- NZ inflation has rapidly accelerated and the RBNZ has started to raise rates to exorcise this demon

- We think inflation pressures go beyond transitory and will require further policy tightening

- This carries risks for asset prices and the latest Omicron COVID-19 variant suggests some volatility is likely along the way

Inflation has risen from the dead and the Reserve Bank of New Zealand (RBNZ) has recently started raising interest rates in its quest to exorcise this unwelcome demon. After sitting dormant for much of the past decade, New Zealand consumer prices have increased almost 5% in the past year and are likely to continue to push higher over the coming quarters. High inflation, along with the monetary policy response to it, holds important implications for businesses, households, and investors.

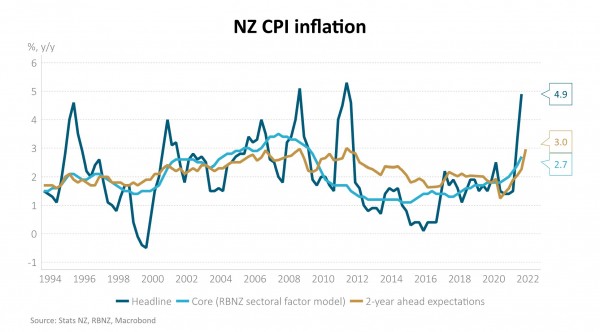

The recent pickup in inflation goes beyond supply chain disruption and higher petrol prices. The strong recovery in demand following the lockdowns of last year quickly absorbed spare economic resources and created broad-based upward price pressure in New Zealand. Both tradable and non-tradable inflation, for example, are well above the RBNZ’s 1-3% target range. Core inflation measures (those that remove volatile components) are between 2.7% and 4% y/y. Inflation expectations have also responded with the RBNZ’s 2-year ahead measure reaching 3% in Q4, equalling the highest level since inflation targeting began in February 1990.

Many of the current inflationary forces are unlikely to reverse quickly. Monetary and fiscal policy settings generally remain stimulatory, both here and abroad. Wage growth is likely to increase further as higher inflation is recognised in wage negotiations and firms struggle to find additional labour. Border re-opening may exacerbate the current shortage of labour as it looks likely to first allow New Zealanders to leave more easily before foreigners can arrive. Housing rents have increased almost 4% over the past year – adding 0.4% to annual inflation (given the 10% weight in the CPI basket). Recent work by the International Monetary Fund suggests that recent house price gains will continue to place upward pressure on rents for years to come.

Central banks are starting to withdraw stimulus as they recognise inflation risks. Modest amounts of inflation can be helpful in allowing firms to adjust to negative shocks by reducing their wage bill in real terms - hence why most central bank inflation targets are around 2% rather than 0%. At higher levels, however, inflation can distort price signals within an economy – making consumption and investment decisions more difficult. Purchasing power is also eroded. New Zealand wages are currently growing at 2.5% annually, around half the pace of current inflation. Savers are also being hurt with term deposit rates nowhere near high enough to ensure real returns are positive. Term deposit rates are currently 1.5 and 2.0% for 6-month and 12-month terms, respectively.

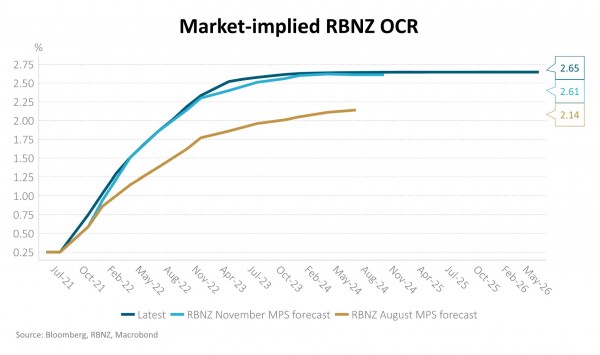

New Zealand has started monetary policy tightening earlier than most others. The RBNZ halted bond purchases as part of its quantitative easing (QE) programme in July and has increased the Official Cash Rate (OCR) by 25bp in both the October and November meetings to 0.75%. In its latest set of forecasts, the central bank expects to increase the OCR by another 1.5% by the beginning of 2023. Higher interest rates should reduce the appeal of borrowing and increase the attraction of saving – easing capacity pressures by lowering the growth in consumption and investment within the economy. This monetary policy action should deliver an eventual fall in inflation and inflation expectations. Financial markets expect the OCR to reach 2.2% by the end of 2022 and 1-year wholesale interest rates to increase by 1.1% over this time. Assuming inflation returns to the RBNZ’s target band by then, real wage growth and real term deposit rates may have become positive.

Policy normalisation carries risks for asset prices. If central banks are aggressive in winding down QE programmes and raising policy rates, real rates could move significantly higher, and asset prices may struggle. If central banks instead sit behind the curve, inflation may persist at higher levels and real assets, such as real estate, might outperform. Regardless, some volatility is likely in this process of policy normalisation.

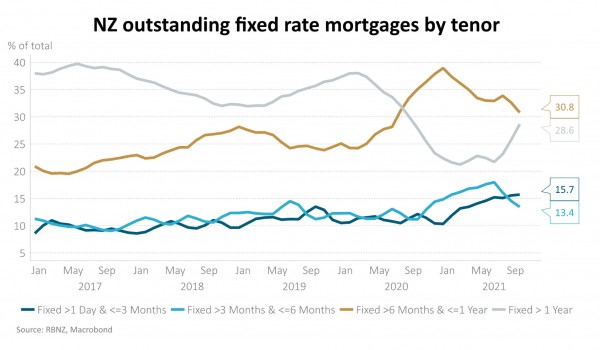

Higher mortgage rates may test New Zealand housing market resilience over the summer. Mortgage rates are already around 1.5% higher than the lows seen in June and are expected to increase another 1.4% over the next year – taking 1-year mortgage rates close to 5%. 30% of outstanding mortgages ($100bn) are due to roll off fixed rates by the end of Q1 next year and be exposed to these higher interest rates. Macro prudential measures have been tightened and investor incentives reduced. Growth in building consents continues to outstrip population growth and the outcome of the Government’s review of migration settings holds important implications for this balance.

Additional monetary policy tightening isn’t set in stone, however, and the latest Omicron COVID-19 variant is a good reminder that policies on re-opening of economies may be ‘two steps forward and one step’ back affair. Nevertheless, our central view is that inflation pressures are likely to be more durable than transitory. This will likely require higher rates and more normal policy settings.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.