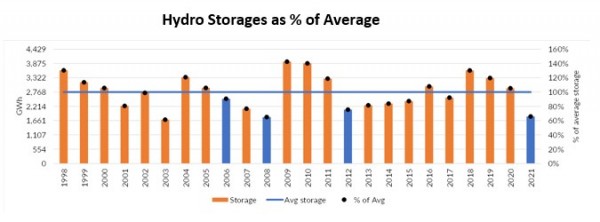

- Hydro lake storage is at about 60% of normal levels; low lake levels may provide risks to the near-term earnings of the electricity sector.

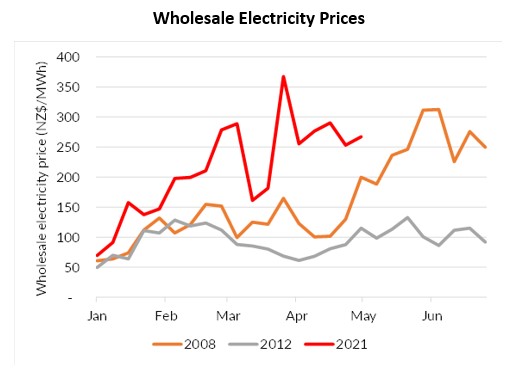

- Commercial electricity users on spot power pricing are facing significant cost increases.

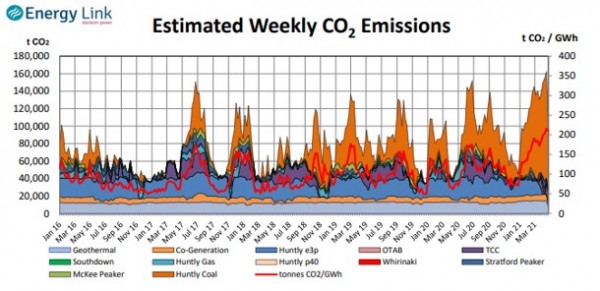

- Dry conditions may mean we burn more coal and gas, which highlights the importance of more investment in geothermal and wind energy projects.

It seems that the utility sector is moving from one event to the next lately. Historically, the sector has been characterised as having low volatility of earnings and dividends, especially since the introduction of the mixed ownership models which saw Meridian, Mercury and Genesis Energy list on the New Zealand share market.

In the last twelve months we have experienced the “I’m leaving”/ “I’m staying” news flow from Rio Tinto and the New Zealand Aluminium Smelter (NZAS)[1], the rising influence of passive and clean energy equity funds, and then the subsequent unwind of some of these investors as the ETF manufacturers changed their index construction rules. All of this has led to investment opportunities for active managers to add alpha for investors. And now current wholesale conditions, caused by low water levels in the hydro lakes, may provide risks to near term earnings of the sector.

Right now, we are experiencing hydrology conditions that could be on track to rival the infamous ‘brown outs’ of 1992 or 2008. Whilst New Zealand can go through periods of drought and flooding in the same year, the current hydrology conditions are at the extreme. Adding to the dry hydro conditions, the industry is facing ongoing gas supply issues with unplanned field outages and the natural decline in the Pohokura gas field raising concerns around security of supply.

Source: Forsyth Barr

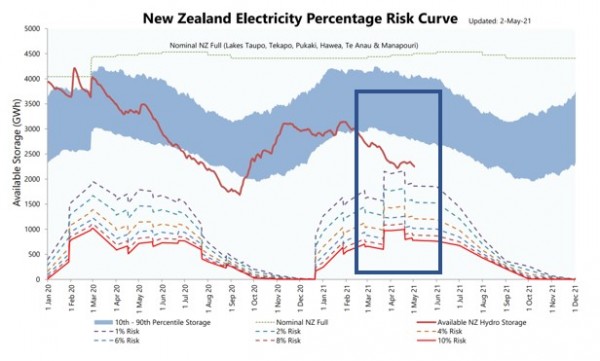

Transpower’s analysis shows that New Zealand has about 500gwh less power storage than at the same time last year. If dry conditions persist for another 6-8 weeks, the situation will start to look serious and we move into a more problematic area for allocating power. A breach of the 10% hydro risk curve is when consumer electricity savings programmes are launched to dampen power consumption. Changes since the last power incident in 2008 now mean that if the 10% risk curve was breached retailers may be required to compensate consumers for having to reduce electricity consumption. Behaviour in the market also raises further the ire of regulators and continues to invite political introspection.

Source: Transpower

Because of this, the market reaction is to drive higher wholesale electricity prices and, ultimately, higher retail electricity prices. Commercial and industrial customers that are on spot pricing or have electricity hedging rolling off are facing significant cost increases. At a time with other inflationary pressures starting to emerge, this is not only a risk for inflation expectations and pricing but also business margins where companies are unable to pass on higher costs.

Source: Forsyth Barr

The Minister of Energy and other regulatory bodies have expressed the view that the high wholesale prices are part of a normal functioning market and that perhaps some commercial customers might have been expecting different outcomes from the Tiwai discussions. We suspect that the current conditions might play into the Government’s current positive view on the development of Lake Onslow ($4-6bn) to establish a dry year reserve and providing one cog in the investment required to move closer to a 100% renewable target. This project has been described by one electricity company as a “freight train that is coming”. Whilst economic assessments of project feasibility are currently underway, market outcomes described above will not necessarily help the cause for political intervention.

Dry conditions require thermal operators to step in not only to provide security of supply for the system but to also provide essential generation capacity for the country. As a consequence, Co2 emissions may also rise in coming months with the burning of coal and gas.

Source: Energy Link

The industry is responding to the wholesale market pricing and government emission targets with several renewable projects announced or in the pipeline. Contact Energy raised $400m to fund the development of the 152mw ($678m) Tauhara geothermal power plant (Harbour Asset Management was a cornerstone investor in that equity raising), Meridian has announced the Harapaki 172mw ($400m) wind farm, and Mercury is also in development mode, completing the Turitea 232mw ($462m) wind farms in the lower North Island. All this new generation is welcome in displacing thermal generation; however, it is too long term to impact the current wholesale price curves. The type of generation is also different, with wind typically being intermittent compared to the current baseload thermal or geothermal. So, despite there being additional capacity on the way, more wind capacity alone might still provide more volatile wholesale markets.

All of this can change quickly in New Zealand; weather patterns may revert to normal, and the lake levels may fill up again. The industry also has other measures in place this time around which provides more room to move. For instance, Meridian, under its resource consents, can take Lake Pukaki levels lower than previously and, in a recent announcement, the company has come to a swap agreement with NZAS to effectively curtail demand for a period. Under the agreement Meridian can also call off production of one pot line which would be less than ideal for NZAS in a period of strong aluminium prices.

In the meantime, the utilities that are long generation are making significant wholesale profits, whilst those with low levels of generation and plant outages are facing potential earnings headwinds.

Maybe we are over-analysing the potential system and company risks in the short term, but sometimes when it rains bad news it also pours. Hopefully, we get some rain in coming months.

[1] https://www.harbourasset.co.nz/research-and-commentary/four-more-years/

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.