Key market movements

- Global equities were slightly negative in November, with the MSCI ACWI falling -0.3% in unhedged NZD terms and 0.0% NZD-hedged. A notable rotation saw defensive sectors outperform cyclical sectors and technology, reversing the trend observed since May's market recovery.

- New Zealand equities declined -0.4%, despite an encouraging earnings season and strengthening business and consumer confidence pointing to a broadening economic recovery. Australian shares fell -2.7%, weighed down by higher-than-expected inflation data and a sharp increase in interest rates.

- Bond markets diverged, with the local Bloomberg NZ Bond Composite Index falling -0.8% as a hawkish RBNZ rate cut signalled the easing cycle may have ended, while the Bloomberg Global Aggregate Bond Index (NZD-hedged) gained 0.1%.

Key developments

Markets welcomed the end of the US government shutdown in November, though the full economic impact remains unclear. At 43 days, this was the longest shutdown in history, surpassing the previous 35-day record during Trump’s first term. The disruption affected hundreds of thousands of federal employees and delayed the collection of critical economic data, including inflation and unemployment figures. The funding bill however only extends through to the end of January, leaving the risk of renewed uncertainty early next year.

Expectations for Federal Reserve easing built over November following dovish comments from several Fed officials. Vice Chair Williams highlighted rising labour market risks and easing inflation pressures, describing rates as “mildly restrictive”, a stance seen as aligned with Chair Powell. Market pricing now reflects a high probability of a December rate cut. US data releases were generally soft, with ADP payrolls declining, consumer confidence weakening, and retail sales losing momentum heading into the fourth quarter.

The Reserve Bank of New Zealand delivered a hawkish 25bp cut to 2.25%, signalling the likely end of its easing cycle. Updated forecasts imply just a 20% probability of another cut early next year, and one MPC member voted to hold rates steady. Markets reacted sharply, with two-year yields up nearly 30bp and the NZ dollar appreciating 2% over the week. Subsequent data reinforced this stance: Q3 retail sales rose 1.9% versus 0.6% expected, business confidence surged to an 11-year high, and consumer confidence improved notably, supporting the view that an economic recovery is underway.

In Australia, an unexpected rise in core inflation in October has diminished prospects for near-term RBA cuts. Trimmed mean CPI increased to 3.3% year-on-year versus expectations for a decline to 3.0%. With limited evidence of spare capacity, markets now anticipate an extended period of unchanged rates at 3.6%, with only a marginal chance of hikes late next year.

Global equities experienced a notable rotation in November, with defensive sectors such as healthcare and consumer staples outperforming, reversing the trend observed so far this year. Despite a strong third-quarter earnings season, where 81% of S&P 500 companies beat consensus estimates, returns over the month were slightly negative. Technology was the weakest sector, reflecting concerns over inflated valuations, even as EPS growth forecasts for the Magnificent Seven surged to over 22% for 2026.

What to watch

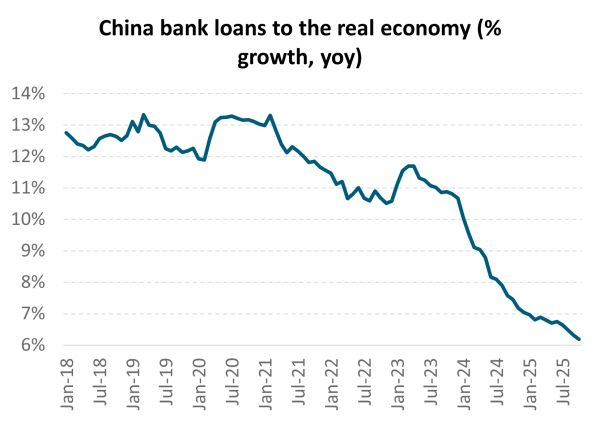

Chinese economic growth looks to be slowing into year end. Consumer spending via retail sales is softening and annual fixed-asset investment growth has turned negative for the first time since Covid lockdowns. The below chart showcases the inertia in borrowing appetite among households and businesses, with a sustained slowdown in lending in the last two years. Consumer worries around property wealth, job security and general cost of living pressures have tempered willingness to borrow. However, policymakers retain tools to support activity if needed. Notably, Chinese exports continue to exceed expectations, providing a partial offset to weak domestic demand.

Source: PBoC, Bloomberg

Market outlook and positioning

While global markets have enjoyed a strong run, risks remain – particularly around valuations, geopolitics, and the sustainability of earnings growth. Central banks globally are now entering a cautious consolidation phase. The US Federal Reserve is expected to deliver another 25bp cut in December, though the path for 2026 remains uncertain. The European Central Bank has largely concluded its easing cycle, while other major central banks including England and Australia have paused rate cuts due to persistent inflation. For New Zealand investors, the outlook is cautiously optimistic: supportive monetary policy, improving corporate sentiment, and a stabilising housing market all point to a gradual recovery. As always, diversification and a focus on fundamentals remain key.

The NZ share market’s improving earnings per share trend is set to support returns. The earnings reporting round for the September period has seen more beats against consensus expectations than misses. This breaks the NZ share market’s three-year earnings downgrade cycle. The benefit of RBNZ easing may be reflected in full NZ share market valuations relative to historical averages, but the potential for a period of above-trend economic growth (potentially above 3%) is yet to flow through to NZ share market earnings forecasts. While we have seen an increase in investor interest in the NZ share market, investors remain underweight in the NZ share market. A continued lift in earnings forecasts may see a further increase in investor allocations to the NZ share market.

The near-term backdrop for Australian share market returns is more mixed. The outlook for Australian economic growth remains supported by Government spending, population growth and firm mining commodity prices. Against this, cost growth remains above average, limiting earnings growth. The RBA is expected to remain on hold until such time inflation falls below 3%. The above average valuation multiples for the Australian market may not reflect the RBA’s move to a more hawkish stance and limit the performance of interest rate sensitive sectors.

Within equity growth portfolios, our strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to focus on companies delivering earnings per share growth, particularly where that earnings growth has the potential to be higher and last for longer than consensus expectations allow for. We continue to see the secular (less dependent on economic activity) tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. Within our portfolios, sector positioning reflects these convictions. We maintain overweight exposure to healthcare, primarily through New Zealand retirement village operators, where returns are expected to improve as supply-demand dynamics stabilise and operational efficiencies strengthen. In information technology, holdings such as Xero and Life360 offer scope for user growth to surpass market expectations. Materials exposure remains overweight, with BHP and Rio Tinto well placed to benefit from robust commodity pricing. Conversely, we remain underweight in sectors where valuation multiples appear stretched relative to modest earnings prospects. Utilities, particularly electricity generators, continue to trade at full valuations despite limited growth potential. Communication services face heightened competitive pressures, constraining earnings momentum, while infrastructure valuations also remain elevated against a backdrop of subdued growth.

In fixed interest, we have previously written about our perception that we were getting towards the end of the rate cutting cycle. Our view had been that it was time to be more circumspect with position sizes. We had shifted bond portfolio duration positions to a modest short, as we could see a scenario where the economy could improve over summer, with the RBNZ choosing not to cut the OCR below 2.25%. However, we didn't expect the RBNZ to be signalling a strong likelihood that they would not cut again. That announcement prompted us to initially reduce duration as we judged that the market might push yields higher as the changed outlook prompted a re-pricing of bond and swap yields.

From here, the question we will face in the bond market is whether the rush of better data generates momentum, or whether it plateaus. The bond market selloff, which reflected plenty of position unwinds from investors looking for more rate cuts, is effectively pricing increasing momentum in the economy. The tempting view to position for is that the economy recovers at a sufficiently moderate pace to enable the RBNZ to take its time with rate hikes. We don't yet expect OCR hikes next year. This scenario implies the NZ bond market isn't such a bad place but that it is still a time to be circumspect about taking big duration positions. With 5, 10 and 30-year NZ Government Stock yields at 3.6%, 4.3% and 5.1% respectively, there is a considerable risk premium above the 2.25% cash rate. Corporate bonds offer even greater yield. We are looking to add investment into longer-dated maturities as yields rise.

Within multi-asset funds, we reduced our overweight global equity position to neutral in early November. We continue to see challenges in the form of high valuations, elevated positioning, and fading exuberance in the AI theme. However, as we navigate this unwind, we are hopeful for a suitable re-entry point prior to year end, as we remain bullish over the medium-term given fiscal support and strong corporate earnings in the US. We remain modestly overweight Australasian equities, reflecting our confidence in the NZ economic recovery, helped by lower interest rates and ongoing export sector strength. Within our fixed income and cash allocation, we are notably underweight domestic fixed interest and overweight global bonds. With the RBNZ rate cutting cycle well priced and NZ bond index yields below 4%, the investment case for domestic fixed interest is not compelling. The investment case for global bonds, however, remains strong. They offer not only attractive yield levels in our base case of moderate global growth, but also valuable portfolio protection, should economic conditions deteriorate, given substantially longer duration. Currency-wise, we remain long NZD vs. foreign currencies. The USD remains expensive on long-term valuation metrics, and many of Trump’s policies carry downside risk for the dollar through potential capital outflows.

In the Income Fund, we have held a fairly neutral exposure to equities and fixed interest over recent months, capturing a view that both asset classes had scope to deliver satisfactory positive returns. We had taken the view that the RBNZ would need to cut the Official Cash Rate towards 2%, due to the ongoing weakness in the domestic economy. While the weakness is not helpful for firms from an earnings perspective in the near term, we have looked ahead, anticipating an economic recovery that could bring more optimistic valuations to equities. Declining inflation, which enables rate cuts, is a classic recipe for better equity returns. Looking ahead, we are still comfortable with our equity exposure. Inflation pressures in New Zealand seem sufficiently low at present to enable the RBNZ to keep the Official Cash Rate at 2.25% for some time. This should ensure an improvement in earnings. In fixed interest, market performance was weaker than we expected, due to the RBNZ projection of no rate cuts below 2.25%. Now, the market is already pricing in rate hikes starting in late 2026. We think this is premature and, accordingly, we see value in longer-dated bonds at present.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.