I visited China last week and met with companies and commentators to dig beneath the data and get a sense of the current issues.

We visited many malls and shopping centres. In particular we went to mother and baby stores to experience the consumer in action, and witnessed the new eCommerce model. We also visited “wet markets”, hired bicycles with WeChat, and saw progress with a2’s new Chinese-labelled product. We saw first-hand innovation in the shopping experience.

Those following the news out of China will know that recent economic data is showing a slowdown in business confidence and investment. The housing market has also cooled, although you wouldn’t know that visiting Xi’an where the population has climbed from 6 million to over 12 million people in 7 years.

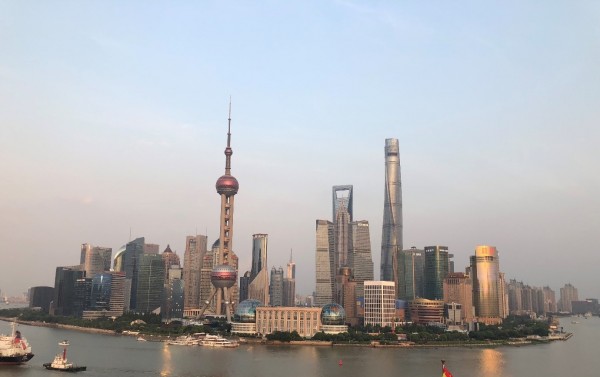

Image: Shanghai

The recent pull-back in nationwide Chinese economic growth largely reflects government decisions to pare back leverage in the economy, to reduce emissions, cut production in some industries (for both environmental and over-capacity reasons) and to engage in broader reform including continuing to stamp out corruption.

And so, even before any impact from US tariffs, Chinese business confidence indicators in both the purchasing managers and services sectors have fallen to lower levels. The Chinese stock market has also been in the doldrums and the Renminbi has weakened.

Partly in response to these weaker indicators China has eased macro-policy with a strong tilt to encouraging private sector investment. Tax cuts have also been added to the recent swathe of looser monetary policy measures which are in motion.

New growth model – eCommerce the China way

Judging China by near term cyclical growth gauges suggests a potential air pocket could be ahead. However, the most interesting development remains the significant continued restructuring of the economy, combined with a very rapid change in consumer and business behaviour.

eCommerce platforms continue to see very significant growth in China. This last week a global conference in Xiamen emphasised the transformation in the consumer-business relationship.

Participants noted that the Chinese economy is rapidly becoming cashless and everyone is on their mobile phone buying via QR codes; everything from food, clothing to services. Delivery bikes and electric scooters carrying goods bought via online platforms are ubiquitous.

A visit to Alibaba’s online Hema store confirms the rapid change in consumer behaviour. Products are scanned as consumers walk through the store, then an overhead “train” hooks up bags for pick up and go delivery to your home, within perhaps an hour or less. Other buyers are online, confirming their orders of everything from Alaskan crab, to kiwifruit, Anchor products and of course a2 Milk’s Chinese-labelled infant milk formula. Recently, Fonterra launched its new fresh milk product through the Hema store too. The in-store experience is surrounded by a food hall, a creche and entertainment. And no one is walking out with plastic bags of shopping.

The rapid change has spurred the Chinese Government into strengthening regulations around eCommerce platforms, to legitimise this channel to market. In recent years Daigou have provided goods to your door from everywhere in the world; driven by high demand for foreign goods especially diapers, infant milk formula, cosmetics and pharmaceutical goods. The Daigou channel was consumer-led, with WeChat groups often leading the charge. This year however, eCommerce platforms like Kaola, Pindoudou and, of course, Alibaba have expanded very rapidly with strong distribution, pricing, product authentication and delivery services providing apparently a better experience for many consumers.

Meetings we had with consumer goods companies confirmed that vertical online platforms, specialising in categories like maternity and baby, are seeing strong growth. It seems likely that some of this growth is actually led by larger Daigou growing (or reinventing themselves) into legitimate large-scale integrated businesses. Recent proposals for reform of the eCommerce platforms may yet see a phase-out of the Daigou channel and a formal recognition of this channel is uncertain. What is clear is in China eCommerce is alive and thriving, and consumers are happy to source more product via this channel.

Innovation and Infant Milk Formula

In China we met with a2 Milk and one of China’s largest infant milk formula companies, Yashili. We also visited three supermarkets and four mother and baby stores, plus met with consumer analysts and advisers that work with large consumer brands.

What surprised on this trip was the extent of product innovation in the infant milk formula market. In addition, we witnessed a further lift in prices compared to our visit in April. Channel checks also showed a2 product manufacturing dates were among the most recent, with some competitor products having dates more than a year old available.

Infant milk formula in China continues to see buyers attracted to premium price offerings. This premiumisation trend is most obvious for foreign brands and foreign-sourced infant formula. Mothers are often attracted to higher-priced brands, in-store promotions, and new packaging. Goat, organic and a2 (non-A1) infant milk formula were all super premium in price and, in the majority of stores we visited, these occupied the best shelf space.

Discussion with instore promotions staff as well as both a2 and Yashili confirmed that mothers who shop in mother and baby stores want advice and are interested in the safety and digestive qualities of different offerings. More often they are selecting foreign-sourced product over Chinese-sourced product. In this space increasingly Chinese-branded (and owned) product is making a come-back, associated with the massive scaling back in the number of brands on the shelf following the requirement for manufacturers to gain Chinese Food and Drug Association (CFDA) licencing (now known as the State Administration for Market Regulation or SAMR). So now the stringent SAMR approval process, and only three brands per manufacturer limit, is seeing greater clarity for sales staff and the consumer. In channel checks we noted several manufacturing dates of 2017 in some foreign-sourced brands, and further rationalisation seems likely benefiting those brands like a2 that already have their SAMR license.

More generally, Chinese commentators mentioned the recent change in policy around birth rates and a likely further lift over the next 5 years with the move away from family planning and birth-limits. The Government is also promoting a rise in breast feeding, especially for 0-6 months, consistent with World Health Organisation targets. However, we understand that at this stage the policy of most hospitals is to introduce infant milk formula at birth to supplement early feeding.

We heard from one of China’s largest infant milk formula manufacturers that they expect compound volume growth of about 10% in the next 5 years, with a continued improvement in selling prices given premiumisation trends. This seems consistent with population studies and household surveys of birth rate intentions.

Overall, this trip has reinforced our view that medium term trends for infant milk formula growth remain strong. The eCommerce model is continuing to change Chinese business and consumer behaviour and we’ll continue to watch carefully to see what opportunities this provides to companies reaching the growing Chinese middle class.

All photos sourced from Andrew Bascand.

This column does not constitute advice to any person. www.harbourasset.co.nz/disclaimer/

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.