Key market movements

- Global equities extended their rally in July, returning 4.2% in unhedged NZD terms and 2.2% NZD-hedged, supported by continued momentum in technology shares and growing investor confidence. The MSCI All Country World Index posted its third consecutive monthly gain, taking the 3-month return to 12.6% in unhedged NZD terms.

- The New Zealand equity market continued to climb, with the S&P/NZX 50 Gross Index (including imputation credits) returning +1.8% for the month. Performance was underpinned by strength in utilities and consumer staples, while some cyclical names continued to lag amidst weak domestic data and cautious earnings guidance.

- Bond markets delivered mixed results in July. New Zealand bonds rose +0.6%, supported by stable monetary policy expectations and moderate issuance, while global bonds posted a marginal decline of -0.1%. US 10-year Treasury yields edged higher, ending the month at 4.37%, as markets digested fiscal developments and continued uncertainty around the timing of Federal Reserve rate cuts.

Key Developments

Markets continued to navigate the evolving landscape of global tariffs, mixed economic data, and corporate earnings updates. US tariffs, though not as high as initially feared, are expected to settle at around 15%, still a significant rise from the 2.5% at the year's start, and are projected to dampen global growth to about 3% this year from 3.3% last. The Federal Reserve, cautious about tariff-driven inflation, kept rates on hold in July and signalled no imminent cuts, noting persistent inflation and uncertain economic conditions. However, a weaker-than-expected July jobs report prompted markets to increase expectations for Fed rate cuts this year.

Meanwhile, Congress passed Trump’s ambitious tax and spending bill, anticipated to boost near-term US growth but also raise concerns about a projected US$3.0 trillion increase in US debt over the next decade, according to the Congressional Budget Office – though some offset may come from tariff revenue. Market attention remains focused on how these shifts will impact underlying growth and inflation trends.

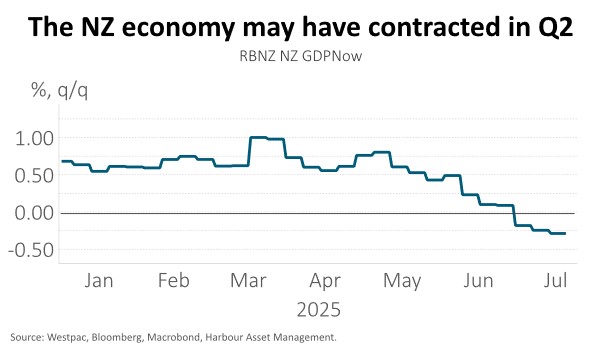

The New Zealand economy showed further signs of softness, with the Q2 QSBO revealing weaker pricing power and persistent spare capacity. The RBNZ held the OCR at 3.25% in July but reaffirmed an easing bias, setting the stage for further cuts. Inflation data for Q2 came in below expectations at 2.7%, and core inflation fell to a four-year low. These developments support the case for further monetary policy support, with the market beginning to price a lower terminal OCR of 2.50%.

In Australia, the RBA also paused but signalled an easing bias, even as loan growth and business sentiment remained resilient. Business credit expanded close to double-digit annual rates, and housing lending remained firm, helping to explain the relative economic strength across the Tasman.

Australasian equity markets reflected cautious optimism ahead of earnings season. The New Zealand aged care sector was a standout, with Summerset and Ryman Healthcare both reporting stronger-than-expected unit sales, lifting share prices and analyst sentiment. A rotation toward healthcare and growth stocks emerged more broadly, supported by continued KiwiSaver inflows and improving investor confidence in corporate profitability. Earnings reports from cyclically exposed stocks were weaker than expected through the month.

In global equities, semiconductors outperformed software, with Nvidia and Broadcom extending gains, while Alphabet delivered strong results driven by AI-related demand. However, signs of margin pressure from tariffs began emerging in earnings commentary, with GM citing a US$1.1bn hit and several Asian automakers flagging profitability concerns. Despite this, investor sentiment stayed upbeat, helped by China’s better-than-expected Q2 GDP growth and the Hang Seng rallying over 22% year-to-date.

What to watch

A string of disappointing activity indicators suggest the NZ economy may have contracted in Q2, according to the RBNZ’s new GDPNow measure. Business surveys have been the key driver with PMIs for both the manufacturing and services sectors dropping in to contractionary territory in May, and the Q2 NZIER Quarterly Survey of Business Opinion reporting a net 23% of firms had experienced lower activity in the quarter vs. Q1. Recent signals from the housing market also suggest that the economy has hit an air pocket with prices falling in June, sales dropping and days to sell lengthening.

It's not all bad news, however. Our external sector continues to enjoy historically high revenue, and the outlook remains relatively positive with China growing above the 5% official target and tariffs settling at lower levels than feared. Elsewhere, lower interest rates should continue to work their way through the economy, particularly as more people roll on to longer-term fixed rates that are notably lower than the short-term ones that were preferred through the second half of last year.

Market outlook and positioning

Earnings remain the dominant driver of equity market returns, and attention now shifts to the Australasian reporting season which kicks off in August. Across both the New Zealand and Australian markets, expectations are subdued, with investors bracing for downside risks and cautious forward guidance. The contrast with the US is notable – strong results from the technology sector have supported US equities, yet local markets lack that same tech exposure. Instead, the New Zealand and Australian markets offer participation in long-duration growth sectors aligned with secular themes such as healthcare innovation, energy transition and demographic change.

The local reporting season is expected to reflect the reality of a low-growth environment. In New Zealand, 28 of the S&P/NZX 50 companies will report results for the June period, with market consensus suggesting that while revenues may fall short of expectations – given weak economic momentum – some margin protection may be achieved through cost containment. Management commentary will be closely watched for signs of operational discipline, ongoing cost-out and productivity initiatives, as well as early signals that green shoots in the economy are taking hold. Sectors such as consumer, housing and construction are showing tentative signs of recovery from low levels, and a slower pace of fiscal consolidation may begin to offer support. Still, dividend growth is likely to remain muted, particularly for more cyclical companies as balance sheets are rebuilt.

Valuations across the New Zealand market remain bifurcated. While headline market metrics appear full, the skew from high PE names such as Fisher & Paykel Healthcare and the gentailers masks more attractive value in other parts of the market.

In Australia, this will be the third consecutive reporting season where earnings downgrade risk is likely to outweigh upgrade potential. Key issues include softening domestic activity, compressed bank net interest margins, rising input costs, and patchy demand in mining. Investors will also monitor how AI investment is impacting capital allocation and productivity. Expectations are for earnings delivery in communications, healthcare and technology to underpin aggregate growth, while the broader market faces tepid earnings momentum in financials, energy and materials. Valuation multiples have pushed higher despite falling earnings forecasts, leaving the market reliant on FY26 and FY27 earnings recovery. Conviction in leadership beyond the banking sector will be key for any sustainable rotation – particularly in healthcare, which faces a changing US regulatory backdrop, and materials, which need improved global growth signals.

Bond markets continue to weigh global fiscal concerns, evolving monetary policy signals and subdued domestic data. In New Zealand, the case for further RBNZ easing has strengthened, with recent inflation and activity data pointing to persistent spare capacity and weak demand. While the RBNZ held the OCR at 3.25% in July, the tone of communication shifted more clearly toward further cuts, and we continue to expect a move to 2.50% later this year. Globally, elevated term premia and concerns around US debt sustainability have steepened yield curves, but recent strong demand for longer-dated issuance has stabilised markets. Locally, fiscal restraint and reduced bond issuance over the coming two years provide a supportive backdrop. With New Zealand’s 10 to 30-year yields trading above global peers and the curve relatively steep, the balance of risks favours remaining constructive on longer duration.

Within equity growth portfolios, our strategy remains to be patient, position for a range of scenarios and to be selective, with a focus on quality growth companies. We continue to emphasise businesses delivering earnings per share growth that can exceed and extend beyond market expectations, supported by long-term structural themes such as digitisation, disruption, de-carbonisation and demographic change. Portfolios are overweight in companies exposed to these secular tailwinds, particularly in the defensive growth healthcare sector and the higher growth technology sector, where strong cashflows support valuation. We also maintain overweight positions in select financial and materials names that benefit from structural change and have demonstrated pricing power. Portfolios remain underweight in lower growth sectors such as utilities, telecommunications, real estate and infrastructure.

In fixed interest, we have had a constructive view on the scope for OCR cuts for some time – we think that weak activity in the New Zealand economy argues for more stimulatory policy, especially as inflation is clearly settling below 3%. We have increased duration in portfolios recently as we believe a strong case exists for the OCR to fall to 2.5%, or lower. Given the abundance of commentary about the prevailing stress across sectors of the economy, notably across households where cash flow is constraining spending, it seems remarkable to us that there is not a greater expectation of lower OCR rates. The market has been reluctant to really commit to this idea, given previous guidance from the RBNZ suggesting a very measured approach. A by-product of lower cash rates should be positive across the whole yield curve, with 10-year government bonds at 4.4% looking attractive to us.

Within the Active Growth Fund, we remain modestly underweight global equities, reflecting our caution around the durability of the recent rally. While earnings momentum has been broadly supportive, we are seeing early signs of softer forward guidance – particularly from companies exposed to tariff-related cost pressures. Recent trade deal announcements have buoyed markets, but we are concerned that the impact of already-implemented tariffs is being underestimated. Several corporates this earnings season have cited rising costs and margin compression, reinforcing our view that backward-looking beats may offer limited reassurance. Some of the earnings coming out of the US this season are showing that it is an AI-driven rally, and the risk to our position is that the AI theme bails out the rest of the economy – hence the small sizing. In contrast, we remain overweight global bonds. They offer not only attractive yield levels in our base case of moderate global growth, but also valuable portfolio protection should economic conditions deteriorate. With global central banks easing and term premia still elevated, we see bonds as an increasingly compelling asset class. Currency-wise, we maintain a higher-than-benchmark hedge on global equities back to the New Zealand dollar. The USD remains expensive on long-term valuation metrics, and many of Trump’s policies carry downside risk for the dollar through potential capital outflows.

In the Income Fund, we have a small overweight allocation to equities. This has been beneficial, even though the premise that we held for the position hasn’t really played out. Our expectation has been that equities can perform if inflation is behaving well and markets can anticipate an economic recovery. We are still awaiting an economic recovery and until we see this being more tangible we are unlikely to add to this exposure. Fixed interest positions have provided solid returns and we expect this to continue.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.