Key Points

- Headlines around COVID-19 outside of Asia have continued to worsen and, coupled with the oil spat between Russia and Saudi Arabia, have sharply reduced investment sentiment and created pockets of financial stress.

- While sentiment is clearly downbeat, we need to recognise that there is still a wide range of outcomes that can occur.

- In the event COVID-19 does result in recession, note all recessions have been different.

- While this volatility is unsettling, it is important to put this sell-off in historical context.

Headlines around COVID-19, outside of Asia, have continued to worsen. Rising virus cases in Europe and the US, coupled with the oil spat between Russia and Saudi Arabia, have sharply reduced investment sentiment and created pockets of financial stress. At the time of writing, the US share market is down 27% since its peak, and the New Zealand market has fallen by about 21%, fearing the worst from COVID-19 with little optimism shown towards policy responses thus far.

It is impossible to plot the exact path that markets will take from here. COVID-19 has become more widespread than markets initially anticipated, affecting supply chains and economic activity. This poses a challenging environment for economic policies and forecasting growth. While sentiment is clearly downbeat, we need to recognise that there is still a wide range of outcomes that can occur. We note already that much of China is getting back to work and, in many areas in Asia, there have been no new COVID-19 cases for over a week.

The best-case scenario is that COVID-19 proves to be, as some recent epidemiologists have suggested, less contagious as the northern summer emerges and that a co-ordinated global monetary and fiscal policy response restores market confidence. The worst-case scenario is that the virus takes longer to burn-out or be contained and indeed leads to a global recession. Currently, markets are favouring, and are pricing in, a recession and more financial stress.

Not all recessions are the same

It is important to remember that, in the event COVID-19 does result in recession, all recessions are different. We know this because there have been 11 recessions in post-war America. Some had relatively small impacts on employment and investment markets, while others, like the Global Financial Crisis (GFC) in 2008, had longer and deeper impacts.

The crisis of 2008 was a “balance sheet” recession. House prices in the US had risen sharply in the years prior due to excessive leverage and over-confidence. When the bubble burst, it left a massive hole in household balance sheets and meant households focussed more on reducing debt than consumption (which means the consumer is in a much better position today than they were in 2008). This, in turn, exposed the highly leveraged banking system and led to a collapse in global demand.

The economic shock posed by COVID-19 affects both the supply and the demand side of the economy. Factory and business shutdowns, travel bans and school closures impact the ability of the economy to produce goods and services. The reaction to COVID-19 also means fewer trips to shops, restaurants and cinemas, which represents a demand shock – consumer spending falls. Large falls in the stock market also have a negative wealth effect, i.e. people cutting back on spending due to falling wealth. These effects can sometimes be self-reinforcing, which is something we are watching as it has the potential for a supply/demand recession to morph into a balance sheet one.

While the GFC was a financial shock that affected the demand side of the economy, COVID-19 is an economic shock that affects both the demand and the supply side of the economy. The two situations are fundamentally different; therefore, the length and impact of the downturn should be different as well.

The GFC in 2008 led to a deep recession followed by an extremely slow recovery as households and financial institutions repaired their balance sheets. COVID-19 may trigger large falls in output of affected economies over just the next 1-2 quarters, provided that the virus fades. This is what has been suggested to us by all epidemiologists we have spoken to; activity should rebound as supply constraints are lifted. It is worth noting that in China, where the outbreak started, economic activity (measured using high frequency indicators like traffic congestion and coal consumption) has started to resume as new cases slowed to a trickle and containment measures are relaxed.

Lastly, the economic shock of 2008 was exacerbated by high levels of corporate debt and an over-leveraged banking sector. Today, banks are much better capitalised and corporate debt ratios, especially in NZ, are not alarming.

How are we positioned in portfolios?

Within Australasian equity portfolios, we have become increasingly constructive on investing in growth companies with strong balance sheets, and where the outlook for earnings is less impacted by either the COVID-19 fall out or a cyclical recession. Our buying more recently has broadened as market pricing across many names has improved the opportunity. We are relatively positive about the outlook for earnings in healthcare, consumer staples and non-discretionary. However, we are more wary of cyclical companies, financials and those directly in the firing line of the tourism sector. Normally we would have expected utilities to do well given their earnings certainty, however Tiwai Point negotiations have made it more difficult for investors to hold this view.

Within bond portfolios, we have recently extended duration and are overweight versus benchmark. NZ bonds offer value given i) the OCR may soon approach zero and stay there for an extended period; ii) NZ yields are now among the highest in the developed world; and iii) they should perform well in an environment of further risk aversion. Volatility, however, is high and positions are being sized accordingly. In credit markets, spreads have started to widen, and more is possible, especially for more vulnerable companies. We have made some divestments and remain cautious.

Within the Income Fund and Active Growth Fund, which have both been materially underweight share markets relative to their benchmarks, we are looking to redeploy some of the underweight back into equity markets while overall maintaining cautious positioning. This reflects that, especially for global equities, we are back to valuation levels which are at or near global financial crisis levels and the more severe COVID-19 scenarios may already be in the price.

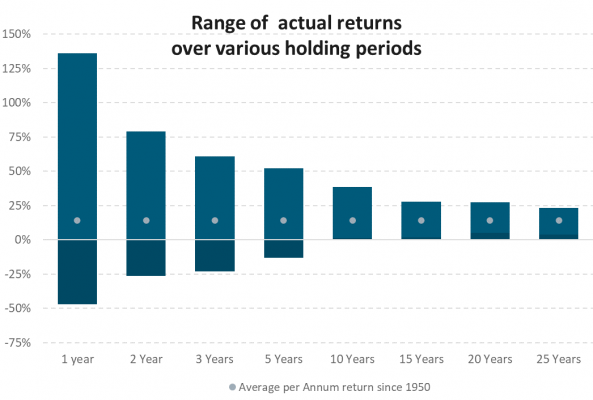

Lastly, while this volatility is unsettling, it is important to put this sell-off into historical context, which the below data, encompassing the 1987 share market crash, the dotcom bubble and the Global Financial Crisis, does. The bars show the highest and lowest per annum return over each of those periods whilst the dots provide an average per annum return over each of those measured periods since 1950.

Source: Harbour, Bloomberg, NZX, Forsyth Barr

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.