Key market movements

- Global shares ended 2025 strongly. The MSCI ACWI rose 0.9% (NZD unhedged) in December (0.7% NZD hedged), taking full year returns to 19.2% for both classes. There was dispersion across sectors in December: Materials (+4.4%) and Financials (+4.2%) led the month, while defensives lagged, with Utilities (-2.9%) and Consumer Staples (-1.4%) under pressure.

- The S&P/NZX 50 added 0.5% in December and 4.1% for the year, with cyclicals leading late gains. Across the Tasman, the ASX 200 returned 1.3% for the month and 10.3% annually in AUD, while NZD investors saw 2.8% monthly and 15.6% for the year thanks to AUD currency strength.

- Fixed income softened into year-end. NZ bonds slipped 0.1% in December but gained 5.0% over 12 months. Global bonds fell 0.4% for the month, up 3.7% for the year, as yields edged higher.

Key developments

Global equities traded higher in December, led by European and Asian strength, while US shares moved sideways after a slightly hawkish 0.25% Federal Reserve cut pushed long-term yields higher. Rising yields and questions over returns on generative AI capex drove a rotation from IT to cyclicals. Quarter-end gains reflected optimism around AI’s economic potential, Fed easing, and increased government spending, particularly on defence. However, concerns over valuations and policy uncertainty triggered a late pullback. Emerging markets outperformed, energy shares firmed as Brent held near USD 80, and semiconductor volatility underscored shifting leadership beyond US mega-caps.

The US Federal Reserve (Fed) delivered an expected “hawkish cut” in December, reducing the Fed Funds rate by 0.25% to a 3.5% - 3.75% range. Notably three members of the committee dissented, signalling caution about the path ahead as inflation has not yet returned to the 2% target. The latest “dot plot” indicates one further cut in 2026 and another in 2027, settling around a 3% - 3.25% longer‑run neutral rate. Markets, however, appear to be placing greater weight on recent labour market weakness and expect the two cuts to come in 2026. With Chair Powell's term ending in May 2026, prediction markets now favour National Economic Council Director Kevin Hassett to be marginally ahead of former FOMC member Kevin Warsh to take up the Federal Reserve Chair.

The Japanese bond market is receiving increased attention as 10-year yields pushed through 2%, having surged 30bp higher over the past month and almost doubling over the past year. Yields have been rising due to concern about new Prime Minister Sanae Takaichi’s plans to stimulate the economy and cut taxes. The Bank of Japan lifted its policy rate by 0.25% to 0.75% given rising inflation pressure from strong wage growth and a weaker yen. Higher yields in Japan could motivate bond investors to shift into this market at the expense of others, as we have seen at times in the past.

New Zealand’s economy surprised on the upside in Q3, expanding 1.1% after a revised 1.0% contraction in Q2. The rebound was driven by construction (+1.7%) and manufacturing (+2.2%), alongside stronger exports and business services. Annual growth of 1.3% marks the first positive print since mid-2024. The data were an upside surprise to the RBNZ's forecast 0.4% q/q growth and our analysis suggests the momentum is likely to have continued in Q4. Other economic data collectively suggest a somewhat lukewarm recovery is underway. While lower mortgage rates are flowing through to households, dairy prices have been easing back and the housing market has a range of data pointing to lower activity than we typically experience at the beginning of a recovery.

Comments by new RBNZ Governor Anna Breman have brought some sense and stability into the rates market after an overreaction that had priced in the OCR being hiked to as high as 2.9% during 2026 in early December. Dr Breman most likely aimed to explicitly push back on market price action at that time by noting that the RBNZ’s implied rate track was consistent with the OCR remaining at 2.25% for some time. She further stated, “financial market conditions have tightened since the November decision, beyond what is implied by our central projection for the OCR.” We think Breman has good grounds to do this with significant spare economic capacity limiting inflation pressure and Treasury’s Half Year Economic and Fiscal Update confirming a contractionary fiscal policy stance as it seeks to reduce the large fiscal deficit.

What to watch

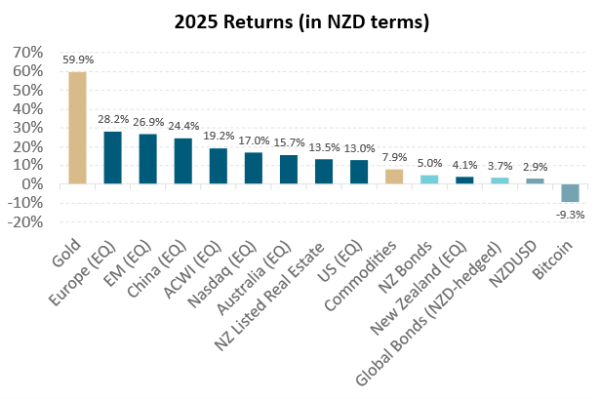

This is less one to watch for the future, but rather what we have been watching over the past year. Our chart captures the striking contrasts in 2025 returns across major asset classes. It has been another lacklustre year for New Zealand equities, with local bonds outperforming NZ shares for the third time in four years – let’s hope 2026 is not another repeat. In Australia, sector dispersion has been extreme – healthcare fell more than 20%, while resources surged over 20%, underscoring the importance of active positioning.

Gold stands out as the year’s big winner, supported by persistent inflation and geopolitical uncertainty, as well as a strong retail bid. Bitcoin, meanwhile, delivered a volatile ride, peaking near USD 125,000 before settling closer to USD 90,000. US equities were on track for a third consecutive 20%+ – a milestone achieved only once before during the tech bubble – but AI-related jitters late in the final quarter tempered that momentum. Even so, global equities have delivered another strong year, extending a three-year streak, with Europe and emerging markets (EM) turning up to the party.

Looking ahead, elevated valuations and recent performance inform our more conservative long-term return assumptions. However, as Keynes observed, even when fundamentals suggest caution, “Markets can stay irrational longer than you can stay solvent.” History also reminds us that stepping out too early can be costly – as Julian Robertson of Tiger Management famously learned during the tech boom.

Source: Bloomberg

Market outlook and positioning

Geopolitics is dominating the headlines and markets are sanguine. The US operation to capture Venezuelan president Nicolás Maduro and the renewed intentions to control Greenland (at a minimum) show that the US’s “Donroe Doctrine” really is the driving philosophy behind foreign policy for now. The focus on the US’s chosen sphere of influence raises questions about their intent in Europe and across the Pacific. Thus far, financial markets have taken the approach of looking at specific effects of the news, e.g. the impact of redevelopment of Venezuela’s oil infrastructure, rather than show any clear change in generalised risk appetite.

Global equity markets enter 2026 supported by steady, if unspectacular, economic growth of around 2–3% and largely neutral monetary policy settings. Easier fiscal conditions and liquidity support provide a constructive backdrop, while geopolitical risks and US midterm elections may inject volatility later in the year. AI remains both an opportunity and a source of uncertainty as elevated capex and regulatory risks weigh on sentiment. Overall, the environment suggests moderate returns with sector rotation likely as earnings trends and valuation multiples adjust.

The economic outlook for New Zealand is improving, underpinned by lower interest rates, stronger consumer balance sheets, and potential fiscal stimulus ahead of the general election. Consensus earnings growth for the NZ market sits near 20%, though history suggests a more modest 10% outcome is possible. Valuation multiples remain above long-run averages, implying some downside risk, but mid-cap and cyclical sectors could benefit from better domestic confidence. In Australia, earnings upgrades in resources and banks have supported sentiment, though persistent inflation and RBA caution may keep rate expectations in focus. Commodity price resilience remains key for Australian market performance.

Globally, investors are watching central bank policy and liquidity trends closely. The US yield curve steepened late in 2025, favouring cyclicals such as commodities and financials while weighing on utilities and technology. Markets expect the US Federal Reserve to cut rates by mid-year, which could support risk assets, though election-related uncertainty and tariff risks may create volatility. AI-driven investment remains a double-edged sword, with productivity gains offset by high capital costs and regulatory scrutiny. Against this backdrop, we expect global growth to remain steady, supporting earnings but requiring selectivity as sector leadership continues to shift.

Within equity growth portfolios, Harbour’s strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to focus on companies delivering earnings per share growth, particularly where that earnings growth has the potential to be higher and last for longer than consensus expectations allow for. We continue to see the secular (less dependent on economic activity) tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. Our growth funds are overweight healthcare (predominantly via NZ retirement village investments where returns are expected to improve as supply and demand conditions stabilise and operational efficiency improves), information technology, and materials (which we expect to benefit from strong commodity prices).

In fixed interest and the Income Fund, the portfolio investment strategy has a renewed focus on the 1–3-year part of the yield curve. This was prompted by the market reaction to the RBNZ's signal that they were likely to be finished with the rate cutting cycle. We think there is a good chance that no further rate cuts will be needed, as we shift towards a recovering economy. However, as the market was quick to price a hiking cycle, we see the opportunity to invest into the 2- and 3-year maturity range particularly. It is not unusual for the market to pivot quickly from a mindset around looking for rate cuts to one of rate hikes. We don't think this is justified and at this stage we would not be surprised to see the OCR remain at 2.25% throughout 2026. From a global perspective, there are offsetting elements, which may suggest a period of relative stability. This leaves us fairly neutral with regards to our exposure to longer-dated bonds. Corporate bonds fared fairly well in December vis-a-vis NZ Government Stock and did especially well relative to interest rate swap levels. Spread levels are quite narrow now and expensive on this basis, so we are being patient with regards to adding exposure. Volatility across different sectors of the market is currently quite low, so we are being selective with our security selection choices as well.

Within multi-asset funds, we maintain our tactically neutral stance on global equities. We continue to see challenges in the form of high valuations, elevated positioning, and fading exuberance in the AI theme. However, we are hopeful for a suitable re-entry point, as we remain bullish over the medium-term given fiscal support and strong corporate earnings in the US. We remain modestly overweight Australasian equities, reflecting our confidence in the NZ economic recovery, helped by lower interest rates and ongoing export sector strength. Given the recent increase in NZ yields, we feel that NZ bonds now offer a comparable yield to global markets (c. 4%) and perhaps a greater prospect of capital gain given our view that the RBNZ is unlikely to hike next year vs. market pricing of c.50bp of hikes. The investment case for global bonds remains strong. They offer not only attractive yield levels in our base case of moderate global growth, but also valuable portfolio protection, should economic conditions deteriorate, given substantially longer duration. Currency-wise, we remain long NZD vs. foreign currencies. We see the USD as expensive on long-term valuation metrics, and many of Trump’s policies carry downside risk for the dollar through potential capital outflows.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.