- Despite downside risks to trading partner growth from tariffs, our export sector is currently enjoying the enviable combination of high global prices and solid demand.

- For now, however, bank data suggest most of the additional export revenue is being used to pay down debt and increase cash balances – limiting pass through to the broader economy.

- Our recent trip to Fieldays, the Southern hemisphere’s largest agricultural event, seemed to confirm this with vendors generally reporting higher sales than last year but not record levels.

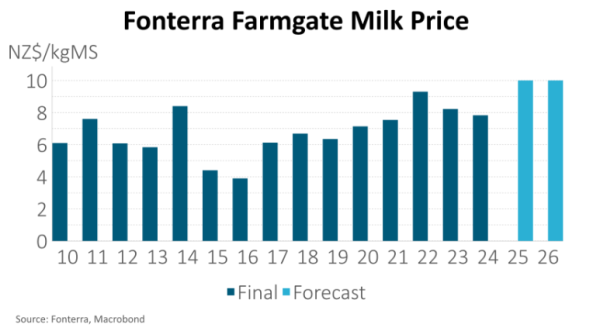

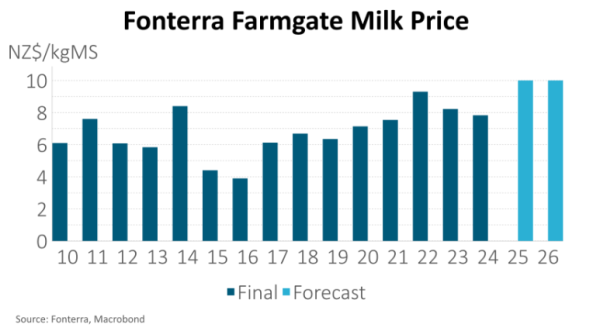

Despite downside risks to trading partner growth from tariffs, our export sector is currently enjoying the enviable combination of high global prices and solid demand. Dairy makes up 30% of our total goods exports and it’s been a bumper season for this sector with a record-high Fonterra forecast milk price of $9.70-$10.30, and an expectation that this largely continues into the 2025/26 season with Fonterra recently providing an initial forecast of $8.00-$11.00. The 2024/25 season ended on 31 May and the last payment that relates to it will happen in October. BNZ estimate that farmers will receive an additional c.$4.5bn of revenue versus the 2023/34 season. Other primary sector exporters are also doing well with meat and timber, which together make up 20% of goods exports, enjoying the highest annual revenue for two years.

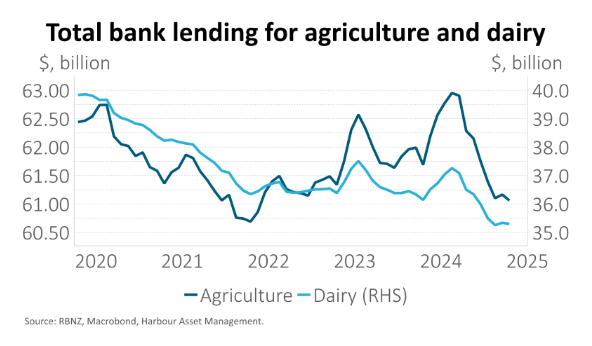

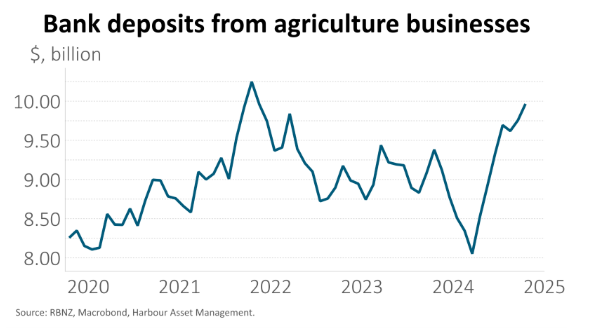

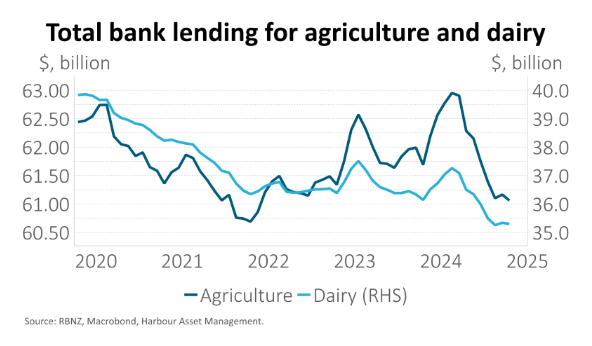

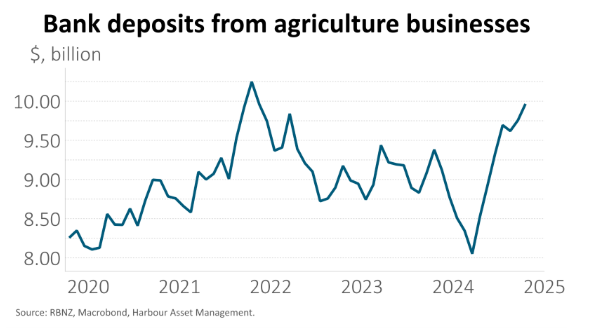

For now, however, bank data suggest most of the additional export revenue is being used to pay down debt and increase cash balances – limiting pass through to the broader economy. Farmer caution likely relates to two tough dairy seasons in 2022/23 and 2023/24, rising farm costs and a highly uncertain global outlook. RBNZ data for the 6 months to April, show the amount of dairy borrowing has dropped $1.2bn (see chart above), if it continues at this run rate through to October, farmers will have used $2.4bn, or more than half the revenue boost, to pay down debt. Looking at the RBNZ’s bank deposit data suggest the residual is likely sitting in cash with agriculture bank deposits up $1.4bn over the 6 months to March (see chart below).

Our recent trip to Fieldays, the Southern hemisphere’s largest agricultural event, seemed to confirm what the aggregate data are saying with vendors generally reporting higher sales than last year but not record levels. We also heard reports of more cash sales this year and less via finance, consistent with the higher cash balances being run by the agricultural industry. We heard that the new government depreciation policy was a positive but not a strong part of farmers’ decisions to purchasing new equipment. As part of the recent Budget announcements, businesses are now able to deduct 20% upfront of the cost of any new assets or improvement to existing assets with the balance continuing to be depreciable where applicable. Some noted the time between making the investment today and receiving the deduction after the end of the tax year was currently too long.

At Fieldays, we also observed the disruption of technology within the agricultural sector. Dairy automation was a key focal point with robotic milking systems and automatic calf feeders reportedly drawing large amounts of enquiry. Drones were also a key feature, with them being marketed as a lower cost alternative to helicopters for spraying in areas with difficult topography. As one farmer noted, “I wouldn’t want to own a helicopter company”.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.