- The RBNZ has confirmed that cheaper bank funding will be here in time for Christmas via its Funding for Lending Programme (FLP).

- This will provide fresh impetus for banks to lower lending and deposit rates.

- Lower mortgage rates will likely boost an already-booming housing market. Lower term deposit rates may encourage consumer spending and a hunt for yield.

The Reserve Bank of New Zealand (RBNZ) has confirmed that cheaper bank funding will be here in time for Christmas. This will provide fresh impetus for banks to lower lending and deposit rates by further reducing bank funding costs.

In its latest Monetary Policy Statement (MPS) decision, the RBNZ said its Funding for Lending Programme (FLP) will be in place from December. It will provide loans to banks at the Official Cash Rate (OCR), currently 0.25%. This is well below the price of other funding sources such as term deposits, at about 0.9%, and 5-year wholesale debt, at about 0.5%. New Zealand banks can initially draw down 4% of their outstanding loans and an additional 2% of these if they increase their lending to the economy. This is almost $30bn of funding if fully utilised.

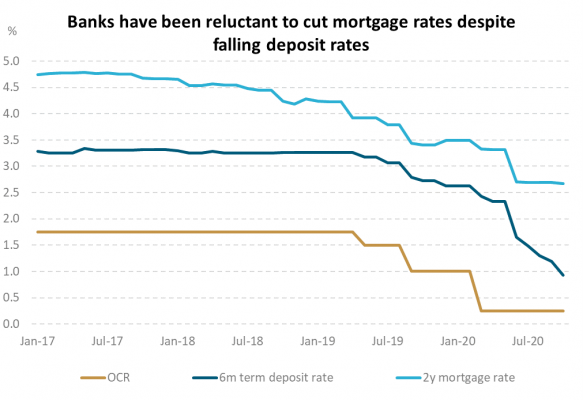

Lower retail interest rates are the RBNZ’s focus. The November MPS was clear; inflation and employment are too low and significant economic uncertainty remains. This augurs for further monetary policy support and the FLP is the chosen tool. RBNZ Governor, Adrian Orr, was also clear in his expectation for banks to lower lending rates and keenly aware that banks have been reluctant to drop mortgage rates since the middle of the year despite term deposit rates being cut by about 70 basis points (0.70%) since then.

Lower mortgage rates will likely provide another boost to an already-booming housing market. New Zealand house prices have increased more than 13% over the past year and are more than 7% above their pre-Covid high, according to data from the Real Estate Institute. There are increasing calls for the government to help slow the pace of increase and improve affordability. These considerations, however, largely sit outside the central bank’s monetary policy objectives. For the Monetary Policy Committee (MPC), higher house prices should help it achieve higher inflation and employment by encouraging household consumption via a housing wealth effect and increasing residential investment. If house price inflation becomes excessive, however, there is a channel through which the MPC may become concerned as it is legally bound in pursuing its objectives to have regard for the soundness of the financial system and seek to avoid unnecessary instability in output.

Increasing house prices are of greater concern to the RBNZ financial stability department and higher loan-to-value ratio (LVR) restrictions are the most likely handbrake. The RBNZ recently announced that it plans to consult next month about re-instating LVR restrictions from March next year (they were temporarily removed in May). Some banks have already started to adjust the terms of lending with ASB, Westpac and ANZ now requiring a 30% deposit for investor housing loans. LVR restrictions, however, are only likely to slow the pace of house price increases, rather than deliver house price declines, given the impetus from lower mortgage rates, insufficient housing supply and favourable tax treatment. We will hear more from the RBNZ on this front when it releases its Financial Stability Report on 25 November.

Term depositors will likely not escape lower returns which may encourage spending and a hunt for yield. Despite term deposit rates halving since March, total balances have fallen just 6% over that time and stand at a whopping $178bn – almost half of total bank liabilities. Term deposit rates have been negative since June, once inflation and tax are subtracted. With the FLP reducing banks’ need for term deposit funding, these rates will likely continue to fall. This may encourage two helpful dynamics from the RBNZ’s point of view: i) Encourage spending over saving - helpful in the RBNZ’s current pursuit of higher inflation and employment; and ii) Encourage a search for alternative sources of income via fixed income or equity investments that may help to deepen New Zealand’s still-shallow capital markets.

We can look to Australia to gauge the likely success of the programme. The Reserve Bank of Australia’s (RBA) slightly more generous Term Funding Facility (TFF) was launched in March and has been effective in lowering bank funding costs. Australian banks borrowed almost all the initial TFF allowance of 3% of outstanding loans, A$84bn, allowing them to reduce reliance on more expensive wholesale funding, and an additional 4% of outstanding loans is now available. Australian 6-month term deposit rates are currently 0.45% and floating mortgage rates are 2.9%, versus 0.85% and 3.25% in March, respectively.

Source: RBNZ, Bloomberg.

Originally published on NBR.co.nz on November 17th

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.