Key Points

- The RBNZ’s quantitative easing (QE), Large Scale Asset Purchase (LSAP) programme has kicked off to a very promising start.

- In a tug-of-war between massive Reserve Bank purchases and NZ Treasury issuance, the Reserve Bank is winning.

- The New Zealand Local Government Authority raised $1.1billion in new bonds issued today – a record amount.

- Along with better COVID-19 news in New Zealand and a rebound in equities, we are starting to see better activity in high grade NZ credit.

- The market is hoping this will flow through to the broader credit market. Early signs are encouraging, but the jury is out on the poor cousins at the lower end of the credit spectrum.

Financial markets are not alone in loving time-honoured phrases to convey ideas. “A rising tide lifts all boats” was originally used by John F Kennedy to suggest that a stronger economy would help everyone. We have learnt over the last couple of decades that it isn’t as simple as that with many people left behind, while others thrive.

However, the Reserve Bank of New Zealand (RBNZ) is hoping that the concept will apply successfully to their quantitative easing (QE) initiative, labelled Large Scale Asset Purchase (LSAP) Programme. It has gotten off to a very promising start. The RBNZ will buy as much as $30billlion in New Zealand Government stock and $3billion in Local Government Funding Authority (LGFA) bonds over coming months. This week marks the third week of the LSAP, with $1.8billion of purchases.

Shortly before LSAP was announced, 10-year New Zealand Government stock yields surged to 1.75%, from below 1.00% only a week earlier. The move was driven by concerns about a massive increase in government stock issuance, to fund the Government’s support programme, coinciding with dreadful market liquidity conditions. The move higher in yields was the largest seen since the late 1980’s when this writer was a rather green bond trader. To their credit, the RBNZ moved quickly, announcing LSAP. Since then, government 10-year bond yields have dropped back towards 1.00%.

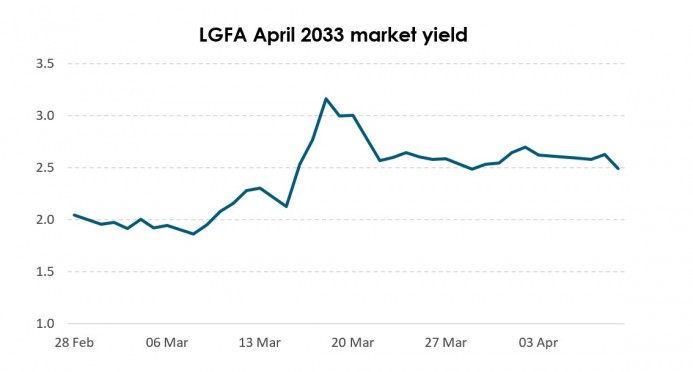

Chart 1. QE has brought liquidity to LGFA bonds and yields have declined

Source: Bloomberg

However, while this happened in the Government stock market, liquidity has remained challenging in the corporate bond market. Trading banks, which provide secondary market liquidity, have been faced with sell requests from investors, driven by underlying clients seeking to exit their fixed interest investments. The corporate bond market, despite its inherent seniority to share capital in a firm, was not immune to COVID-19.

While this created some intense volatility for a couple of weeks, the recent calm in equity markets has been replicated in corporate bonds. Prices have stopped falling, but liquidity hasn’t really improved significantly.

However, the RBNZ’s announcement to include LGFA bonds has enabled a stunningly successful bond issue today. Feedback from the trading banks is that liquidity has re-emerged in the high-grade end of the corporate bond market. It was difficult to find a willing seller this morning. The RBNZ, and especially the LGFA, should be delighted.

So why is the “rising tides lifts all boats” analogy pertinent? If, as we have seen since the Global Financial Crisis (GFC), an improving economy hasn’t helped everyone, might this apply for the weaker credits in the corporate bond market? Given the extent to which economies are weakening, and the pressures being faced by many firms and households, it seems probable that investors will tread carefully with the more challenged issuers. We only see a very small number of troubling issues in the New Zealand market, but offshore they are numerous. Viewed this way, we can see both the benefits and limitations of QE programmes. By bringing liquidity back to markets, many firms will find it easier to refinance debt and remove one source of stress. QE is one crucial piece of the economic and financial support framework. However, it can only do so much.

Credit investors can be well pleased with developments this week but will still need to apply strong credit research to their decisions.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.