The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed income and equity markets.

- The MSCI All Country World (global shares) Index rose 5.0% in USD in October, lifting the 3-month return to +2.9%. Returns in NZD were more modest, up 1.3% for the month and 0.7% over the past three months.

- October brought a strong earnings season in the US. At the time of writing, 440 companies in the S&P 500 had reported results with 360 companies (82%) beating earnings estimates, compared to a long-run quarterly average of 66% since 1994.

- An emerging trend is that companies with pricing power that have been able to weather supply side constraints have been able to significantly grow profits, beating expectations. We think this trend will selectively continue.

- Bond yields continued to rise through October; the New Zealand 10-year bond yield increased sharply by 0.54% to 2.63%, while the US 10-year bond yield climbed a more modest 0.06% to 1.55%. This contributed to declines for major New Zealand and global bond indices.

Key developments

Global equity markets continued to push ahead with the reporting season in the US on balance beating market expectations; however, many management comments highlighted inflation – in particular labour, energy and input costs. This wasn’t lost on the bond market with interest rate curves flattening, seeing sharp sell offs in local markets. The New Zealand 2-year swap rate moved up 0.80% in the month to close at 2.23% with similar moves seen in Australia and globally.

Despite a solid AGM and quarterly update season, the New Zealand equity market retreated, underperforming more cyclical offshore equity markets. The increase in interest rates continued to weigh on the valuation of New Zealand structural growth and defensive yield stocks, with the New Zealand market being more exposed to these sectors compared to global benchmarks. New Zealand cyclical stocks were largely flat for the month, with mixed earnings outlooks holding back their performance.

The Reserve Bank of New Zealand (RBNZ) has started its tightening cycle and is expected to deliver around 1.75% of rate hikes over the next year, taking the Official Cash Rate (OCR) to above 2.25%. In its October Monetary Policy Review, the central bank noted that the recent COVID-19 outbreak had not changed its medium-term outlook. It made clear that further removal of stimulus is to be expected and that emergency policy settings were no longer appropriate.

New Zealand inflation has been surprisingly strong and survey data suggest there is very little spare economic capacity. The RBNZ’s preferred measure of core inflation increased to its highest level since early 2009 in Q3 (2.7% y/y). The NZIER Quarterly Survey of Business Opinion (QSBO) reported high levels of demand and strong intentions to hire among firms in Q3, despite lockdowns. Firms are experiencing notable difficulty in finding labour. Among manufacturers and builders, capacity utilisation is at 50-year highs (96%).

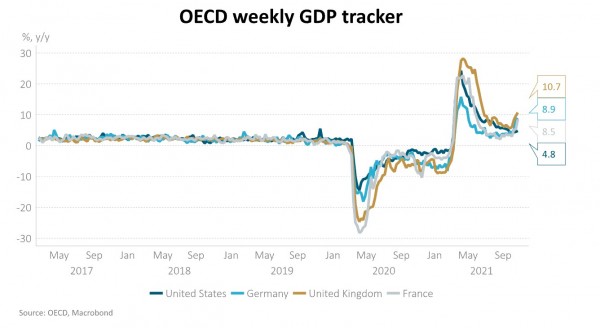

Globally, most economies have returned to pre-pandemic levels of activity as vaccines and lockdowns have tamed COVID-19. Above-potential growth should continue to remove excess capacity and add inflation pressure. Recent weakness in US and Chinese economic activity has been partly offset by strength in Europe.

The broad consensus is that the global economy remains on track to grow 6% this year and 4.5% next. Extremely easy monetary policy continues to support demand via loose financial conditions and high asset prices. Household balance sheets remain strong, thanks to government support programmes. Manufacturing customer inventory levels remain low, suggesting re-stocking will be an additional driver of demand over the coming year.

What to watch

Stagflation: Should we be worried? There has been a sharp spike in the number of internet searches for the term stagflation (the combination of high inflation, high unemployment and slow GDP growth). However, whilst higher inflation may prove to be more persistent than initially thought, the other conditions required do not appear to be rearing their ugly head. Firstly, on unemployment, globally economies are nearing or at pre-COVID levels of unemployment, and at post-GFC lows. Secondly whilst GDP growth may have slowed recently it remains healthy and above potential.

Market outlook and positioning

The macroeconomic environment remains broadly positive for equity market returns, but market volatility may increase from ultra-low levels. The global and local recovery in economic activity has seen the level of activity back to pre-2020 levels. We think global growth is likely to continue but COVID-19 mobility controls may make the recovery halting and elongated. Some parts of the global economy may be past ‘peak’ delta fears (e.g., the US and Europe with high vaccination rates), whilst other regions are at risk with implications for global trade disruption. And not all economic sectors will participate in the recovery – some may be impaired for some time. As a result, the rate of economic recovery may slow from a steep rate to a solid rate, with some push to the right in timing.

Capital markets are rapidly factoring in a normalisation of monetary policy, including higher interest rates, as economies re-open from COVID lockdowns and inflation re-emerges. Equity markets are generally volatile in monetary policy transition periods, and we expect equity market volatility will continue to increase over the next few months from low levels. We also expect to see rotation of capital between sectors depending on whether markets are focused on near-term inflation risk or the risk that global growth rates prove to be slower than expected over the next year (which is what tighter monetary policy settings are supposed to do). The New Zealand equity market is fully valued and its bias to utilities and growth stocks makes it more sensitive to higher interest rates than other markets. That bias to utilities and growth stocks makes its earnings base more resilient should global economic growth continue to slow.

Within equity growth portfolios, our strategy remains to ‘cut through the noise’ and build diversified, resilient portfolios, predicated on secular trends. We continue to focus active investment on a mix of quality sustainable growth stocks supported by secular thematics including digitisation (internet of everything, big data everywhere, e-commerce, automation, and robotics), demographic change, urbanisation, rapid medical advancements and the rise of sustainability. While economic expansion remains positive, the increased volatility reinforces the need to be active and aware of valuations. It also reinforces the need to be selective and focus on long term sustainable structural trends, competitive advantages, and pricing power.

Within fixed interest portfolios, the key views held over the last month have reflected the judgement that global inflation pressures are likely to persist longer than most central banks and market consensus suggest. That should lead to the prevailing easy monetary conditions being removed over time across developed economies. In New Zealand, with the RBNZ already hiking the OCR and further hikes priced into market yields, we think the market is already sufficiently anticipating our scenario. In fact, pricing has likely exceeded the rate hike path we expect, so we became willing to invest in 1- to 3-year bonds as yields raced higher during October. However, global markets are only starting to re-price. We expect more to come. Therefore, we are wary of longer-dated securities and are holding a short duration position around the 10-year maturity.

Within the Active Growth Fund, our strategy within the portfolio has been to trim exposure to areas of the market which are likely to be sensitive to the path of interest rates in the short term. This has seen us reduce our allocation to listed infrastructure. The Active Growth Fund has an overweight position to equity markets overall. We think there is still scope for further earnings upgrades due to forward earnings revisions remaining muted. The portfolio is tilted towards quality growth stocks which we believe can grow earnings faster than inflation.

Within the Income Fund, we had moved the Funds’ asset allocation into a more cautious position in September, reducing equity exposure to 29%. We were wary that rising inflation and extended equity valuations suggested that prospective returns may be soft. The Fund does hold 5% exposure to offshore markets, where performance has been stronger. In the fixed interest sector, we have been steadily raising portfolio duration. We have been prepared to invest in the 2- to 3-year part of the New Zealand yield curve as market pricing looks too aggressive with regards to the number of hikes that we expect the RBNZ to deliver over the next 2 years. In early November, we lifted the duration of fixed income securities to 4.2 years. At the start of the year, it was just 1.1 year.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.