Key market movements

- Global equities got off to a strong start despite renewed geopolitical tensions. The MSCI ACWI fell 2.1% in NZD terms but rose 2.3% for NZD‑hedged investors, with currency moves dominating performance as US dollar softness offset solid underlying global momentum.

- New Zealand and Australian equities were mixed. The S&P/NZX 50 declined 0.9% as local markets lagged the global tone, while Australian shares gained 1.8% in AUD and 1.5% in NZD terms, supported by firmer risk appetite across the region.

- Bonds were broadly steady. Global bonds (NZD‑hedged) rose 0.1%, reflecting contained volatility even as Japan saw outsized moves in long dated yields. The Bloomberg NZ Bond Composite slipped 0.3% as domestic yields drifted slightly higher.

Key developments

Global equities started the year strongly in January, with gains broadening beyond last year’s narrow leadership despite a steady flow of geopolitical headlines, including developments involving Venezuela, renewed Middle East tensions and ongoing debate about US policy and Federal Reserve independence. Resilient US activity data, particularly stronger services indicators, supported risk appetite and reinforced a “run the economy hot” narrative, helping cyclical and higher‑beta markets outperform as investors focused on earnings delivery and continued AI‑related investment. At the same time markets were buffeted by geopolitical events that increased interest rate, currency and commodity volatility. Through most of the month investors continued to sell the US dollar and rotate into gold and silver, reflecting concerns about a widening US fiscal deficit and a weakening Federal Reserve. Precious metals rallied sharply before reversing late in the month after President Trump’s Fed Chair announcement was seen as supportive for the US dollar.

Trump announced former Federal Reserve governor Kevin Warsh as his pick for the next Fed Chair and while markets see Warsh as one of the more hawkish contenders, rates barely moved on the news. Warsh doesn’t appear to be all hawk having recently indicated the ability for rates to be lower if the Fed’s balance sheet could be smaller and noting that he doesn’t believe the unemployment rate has to go up for inflation to fall. Warsh is also not a fan of too much data dependency or forward guidance. As Fed Chair, Warsh will certainly have influence on the rest of the committee, but he ultimately has just one vote and has limited ability to push the committee to places it doesn’t want to go.

The US Federal Reserve left rates unchanged at 3.5% - 3.75% after three straight cuts, with a split decision that included two members favouring a further 0.25% reduction. Chair Powell kept the emphasis on an improving US economy in his press conference and declined to be drawn into political commentary.

Long‑term Japanese government bond yields surged to multi‑decade highs during January, driven by rising fiscal concerns following Prime Minister Takaichi’s proposed tax cuts and pre‑election spending signals. Thirty‑year JGB yields rose to 3.87%, with 10‑year yields climbing to 2.35%, the highest since the late 1990s. The sell‑off reverberated across global bond markets, lifting US and European yields as investors weighed the prospect of looser Japanese fiscal policy and the risk that the Bank of Japan may need to respond with tighter monetary policy sooner rather than later. Finance Minister Katayama called for calm following a bout of disorderly trading, though markets remain sensitive to fiscal signals ahead of February’s election.

NZ joined the rest of the world in January as our composite PMI returned to expansionary territory after the services component jumped to 51.5 from 46.9. The data are consistent with signals from other business surveys, such as the ANZ Business Outlook and NZIER QSBO, that suggest growth has continued after the Q3 bounce. It remains early days in NZ’s economic recovery, however, with a large amount of spare capacity remaining that will likely take at least a year to fully remove.

What to watch

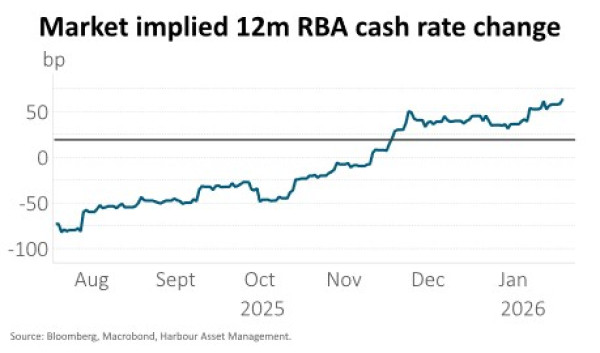

The RBA lifted its cash rate by 25bp to 3.85% after recent data suggest capacity pressures may be building in the Australian economy. The unemployment rate unexpectedly dropped in December and core inflation accelerated to 3.4% in Q4, well above the top of the RBA’s 2-3% target band. The market now prices another 25bp hike in June this year to 4.10%, a massive turnaround from 6 months ago when the market was implying the cash rate to be 3.10% in June as inflation pressures appeared to be dissipating at the time.

Market outlook and positioning

Global equity markets enter 2026 with a constructive backdrop. Solid mid‑2% to 3% global growth, neutral policy settings from most central banks, and ongoing investment in AI continue to support earnings. However, volatility may remain elevated given geopolitical risks, diverging central‑bank paths, and the US government’s willingness to “run it hot”. Sector rotation is likely to persist as markets balance opportunities in cyclicals against higher rates, productivity trends and AI‑driven disruption.

New Zealand equities face a more supportive domestic policy environment, with fiscal conditions easing and monetary policy likely to become less restrictive as the year progresses. The December reporting season will be pivotal for sustaining recent gains, especially given market expectations for strong earnings growth from sectors such as aged care, tourism, technology and materials. Although valuation multiples for the S&P/NZX 50 remain elevated in aggregate, the median company multiple sits closer to long‑run averages, suggesting returns will hinge on companies demonstrating operating‑leverage gains and delivering on self‑help initiatives.

The broader NZ macro outlook is improving. A lift in government spending, stronger household balance sheets and a sizeable dairy payout boost are expected to support growth through the first half of 2026. While the market is pricing RBNZ rate hikes, sluggish employment recovery may slow the pace of tightening. Consensus revenue and interest‑cost assumptions may still require adjustment, but the environment remains reasonably balanced. Election‑year uncertainty may weigh on confidence at times, though history suggests NZ equities typically deliver acceptable returns through the cycle.

Within equity growth funds Harbour’s strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to focus on companies delivering earnings per share growth, particularly where that earnings growth has the potential to be higher and last for longer than consensus expectations allow for. We continue to see the secular (less dependent on economic activity) tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. Our growth funds are overweight healthcare (predominantly via NZ retirement village investments where returns are expected to improve as supply and demand conditions stabilise and operational efficiency improves), information technology (where there is potential to exceed user growth expectations), and select financials.

In fixed interest and the Income Fund, we remain constructive on short‑dated New Zealand interest rates, where we continue to see attractive risk‑adjusted value. Market pricing for around 50 basis points of OCR hikes by late 2026 looks over‑enthusiastic given ongoing labour‑market slack and the RBNZ’s likely reluctance to validate more aggressive expectations at the upcoming MPS. While we hold this positive stance at the front end, we are more cautious on longer‑dated yields, with high global debt levels and the risk of fiscal missteps pointing to a more uneven path for long‑term rates. Although Kevin Warsh’s nomination reduces the prospect of unorthodox US policy settings, we continue to see insufficient compensation in New Zealand long bonds and retain a defensive bias. Inflation‑linked bonds remain supported by reasonable valuations, modest inflation pressure and demand for diversification. Government bonds outperformed swaps last month, aided by a lack of further government syndications for FY25/26, a trend that we expect to continue.

Within multi-asset funds, we have moved to a modestly overweight global equity position given ongoing economic growth and strong corporate earnings upgrade momentum. We remain modestly overweight Australasian equities, reflecting our confidence in the NZ economic recovery, helped by lower interest rates and ongoing export sector strength. We are modestly underweight both domestic and global fixed income. Currency-wise, we remain long NZD vs. foreign currencies. We see the USD as expensive on long-term valuation metrics, and many of Trump’s policies carry downside risk for the dollar through potential capital outflows.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.