- Some of New Zealand’s non-bank mortgage lenders have provided detailed data that illustrates they appear well-positioned to weather an increase in non-performing loans when COVID-related loan deferrals expire

- Our various probes into the big banks indicate no cause for alarm, albeit we expect loss provisioning needs to rise and small to medium-sized enterprise (SME) lending trends need to be monitored

If you lend to someone who subsequently falls on hard times, it might not be purely from the kindness of your heart that you grant them a period of grace on their repayments. If their hard times are likely to be temporary, it’s probably in your financial interest to give them time to get back on their feet and continue to earn you a return, rather than incurring the costs of foreclosing. By our reckoning, that's a story currently playing out across around 10% of mortgage borrowers and an even greater portion of SME loans. How those borrowers restart their payment habits will have a material bearing on banks’ earnings.

Perhaps ironically, some pejoratively named ‘shadow banks’, i.e. less regulated, non-deposit taking lending institutions, have provided data shining a light on the quality of their lending books. They have disclosed stratification tables of their borrowers’ rationale for opting for COVID-payment holidays and have updated us on borrowers’ employment status as they have continued to check in with customers.

In our research, we expected to find non-banks potentially exposed to larger losses. After all, these non-banks service a greater portion of New Zealand’s self-employed borrowers. However, their data is encouraging. We can see that the vast majority of borrowers sought a payment holiday for precautionary reasons, rather than owing to job losses. Many were in industries that could not access their workplace during the Level 4 lockdown or, for example, relied on commission income. Most encouraging has been the progress as deferrals have begun to expire. Digging into one such lender, Auckland-based private lender Avanti Finance, has seen COVID-related assistance fall from 11.1% of their book to just 2.6%. This assistance level was still declining as at mid-August. At the same time, there has been a modest rise in arrears from those borrowers not receiving COVID assistance. If all 2.6% of the borrowers still receiving payment deferrals were to falter, this would represent a large potential loss but, in our view, this would be a manageable loss.

It should follow that the same holds for the major banks, but verification is difficult with the major banks providing less granular data. Our requests for detailed information have been declined reflecting concerns about ‘commercial sensitivity’. Reserve Bank of New Zealand flow data shows that 7.2% of borrowers (by value) amended payment terms to interest-only at some stage between March and July. New Zealand Bankers Association data shows a similar amount ceased all payments. Adding this to insights from conversations and reviewing covered bond pools, brings us to estimate that around 10% of mortgage borrowers are still receiving a mortgage deferral. We expect the Reserve Bank to shortly announce details of an extension of the deferral scheme. This will assist the banks’ capital positions, allowing them to give borrowers more time to adjust to any change in income they face.

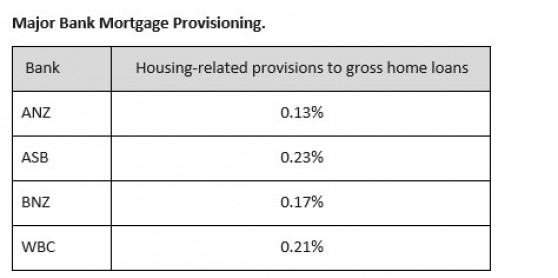

Bank capital provides the last line of defence for bond holders. However, before this comes to the fore, and equity holders’ earnings are eroded, banks’ loss provision reserves absorb the impact of delinquencies. In order to set these provisions, the banks infer expected losses from their macro-economic forecasts. Our prior expectation is that borrowers who sought mortgage deferrals are likely to be the most vulnerable group. Therefore, insights from this group can give us a bottom-up cross check of the bank loss provisioning accounted for in the banks’ most recent results. Based on our cross check, we estimate provisioning was light despite a stronger economic outcome than feared when these provisions were set. If our expectation is correct, a top-up of provisions could weigh on subsequent bank profit results; however, the scale of further provisioning required pales in comparison to the stout capital positions of the banks. We continue to push the banks for transparency to refine our estimates and so we can quantify the risks.

Data to March 2020 for ANZ, BNZ & Westpac Source: RBNZ dashboard. ASB data to June 2020 Annual report.

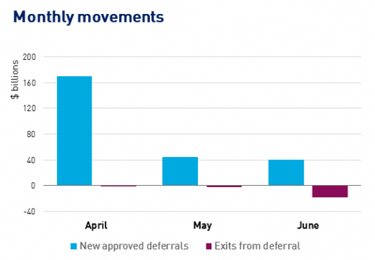

Over in Australia, data from the major banks’ parents tells a similar story with deferrals until June plateauing at a touch above 10% as some deferrals ended. We await the Australian Prudential Regulation Authority’s (APRA) July data given anecdotes of Melbourne’s renewed lockdown leading to further mortgage holidays.

Source: APRA

After analysing mortgage deferral data, we have gained a degree of comfort that mortgage asset quality is manageable. Indeed, we are more interested in the potential for losses from the small business sector, especially in light of the data for Australian banks which shows that 16% of bank loans to Australian SMEs remain on deferred terms. That will be something to monitor more closely.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.