As a child on long car trips to sunny destinations there would be the constant chorus of ‘Are we there yet?’ to the parents up front. The terse retort from up front would usually be ‘Not yet!’. We could draw parallels with the performance of the New Zealand equity market and company earnings which have been on a long sideways journey.

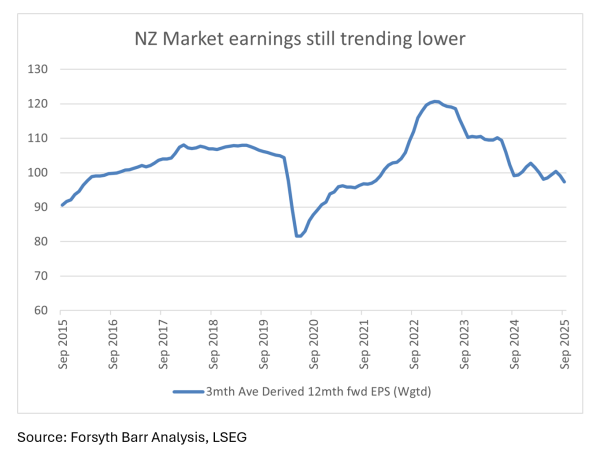

The latest reporting season for New Zealand companies with June balance dates continued this trend, and could be described at best as being mixed, with reported results generally coming in below expectations and future forecast earnings continuing to be reduced. The S&P/NZX 50 Index returned 0.8% in August.

Earnings expectations in aggregate were trimmed mainly due to lower sales/revenue expectations. Costs were relatively stable, although earnings forecasts were reduced in some cases due to rising depreciation resulting from higher capital expenditure. Companies with strong pricing power held up well. While earnings forecasts were reduced, there were more positive company outlook statements than negative. Improving confidence contributed to some companies announcing or extending capital management initiatives, including a slight increase in dividends and buybacks.

In Australia, it was a similar story with the market looking ahead and buying future earnings growth. The S&P/ASX200 returned 3.1% for the month despite earnings growth for FY25 settling at -3.1% and a low bar FY26 reset for growth of 4.5%. This lifted the price to earnings multiples valuation metric to a record high of 19.9x and marked the second largest increasing in one year forward multiples in the last 15 years.

Perhaps the most notable aspect in Australia was that the August reporting season was the most volatile on record, with close to 30% of the ASX200 experiencing a +/- 3 standard deviation move or a relative return of 8.3% on result day. This wasn’t just confined to Australian listed stocks, with New Zealand dual-listed companies such as a2 Milk, Ebos, and Chorus also experiencing significant share price volatility. Within the market several ‘blue chips’ including CSL, James Hardies, and Woolworths suffered record or near record price declines. Similarly on the positive side there were some clear winners, including Coles, Brambles, and Qantas all gaining 9%+ on the day.

At times, fluctuations in share prices may represent overreactions to relatively minor shifts in business conditions, with the potential for subsequent correction as market sentiment stabilises. Conversely, evolving competitive dynamics, policy frameworks, and technological developments can place fundamental business models under scrutiny. Amid the noise of reporting season, there have also been positive developments, as certain companies demonstrate resilience and adaptability in navigating economic and industry headwinds, thereby positioning themselves to deliver enhanced returns to shareholders.

The trade winds blew with some ferocity, as Australian companies with offshore operations particularly in the US noting more challenging conditions, whether that related to tariff concerns or softness in final demand. NZ companies to an extent were less exposed, albeit challenges and uncertainties were noted from the likes of Fisher & Paykel Healthcare and Skellerup.

Domestically, cyclically exposed companies generally provided updates that met the market expectations – perhaps after several periods of disappointment the bar was set relatively low. Within this group Spark, Fletcher Building, Heartland Group, and Freightways all had results which met or bettered market expectations with investors looking forward to possibly better earnings outlooks as the economy improves. The companies themselves still see a long road ahead and are not forecasting a substantial lift in growth in the immediate future, albeit there are some signs of improving conditions.

The surprise result and share price response came from Ebos – traditionally a business which delivers on market forecasts, it disappointed with a result below expectations, with the key contributors being higher operating costs, lower community pharmacy margins, and slower animal pet care growth. However, the bigger shock was Ebos Group’s maiden guidance for EBITDA (earnings before interest, tax, depreciation and amortisation) for 2026, which was about 6% below the current consensus weighed on investor sentiment. We do not consider the result and outlook as structural for Ebos, with the company still positioned for medium-term growth. However, management have a job to do to rebuild investor support and confidence through delivering on cost control and stabilising margins in its core healthcare business, gaining returns on capital invested in infrastructure, and making accretive acquisitions to support growth.

There were however some brighter spots with Scales Corporation positively surprising the market by raising earnings guidance, with all divisions beating consensus for the first half, with apples the key positive. Earnings expectations were lifted by over 10%, with the company having a bumper apple harvest and continued momentum in their global petfood/protein business.

The a2 Milk Company was another star in the reporting season, despite conflicting distribution channel data leading into the result, and the company continues to grow share in the Chinese infant formula market. The news of the purchase of Yashili’s Pokeno processing and canning plant provides a further growth opportunity for a2 to improve manufacturing margins and provide for product extension opportunities to sell into global markets.

The New Zealand and Australian equity markets continue to trade at price-to-earning valuation multiples that remain above their long-term averages. Central bank rate cuts are likely to sustain market liquidity and underpin valuations. Economic growth is gaining momentum, albeit from a low base in New Zealand. While favourable liquidity conditions may not persist indefinitely, we anticipate they will continue to support local share market returns over the coming year. Additionally, if company guidance remains cautious, a succession of profit upgrades could further bolster returns.

Long car journeys ultimately come to an end – and finally we get the response that we wanted from our parents of ‘yes, we are here’. Maybe we are also nearly there, with local company earnings growth having the potential to improve and providing investors with better returns from the local share market.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.