Key market movements

- After a strong first quarter, the MSCI All Country World Index (ACWI) fell in April with a return of ‑2.3% in New Zealand dollar-unhedged (-2.7% in NZD-hedged) terms for the month. Performance was broadly negative from a sector perspective, with only the utilities and energy sectors in the black. Information technology was a standout on the negative side with a -5.6% return.

- Locally, market returns for the month were also weak with the S&P/NZX 50 Gross Index (with imputation credits) returning -1.2%, and the S&P/ASX 200 Index returning -2.9% (-2.0% in New Zealand dollar terms).

- Bond indices were also negative over the month. The Bloomberg NZ Bond Composite 0+ Yr Index fell -1.0%, whilst the Bloomberg Global Aggregate Bond Index (hedged to NZD) fell -1.6% over the month. 10-year government bond yields in the US were nearly 50bps higher on the month, ending at 4.7%, whilst in New Zealand the 10-year yield rose 36bps to end at 4.9%.

Key developments

The New Zealand economy likely remained in recession in Q1. That’s what the latest QSBO (Quarterly Survey of Business Opinion) told us. A net 23% of businesses reported lower activity, more than reversing the post-election Q4 bounce. Labour market indicators continued to ease. Employment surprisingly dropped in Q1, the unemployment rate increased by more than expected and the participation rate fell, likely due to people becoming discouraged by not finding work. Average hourly earnings growth dropped considerably, back to pre-COVID levels of c.0.5% q/q, representing yet another hit for the consumer. With public sector redundancies just beginning, the worst is likely yet to come.

Overall, recent data is consistent with an economy that doesn’t need the degree of monetary policy restriction that is currently being imposed. The RBNZ, however, isn’t interested in entertaining such a thought just yet with the April Monetary Policy Review message largely a carbon copy of the February MPS – “the Committee is confident that maintaining the OCR at a restrictive level for a sustained period will return consumer price inflation to within the 1- to 3-percent target range this calendar year.”

The US economy appears to be slowing but the recent pickup in inflation suggests the Fed may not be cutting rates anytime soon. The US economy was disappointingly weak in Q1, growing just 1.6% q/q saar vs. expectations of 2.5%. The Fed may be pleased to see signs that tight monetary policy is having an impact as it looks to build confidence that the recent pickup in inflation will reverse. Markets, however, appear more concerned about stagflation – an environment where growth is weak but high inflation limits the scope for rate cuts. In Q1, the Fed’s preferred measure of core inflation, core PCE, was 3.7% on an annualised basis and wage growth accelerated.

Unexpectedly strong Australian inflation has seen the market move from pricing Reserve Bank of Australia (RBA) cuts this year to hikes. Annual headline inflation increased to 3.5% in Q1, from 3.4%, and core measures moderated by less than expected. This was seen by economists as postponing any easing from the RBA, with the key trimmed mean inflation measure at 4% being too far away from its 2-3% target band. Markets, that had been pricing more than 20bp of cuts this year, took it one step further and priced 10-15bp of hikes by the end of this year.

What to watch

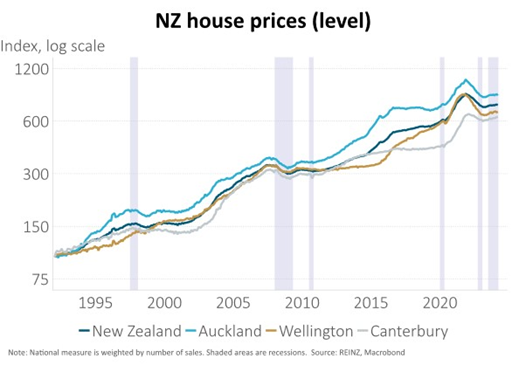

Our housing market has been stagnant for the past 8 months with prices just 0.5% higher over that period. Sales have picked up but remain well below historical average. The same goes for days to sell, which have dropped, but are above long-term averages.

The housing market continues to be caught between offsetting forces, a dynamic that is likely to continue with most forecasters expecting only modest house price growth this year (RBNZ, for example, forecasts +3.3%). Positive factors include strong population growth and pro-housing policies from the new government. Negative factors include high mortgage rates, poor affordability and rising unemployment.

Market outlook and positioning

Share market returns are likely to remain volatile and choppy in the near term. Investors started the first quarter of calendar year 2024 expecting disinflation and weaker growth and ended the quarter with solid economic growth and stickier inflation. The next few quarters may still be driven by this unstable balance between growth and inflation. Capital markets are now pricing in higher-for-longer (H4L) interest rate expectations. We continue to see disinflation (falling rate of inflation) as providing positive support for share market returns (better for profitability), but inflation may not fall enough in the near term given sticky non-tradable parts of inflation to allow central banks to cut official interest rates. While the OECD has recently lifted its global gross domestic product (GDP) economic growth forecast for 2024 to 3.2% from 2.9%, we continue to observe weakening lead economic indicators for global and local economic activity. For example, the S&P Global Manufacturing Purchasing Manager Index (PMI) has moved into slight contraction which may represent a bit of a headwind for more cyclical share returns. While the gap or “jaws” between economic growth and inflation remains positive, supporting share market returns, it is less positive than it was earlier in 2024.

Globally investor sentiment is no longer euphoric. Bullish (optimistic) investor positioning and sentiment has unwound and now looks more neutral. Investors may continue to be underestimating geopolitical risk particularly in a big year for government elections. In contrast, investor sentiment in the New Zealand share market remains low, with investors holding lower exposure to the New Zealand share market than they historically have. The earnings season could refocus investor attention on underlying fundamentals that may be better than expected. We have used the recent pullback as an opportunity to selectively add to investment in businesses that our research suggests can grow earnings faster and/or for longer than the market expects.

We expect share markets will continue to chop around in the near term, and the best returns will be made at the company specific/sector/thematic levels of the return stack. Investors are now poised for continued volatility. The blend of slow growth, rising inflation, and cautious monetary policy hints at a challenging environment for equities. Investors might see more defensive trading patterns as they navigate through economic uncertainties and await further clarity from upcoming earnings reports and central banks actions.

Within equity growth portfolios, Harbour’s strategy remains to be patient, position for a range of scenarios and be selective, focusing on quality growth. We continue to see the secular tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. Within the portfolio we are selectively overweight growth at a reasonable price (GARP) shares in the healthcare, materials, information technology and financial services sectors given they offer the potential for compound growth. While the healthcare sector may remain dynamic and face further disruption from innovative technology, the reset in investor expectations and valuation multiples provides us with the confidence to sustain a relatively large but share-specific investment in this proven compound growth, wealth-creating investment sector. The information technology (IT) sector’s secular growth potential is underscored by the runway remaining in GenAI, improving IT budgets, and expectations for improving margins but we are mindful of share price valuations. We favour businesses with productivity and efficiency ‘self-help’ programmes, particularly where business reengineering introduces technology that improves both revenue and cost structures. We continue to have a bias to quality, well-capitalised businesses that are positioned to fund value adding growth opportunities.

Our fixed interest strategy remains positive about the scope for rate cuts over the next 2 to 3 years. We are in the unusual situation of having a weak economy, with rising unemployment, yet the RBNZ is continuing with tight monetary policy and the government is tightening fiscal spending. This suggests that the economy will remain soft for the next 6 months. This should enable inflation to fall below 3% and we think it is likely that the RBNZ will cut the OCR this year. While this scenario creates a positive backdrop for the fixed interest market, long-term bond yields face some constraints in terms of their ability to fall. Fiscal deficits require funding and bring increased supply of bonds to the market. Deferral of rate cuts by the US Federal Reserve and caution about the medium-term scope for inflation to re-anchor near 2% all could curb enthusiasm for a meaningful decline in long-term bond yields.

The Active Growth Fund is defensively positioned, being overweight bonds and underweight equities. Despite the recent pullback in global share markets, the current risk/return proposition remains far less than compelling, and we may see a continued period of consolidation in global equity markets. At a headline level, global equity markets (measured by the MSCI ACWI Index) are trading at their 90th percentile valuation when compared to the past 20 years, which is expensive in absolute terms. However, when we look at the forward-looking risk premium relative to bonds, we see an even more extreme outcome, trading at 100th percentile (i.e. expensive relative to history). These valuation levels have historically preceded below-average returns in the following 12 months, which makes us wary of holding a higher weight to equities.

The Income Fund strategy was adjusted last month after recent declines in bond markets, equity markets and the New Zealand dollar. Higher bond yields have prompted us to increase duration in the fixed interest sector. We have added to equity allocation, while remaining modestly underweight and we have bought New Zealand dollars after price declines, again remaining underweight. These changes are somewhat tactical in nature and are happening within our core macroeconomic view that inflation can continue to decline while the economic outlook remains soft in New Zealand. The judgement that the RBNZ will move to cut rates before year end has scope to enable a phase of stronger performance from asset markets.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.