in which we have consistently positioned portfolios to benefit from lower yields is likely nearing its end. However, we arrive at a similar portfolio construction when we consider the attraction of higher yields, as we move out the yield curve towards longer-dated securities, which offer yields well above the OCR. We expect the OCR to stay below 3% for quite a long time, which means that where we can access securities with a higher yield, we can be optimistic about realising a better return over a medium-term holding period. At a security level, we favour inflation-indexed bonds and are somewhat cautious about some corporate credit as risk premia across the sector is mostly tight.

Within the Active Growth Fund, we are modestly overweight Australasian equities, reflecting our confidence in the NZ economic recovery, helped by lower interest rates and ongoing export sector strength. We are also modestly overweight global equities whilst earnings momentum continues to be supportive. However, we are keeping a close eye on increasingly long positioning along with events in the non-bank lending space. Within our fixed income and cash allocation, we are notably underweight domestic fixed interest and overweight global bonds. With the RBNZ rate cutting cycle well priced and NZ bond index yields below 4%, the investment case for domestic fixed interest is not compelling. The investment case for global bonds, however, remains strong. They offer not only attractive yield levels in our base case of moderate global growth, but also valuable portfolio protection, should economic conditions deteriorate, given substantially longer duration. Currency-wise, we remain long NZD vs. foreign currencies. The USD remains expensive on long-term valuation metrics, and many of Trump’s policies carry downside risk for the dollar through potential capital outflows.

In the Income Fund, our investment strategy has benefitted from a phase of strong performance across equity and fixed interest markets. The positive tone has flowed notably into the corporate bond market, with high yield credit and private credit performing well, despite the traditional behaviour being that credit is more at risk in times of economic weakness. Our positive view on New Zealand shares stems from the observation that with inflation having declined into the RBNZ's target range, we have seen the Official Cash Rate cut into "easy" territory. The current expectation of the OCR being taken down to 2% or thereabouts enables us to anticipate some economic recovery through 2026. That can facilitate an improvement in corporate earnings.

At present, with global equity markets fully valued and concerns about a bubble persisting in market commentary, there is some scope for a pullback. If this happens, we expect this to affect offshore markets more than the defensive stocks we emphasise in the portfolio. Similarly, bond markets are fully pricing the rate cutting cycle, such that forward-looking returns are less likely to enjoy the benefits of capital gains. It will be the existing yield on securities that drives returns from the fixed interest sector. In this regard, we can enjoy the benefit of a steep yield curve in New Zealand. A steep yield curve is one where longer term (5-20 year) securities offer a yield considerably higher than short-term (cash) returns. In a similar vein, the defensive equity bias we engage provides a higher dividend stream than other equities. Bringing this together the fund is well positioned to derive the income that is fundamental to our investment philosophy. We expect the OCR in New Zealand to stay below 3% through 2026 and quite likely well into 2027. This is supportive of relatively stable returns going forward, but perhaps without the prospect of very high returns.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.