- Growth in evergreen private investment funds has been significant and may provide a more efficient way to access private opportunities across different regions, sectors and transactions.

- The broader and growing opportunity set in private markets can help mitigate the concentration risk of the modern-day equity market.

- Liquidity remains an important consideration. Private assets are less liquid than listed markets, even when accessed through evergreen structures.

Private assets are an increasingly important component of the investment universe. Under this umbrella sits a range of asset classes, including private equity, private credit, venture capital, unlisted infrastructure, and unlisted property. These asset classes have different characteristics compared to more traditional forms of investment, and have become popular among investors seeking to enhance the overall performance and resilience of multi-asset portfolios.

The rise of private assets

Allocations to private assets are on the rise. PitchBook forecasts that assets under management in private markets will grow from US$18.7 trillion in 2024 to US$24.1 trillion by 20291. This growth is being fuelled by several factors.

An important trend is that companies are staying private for longer. In the 1980s, the median age at listing for a US company was 7.5 years, however, between 2010 and 2024 this increased to 10.7 years2. As a result, there is now a longer period of value creation available to private investors before companies go public. We’ve also seen a decline in the number of US-listed companies (from around 7,000 in 2000 to about 4,500 in 2024) and a rise in the number of US private equity-backed companies (from about 2,000 to 11,500 over the same period). This shift is attributed to an increase in the availability of private funding, less regulatory burden for private companies (freeing management to focus on growth), and a rise in mergers and acquisitions. All told, the opportunity set for private investors is expanding.

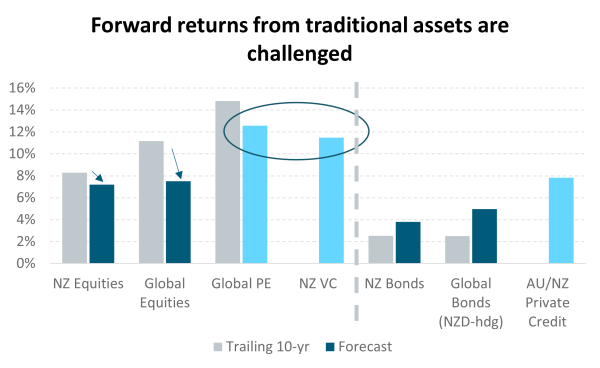

Separately, forward-looking research, including our own (Chart 1), suggests that returns from traditional, listed equities may be lower in the coming cycle due to elevated valuations, demographic changes, deglobalisation, and fiscal constraints. While global listed equities are trading near the 90th percentile of their 20-year valuation range, buyout private-equity deal multiples remain far more subdued, sitting well below prior cycle peaks. This environment makes the case for broadening the sources of return within portfolios.

Chart 1:

Source: Harbour Asset Management, Bloomberg.

Note: Forecast returns for private assets are net of fees, traditional asset classes are gross of fees. Trailing 10-year returns shown to end June 2025. Trailing 10-year data not shown for NZ Venture Capital and Australasian Private Credit due to limited availability of historical data.

Private assets also offer diversification benefits. The broader and growing opportunity set in private markets can help mitigate the concentration risk of the modern-day equity market. Also, valuations are not marked to market daily, which dampens short-term volatility and reduces correlations with listed assets. This can help smooth portfolio returns, especially as public markets become more concentrated, with a handful of mega-cap companies (i.e. the “Magnificent Seven”) driving much of the market’s recent performance.

Access to private assets has also evolved. Historically, these investments were limited to institutional and wholesale investors due to their structure (i.e. illiquid closed-end funds with capital calls over multiple years) and their terms (i.e. high fees and high minimum investment amounts). In recent years, open-ended (“evergreen”) funds have emerged, offering lower fees, no capital calls, lower minimum investment amounts, and some liquidity. This has made private assets more accessible to smaller investors. The size of the evergreen market is only set to increase, having already quadrupled between 2014 and 2024 to US$ 400 million, and forecast to exceed US$ 1 trillion by 20293 – growing at 4x the rate of the broader private assets universe.

Private assets in a New Zealand context

In New Zealand, allocations to private assets remain low compared to our global peers. As of March 2024, only 2–3% of KiwiSaver funds were invested in private assets, whereas Australian superannuation funds had nearly 16% allocated as of June 20244. This gap has led to a growing appetite among New Zealand asset allocators to increase exposure to private assets and capture their benefits.

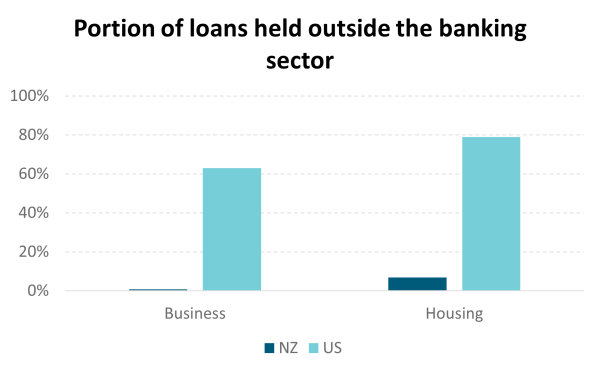

The New Zealand private credit market remains underdeveloped compared to global peers, with business lending dominated by the four major domestic banks, and non-bank lenders representing only a small share of total lending. By contrast, private credit is a mainstream funding channel in markets like the US (Chart 2). This underdevelopment in New Zealand creates opportunities for non-bank lenders, who can command pricing power and potentially earn attractive returns by serving creditworthy borrowers who are underserved by traditional banks. Additionally, the shorter tenor of loans in New Zealand’s private credit market reduces sensitivity to long-term economic shifts, further enhancing the risk-return profile of these investments.

Chart 2:

Source: NZ lending: RBNZ T4 and S31, 2025; US Business = McKinsey 2023; US Housing = Consumer Financial Protection Bureau, 2024.

In NZ venture capital, we partner with specialist teams that bring deep networks and proven expertise in early-stage investing. This provides access to New Zealand’s nascent but rapidly developing venture ecosystem, which has significant room for growth and is underpinned by a technology sector that is now the country’s third-largest export (behind dairy and tourism). Innovation across software, fintech, and deep tech is creating global opportunities not represented in public markets. Venture capital gives investors exposure to high-growth, unlisted companies with asymmetric return potential, offering a valuable complement to traditional asset classes. We believe there is a role for a small but deliberate allocation to VC within a diversified portfolio, recognising the long-term growth potential of New Zealand’s expanding venture landscape.

With the New Zealand IPO market subdued and many promising businesses choosing to stay private or list offshore, there is a longer runway for value creation in private companies. This mirrors global trends, where companies increasingly raise multiple rounds of private capital before considering a public listing. By allowing a small allocation to private assets in listed equity funds, Harbour can engage earlier with local growth companies and support their development, while also broadening the opportunity set for investors.

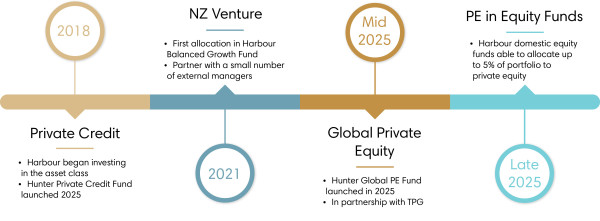

Globally, the growth in evergreen funds has been significant and provides an efficient way to access opportunities across different regions, sectors and transaction types. In global private equity we want exposure to structural growth trends that are occurring in sectors such as technology and healthcare, as well as the energy transition that is underway. There are more of these high-growth opportunities globally than domestically. For these reasons, we’ve partnered with TPG, a global private equity manager with a strong track record over its 33-year history, for our Hunter Global Private Equity Fund which was launched in 2025.

Chart 3: Our private assets journey

Adding private assets to a diversified portfolio

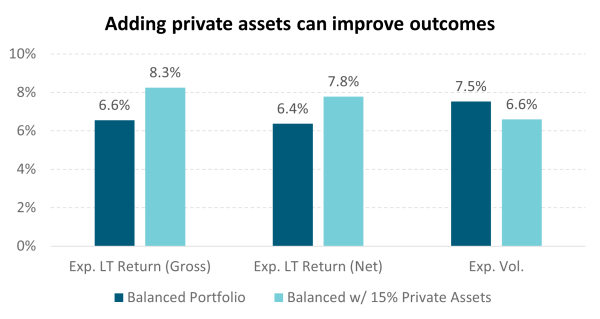

Our modelling shows that adding a 15% allocation to private assets meaningfully improves the long-term characteristics of a traditional Balanced portfolio (60% equities, 40% fixed interest). The mix we tested – 5% Australasian private credit, 7% global private equity and 3% NZ venture capital, to make a 50% equities/35% fixed interest/15% alternatives portfolio – shifted the portfolio outward along the efficient frontier, increasing expected returns while reducing overall volatility. The uplift reflects not only the higher return premia available in private markets, but also the different cadence of valuations, which dampens the noise that often dominates listed markets during periods of macro uncertainty.

Chart 4:

A notable finding is the improvement in downside behaviour. New Zealand private credit’s income, security and shorter loan terms helped stabilise outcomes when listed markets experienced valuation compression. Meanwhile, global private equity and early-stage NZ venture capital introduced exposures that sit outside public-market concentration, reducing reliance on the handful of global mega-caps driving index performance.

Liquidity, however, remains an important consideration. Private assets are less liquid than listed markets, even when accessed through evergreen structures. Investors with daily liquidity needs – for example, those running portfolios with frequent cashflow requirements – will naturally have a lower tolerance for large private-asset allocations, although still a worthwhile endeavour at half the size we modelled above (i.e. a 7.5% total allocation). But for those with more stable capital bases, the modelling suggests there is room to go towards or even beyond the 15% modelled without compromising portfolio flexibility.

Taken together, the modelling affirms that a modest, diversified allocation to private assets can enhance expected returns, smooth the return path, and improve the probability of outperforming a traditional benchmark – provided the investor’s liquidity profile is aligned with a longer-term allocation.

1) PitchBook. “2029 Private Market Horizons”. 1 May 2025.

2) Professor Jay R. Ritter, University of Florida.

3) PitchBook. “2029 Private Market Horizons”. 1 May 2025.

4) MBIE. “Enabling KiwiSaver investment in private assets”. December 2024.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.