Harbour has been a signatory to the UN Principles of Responsible Investing since 2010 and is also a member of the Responsible Investing Association of Australasia.

- Harbour is adding sustainability as an investment mega trend in our equities process

- We continue to find integration of ESG factors is a positive factor for returns

- An additional overlay of sustainability as a mega trend influence may provide better interaction and allocation of capital

Long term structural mega trends often determine the direction of asset markets, and which assets and sectors perform better. Harbour already considers four key mega trends as critical for long term investing including demographics, healthcare innovation, technology disruption and the growth in Asian middle class through urbanisation. We are adding sustainability as a fifth dimension for our fundamental analysis of investment opportunities.

Through time, regardless of short-term volatility in markets, changes in monetary and fiscal policy, and changing geopolitical settings, companies that benefit from positive structural changes tend to have greater pricing power and attract more capital than those on the other side of the street.

Harbour has added sustainability as one of its key mega trend investment considerations. Harbour’s research indicates that companies who take more responsibility from an environmental, social and governance (ESG) perspective may be more profitable and attract more capital than those companies that don’t.

Harbour has long integrated ESG considerations in its individual security selection criteria and actively engages with companies to improve their ESG practices. Including sustainability as a mega investment trend means where there is a difference in company sustainability ratings, Harbour will tilt investment towards companies that have better sustainability ratings.

What is sustainability from an investment perspective?

From an investment perspective, sustainability covers a wide range of practices that broadly comprise a company’s environmental, social and governance engagement. It considers the impact of company practices on products, employees, customers, society and the environment. There are multiple lenses to consider sustainability. Examples of environmental practice considerations include a company’s emissions, environmental stewardship and environmental management. Examples of social practice considerations include a company’s community relations, health and safety practices, and human rights policies and programmes. Examples at a governance level include business ethics (such as anti-corruption policies), transparency and sustainability of capital structures.

At its core, companies that are improving sustainability are likely to be able to sustain or grow profitability in a society that will no longer tolerate abuse of the environment and its people. With increasing urbanisation and pressure on infrastructure, millennials are most engaged on climate change issues and poor historical governance practices[1]. The rise of millennials who have a strong sustainability focus as consumers are likely to amplify this trend[2].

Source: CHI Proceedings – Green Day December 2001. Images of unsustainable technology. A migrant child from Hunan province sits atop one of countless piles of unrecyclable computer waste imported from around the world.

As populations continue to urbanise, cities will continue to place stress on the environment. Millennials are at the sharp end of sustainability issues as they are over-represented in urbanisation data. A 2014 US study concludes “millennials … (are) broadly supportive of public transportation, recycling, and conserving energy and water … (albeit) there is little evidence that students are becoming more committed to sustainability.”[3]

Companies with excellent sustainability practices, where these are ingrained in corporate culture are likely to see a higher engagement with customers. This trend is seen in industries as disparate as outdoor retailing and financial services.

For example, Kathamandu consistently ranks across several independent surveys as having strong, if not the strongest sustainability and ESG scores. [4] You can access the Kathmandu Sustainability Report by clicking here.

Kathmandu’s top 5 2018 sustainability highlights:

Source: Kathmandu 2018

In contrast, poor sustainability and governance may increase the prospect of consumer backlash, government intervention and a general restraint on profitability. The Australian Royal Commission into misconduct in the Banking, Superannuation and Financial Services Industry highlighted the extent of financial penalties and consequent consumer impact.

More generally, companies that are not improving practices may face falling demand as consumers substitute to more sustainable providers. They may need to increase capital investment and operating costs to improve practices or they may have their ability to operate curtailed by regulation. It’s not only consumers that change direction, investors are more likely to be attracted to allocating capital to companies that are improving their sustainable practices.

Not an either/or choice – there is no return trade-off for poor sustainability

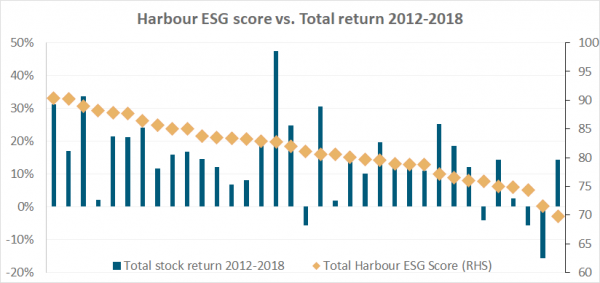

Harbour’s research indicates there is no negative investment return impact from emphasising investing in companies implementing sustainable practices. There is also no obvious sacrifice to portfolio diversification or long-term performance. We think that companies with less sustainable practices often have more volatile return profiles. At a minimum, a focus on corporate sustainability represents part of Harbour’s due diligence process and portfolio risk management approach. The upside to an increased sustainability focus is that companies benefiting from consumer preferences are likely to be more profitable over the long term, lifting share price values and total returns.

Source: Harbour Asset Management 2019. ESG scores are aggregated Corporate Behaviour Survey scores over the time period compared to annualised total stock returns on a one year forward basis.

Companies with better sustainability practices are likely to benefit from the growing global pool of investment funds that invest with a sustainability and positive investing focus. In contrast, companies with poor sustainability practices may see capital withheld and their share prices languish.

As with all mega trends, investors need to take the long view as to when better sustainability practices are reflected in absolute and relative returns. Over the last five years Harbour has observed a significant increase in funds favouring sustainable investments[5], so it may be reasonable to expect differential risk-adjusted returns are likely to favour companies with more sustainable practices over a five year plus time frame.

In Harbour’s view sustainability is an investable mega trend – in the words of Dr Seuss (The Lorax) “It’s not about what it is, it’s about what it can become”.

[1] https://medium.com/@nealsimon/millennials-are-angry-they-should-be-69a3effaefbb & https://www.pewsocialtrends.org/2019/01/17/generation-z-looks-a-lot-like-millennials-on-key-social-and-political-issues/

[2] See Sustainable Millennials. Hanks, Odom, Roedl and Blevis. School of Informatics.

[3] Green cities and ivory towers, shaping millennials consumption practices. Schoolman, Shriberg, Schwimmer and Tysman, Journal of Environment studies 2014.

[4] https://issuu.com/kathmandulimited/docs/kathmandu_susreport_18_hi_res_singl

[5] Global sustainable investments rose 34% in the year to 1 April 2019 to $30.7trillion. 4. https://www.bloomberg.com/news/articles/2019-04-01/global-sustainable-investments-rise-34-percent-to-30-7-trillion

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.