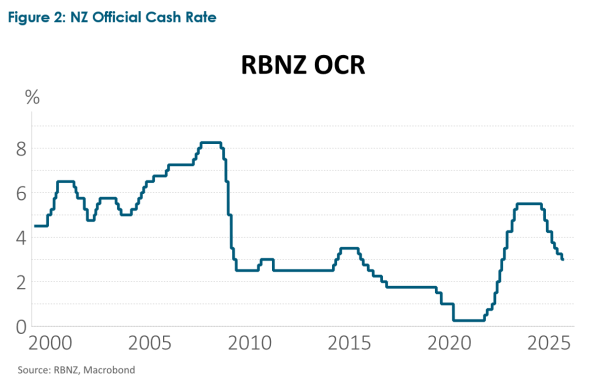

- Market anticipates 75bps of OCR cuts by mid-2026, possibly delivered in upcoming RBNZ Meetings in October and November.

- Dr Anna Breman, appointed as new RBNZ Governor, starts 1st December. Dr Breman comes to New Zealand after serving as First Deputy Governor of the Swedish central bank.

- At 2.25%, the Official Cash Rate (OCR) would have been lowered by 3.25% within 18 months and finally would be comfortably within accommodative territory.

- The possibility of being at or near the end of the rate cut cycle has interesting implications for borrowers and investors.

As Dr Anna Breman wings her way from the land of Vikings to the land of Hobbits, there is every chance that amongst the compulsory reading list of official documents, is also a story about a ring, which opens with the lines “The world has changed. I feel it in the water. I feel it in the earth. I smell it in the air. Much that once was is lost, for none now live who remember it.”

In this vein, the challenge of arriving in an unfamiliar country as the Governor of the central bank would seem a daunting proposition. It looks more so when you factor in that the Reserve Bank has fairly recently gone through a phase of uncharacteristic criticism and that the well-regarded interim Governor Christian Hawkesby will have just left, leaving the leadership team short on experience. Dr Breman’s world may indeed have changed, but in our opinion not nearly as ominously as foretold in the Lord of the Rings.

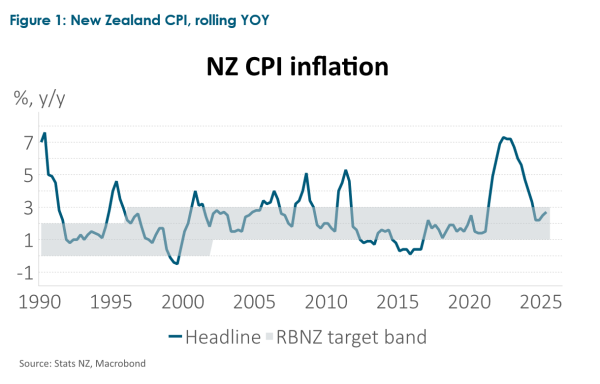

In fact, the environment for monetary policy in New Zealand is arguably becoming more orderly. We are undeniably in a better position with regards to broader inflation than we were through 2022 and 2023. At 2.7%, year-on-year CPI is within the RBNZ’s target band. However, one complicating element, still unresolved, is that some high-profile areas of inflation have persisted. Elevated food prices and sky-high council rate increases have reinforced awareness that the cost of living has risen.

Another complicating factor has been the observation that rates cuts seem to have had little impact on the economy so far. The housing market is generally not responding to rate cuts as we have seen it do during previous rate cut cycles (especially in Auckland and Wellington). Both consumers and employers still seem to be cautious. The RBNZ appears to have been surprised by quite how soft the economy became through the middle of the year. It was this that prompted the shift in August to signal that further rate cuts would be needed.

However, we may be getting closer to an economic recovery. Some confidence surveys are improving, albeit off a low base. Now that the RBNZ is likely to take the OCR into moderately accommodative territory and with the New Zealand Dollar’s weakness also effectively easing financial conditions for exporters, the prospect of a recovery improves.

Consequently, it seems reasonable to opine that fixed income markets are already anticipating the end phase of the rate cutting cycle. This is the point where central banks need to make a tough judgement about how much further to cut, when they are trying to look ahead into an uncertain future. It is normally a time for fine-tuning monetary policy, rather than making large shifts. In this regard, there is arguably some sense in the RBNZ seeking to get the OCR down towards 2.25%, as that would also give Dr Breman some breathing room on this front when she holds her first Monetary Policy Committee meeting in February after the long summer break. We think getting to 2.25% before Dr Breman arrives makes sense, as at this stage, upsetting market expectations could risk knocking an emerging uptick in confidence and make for a more difficult decision-making situation in the new year. So instead of fine-tuning just yet, a 50 basis point cut at the October or November RBNZ meeting can be portrayed as something more positive.

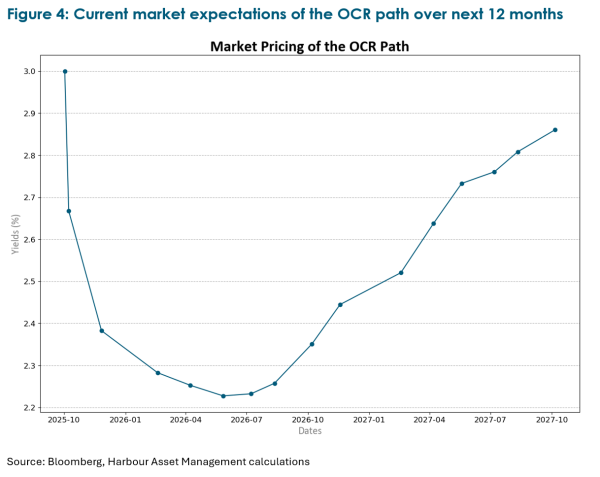

For investors and borrowers the prospect of being near to the end of the rate cutting cycle raises some interesting questions. Mortgage borrowers will naturally consider the issue of extending the term of their fixed rate mortgage. Investors may become more reluctant to buy longer-dated fixed rate bonds or term deposits.

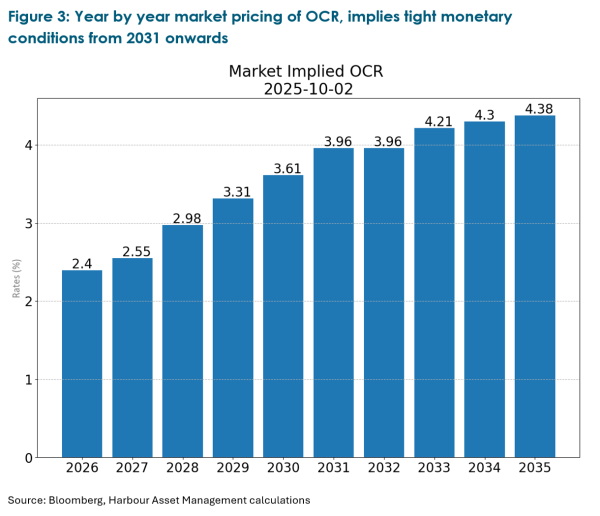

However, for both groups, analysis will include taking note of the shape of the yield curve. In effect this is largely the market’s assessment of the future path of the OCR. Will it stay low for a long time and how fast might future interest rates rise, if indeed the OCR does not need to go even lower than is currently priced into the market? Our observation is that the NZ yield curve is quite steep and, perhaps surprisingly, expects the OCR to be back above 3.5% in 5 years’ time, climbing to above 4% in 10 years’ time. That includes an expectation that the RBNZ will begin hiking the OCR in late 2026. The idea that we move back into a situation where monetary policy is persistently tight surprises us.

At this stage we envisage a high likelihood that the OCR stays somewhere near 2.0% to 2.5% for an extended period of time. Our judgement is that high debt levels and limited income growth continue to put a cap on consumption and the strength of a recovery. The government is likely to continue to be fiscally constrained. Economic performance can certainly improve but in our opinion there is plenty of spare capacity in the economy and hence a recovery seems unlikely to place excessive upward pressure on inflation, assisting our view that the RBNZ may take some time to enter a new tightening cycle.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.