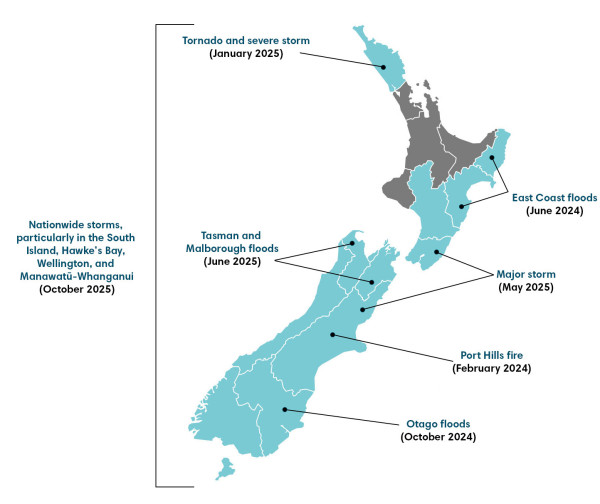

We are mindful of the January 2026 weather events that have affected parts of the country. These events reinforce the importance of resilience - not only within communities, but in how we assess business continuity, supply chains and the long‑term resilience of company earnings.

The insurance market can provide signals of increasing climate risks

Rising premiums, reduced coverage, and risk-based pricing in the insurance sector can be early indicators of increasing physical climate risks.

In this research piece we explore the implications of insurance market dynamics for investment portfolios, asset valuation, and financial lending access in New Zealand. While most of the data is centred on residential insurance costs and availability, these trends also have important implications for business operations and assets.

- Adaptation is critical: Proactive measures - such as property-level mitigation, government frameworks, and innovative insurance products - will support insurability and resilience, as climate-related hazards intensify.

- Investor implications: Investors should consider integration of insurance trends into risk assessments, engage with portfolio companies on adaptation strategies, and advocate for transparent hazard data and long-term planning.

Signals from insurance markets

Insurance affordability and availability can be an indicator of evolving climate-related physical risk. While exposure within insurance portfolios in New Zealand to significant physical risks is currently low, the impacts of climate-related hazards are increasing, and adaptation measures will be key.

Direct exposure to insurance companies in diversified portfolios may be limited. However, increases in physical climate risks and implications for future insurance affordability and accessibility can have wider implications for asset protection, financing, and valuation.

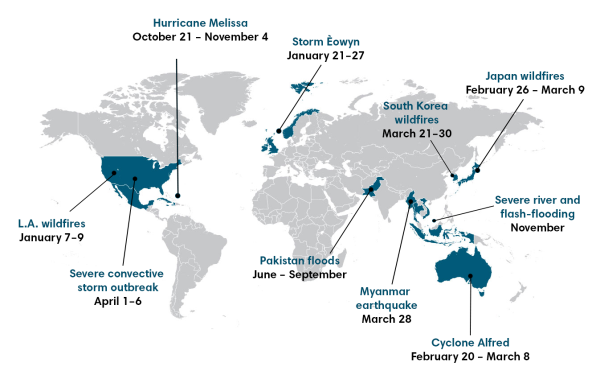

2025 was the sixth year that insured natural catastrophe losses exceeded US$100 billion1. These losses were dominated by the Los Angeles fires in the US. Overall global economic losses totalled US$260 billion2. In Australia, a Climate Council report estimates that 1 in 25 homes and commercial buildings will become effectively uninsurable by 2030, with Queensland deemed most at risk.

These global trends are already reflected in New Zealand’s insurance landscape. Locally, natural disasters cost insurers and the Government an estimated NZ$64 billion between 2010 and 20253. There are over 10,000 properties sitting in coastal inundation and flood zones in New Zealand that could become uninsurable by 20304,5. A recent study by Earth Sciences New Zealand shows that more than 750,000 New Zealanders live in locations and buildings valued at NZD $235 billion that are exposed to flooding from one-in-100-year rainfall flooding events.

While there were some signs of relief in 2025, New Zealand has seen some of the highest increases in premiums globally, with a circa 60% increase in the last five years6.

Pricing models: Community vs risk-based

Community-based pricing averages risk across policyholders, often used when granular data is unavailable.

Risk-based pricing tailors premiums to individual property risk profiles, increasingly used for residential dwellings. Risk-based pricing can be applied at various levels – by postcode, suburb, street, or individual property.

While insurance has always involved risk selection, the inclusion of natural hazard risk in a more granular way is evolving. Findings from a May 2025 Ipsos poll commissioned by IAG7 found:

- 60% of people support higher premiums for high-risk properties.

- 71% are willing to pay more if they live in high-risk areas.

Role of Government schemes

Government disaster relief schemes typically act as supplemental coverage with defined caps and eligibility criteria:

- In New Zealand, the Natural Hazards Commission (NHC) covers the first NZ$300,000 for insured properties with fire coverage.

- This is funded via levies in private insurance, with a government backstop if the fund is insufficient.

While seemingly generous by global standards, this structure still relies heavily on private insurance markets, which have been under pressure from rising reinsurance costs and climate volatility.

Is it just an insurance industry problem?

The interdependence between insurance and access to finance is strong. In the banking industry, property as collateral for loans remains the backbone of residential and business lending in New Zealand - especially for small and medium enterprises. Roughly two in every three loans is secured by property8. Data from a recent industry survey indicates that about 79% of farmers have a mortgage, with arable farmers even higher at 89%9. While the number of properties in New Zealand exposed to physical climate risks is currently low, access to insurance is an important factor in home ownership and business lending.

New Zealand's commercial property market has also seen historic increases in premiums for commercial material damage and business interruption, which rose from NZ$1.01 billion to NZ$1.60 billion, a 59% increase10 from 2020 – 2024. These increases were driven by seismic events in New Zealand, climate change and rising building costs.

Portfolio companies typically purchase commercial insurance through global markets, which are more aligned with global reinsurance trends. We may, however, have seen the peak in commercial insurance premiums. Construction costs are flattening out and the risks of seismic activity in New Zealand have decreased, which is supporting increased insurance availability and competition for the New Zealand market.

This is a positive for the industry; however, the environment does remain volatile due to risks associated with climate hazards, cyber threats and social inflation (e.g. increasing litigation), so it doesn’t negate the need to continually monitor and manage the impact of climate-related hazards in relation to property assets.

With the introduction of climate reporting regulation in New Zealand, we have seen banks start to analyse their physical climate risk across their lending portfolios. However, due to it still being the early stage of reporting, there is a varying level of detail, methods and outputs used to assess these risks. Using a high emissions scenario BNZ and Westpac show in 2030 11% and 6.9% (respectively) of residential, agricultural and commercial lending may be exposed to severe flood risk. ASB have used 1-in-100, 1-in-250 and 1-in-500-year events and under a 1-in-500-year event 5% of their lending portfolio may be vulnerable to damage from flooding.

These assessments don’t reflect the often-localised nature of climate-related hazards or the adaptation aspects of individual properties which may reduce this risk. All four of the major banks in New Zealand have noted insurance availability and affordability as a key risk in their 2025 climate statements.

Tough decisions or proactive steps

Insurance companies and banks are at the forefront of balancing risks with insurance and access to finance in the New Zealand market. While insurance retreat is limited in New Zealand (home insurance coverage has approximately 96% penetration nationally), there are pockets of insurance withdrawal for both climate-related hazards and seismic activity. Areas with high risk of natural hazards without investment in adaptation to physical climate-related risks may mean we continue to see further insurance withdrawal.

Insurers are responding with data-driven risk assessments and product innovation. We spoke to Tower Insurance who noted that they use close to 200 million data points to assess property risk.

Adaptation measures can be key to reducing insurance premiums for homes and buildings under a risk-based pricing model. The message is clear: where properties receive a high-risk rating under a risk-based pricing model, engagement with the insurance provider is essential. Simple steps such as native planting, improving drainage or more extreme measures such as building elevation or floodproofing could see a reduction in insurance premiums.

This doesn’t mean that some tough decisions won’t need to be made. Exclusions from policies or increased pricing may be required where risk can’t be mitigated.

Insurance companies are looking at innovative options, e.g. parametric insurance, while not yet common in New Zealand, has a fixed payout for a specific event (e.g. a cyclone) providing some cover for natural hazards that may not otherwise be covered under a comprehensive insurance policy.

While insurers and property owners can take steps to manage risk at the asset level, sustained resilience will ultimately require coordinated action across government, industry and communities.

Adaptation required at all levels

Government and councils also recognise the need for urgent action. This includes understanding risk as a country or region and implementation of adaptive measures to protect assets and economic activity.

Early in 2025, the Ministry for the Environment established an independent reference group to support development of New Zealand’s Climate Adaptation Framework11 which outlined a 20-year plan emphasising four key pillars. In October 2025 the Government announced the implementation of a climate adaptation framework based on the recommendations from the independent reference group.

The framework is based on four pillars: Risk and response information, roles and responsibilities, investment in risk reduction and cost sharing. They are all noted as essential to ensuring New Zealand is prepared for climate impacts. A long-term bipartisan plan is essential for ensuring long-term resilience and risk transparency.

Managing impacts of major weather events needs to be done at a granular level. The higher the claims from these events, the higher the likelihood we will see increased costs flowing through from reinsurers and insurers, not to mention the economic impacts from interruption to business activity.

One of the key issues we face is understanding the risks in the first place. There are a few tools available that provide hazard information which should be a first step if you are buying property or setting up a business12. The Government as part of their adaptation framework are working on a national flood map that combines government, insurance and council data in one place, however, there will still be more work to do in making data available for all regions and all climate hazards.

Strategic implications for investors

Insurance market dynamics are increasingly reflective of climate risk exposure. For institutional investors, these signals can be incorporated into portfolio strategy, risk management frameworks, and engagement practices. The convergence of insurance, banking, and climate adaptation presents both challenges and opportunities for long-term value creation and systemic resilience.

- Engagement: Investors should engage with portfolio companies on climate adaptation, insurance strategies and product innovation.

- Valuation models: Rising premiums and insurability may affect asset values over the long term, especially in real estate and infrastructure.

- Policy advocacy: Support for transparent hazard data, equitable insurance access, and long-term adaptation planning is essential.

At Harbour we see the insurance sector providing early warning signs that should be incorporated into climate risk monitoring. Rising physical climate risks have implications for asset protection, capital access and long term economic stability. By actively engaging on adaptation, scrutinising exposure and supporting robust national risk frameworks, we believe investors can play a meaningful role in shaping a resilient future for New Zealand’s homes, businesses and communities.

1) 2025 marks sixth year insured natural catastrophe losses exceed USD 100 billion, finds Swiss Re Institute | Swiss Re

2) Los Angeles fires dominated insured losses of $127bn in 2025, says Aon

3) IAG Sapere Report: New Zealand’s $64b spend on natural hazards heavily skewed to recovery over resilience

4) Climate Sigma - Report prepared for the Ministry for the Environment

5) More than 10,000 properties could become uninsurable as climate risks grow - report | rnz news

6) Source Stats New Zealand CPI June 2025 quarter index numbers.

7) IAG climate change survey 2025

8) Banks: Assets – Loans by purpose (S31) - Reserve Bank of New Zealand - Te Pūtea Matua

9) Federated-Farmers-of-NZ-Submission-on-Market-study-into-personal-banking-services -September-2023

10) Market Data - ICNZ | Insurance Council of New Zealand

11) A proposed approach for New-Zealand’s adaptation framework

12) Natural Hazards Portal: Natural hazards in your area; Flood Hazards across New Zealand

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.