- The Commerce Commission’s draft market study into New Zealand’s personal banking services made 17 recommendations which, if implemented, would likely have some impact on bank competition.

- But they likely entail compromises to financial stability

- In Australia, Macquarie Bank’s highly digitized banking solution offering has reinvigorated competition in the deposit and mortgage markets.

- The learnings from this Australian experience encourages examination of the path to licensing and regulating new digital banks or bank offerings in New Zealand. This is likely to be more impactful to invigorate competition as opposed to just injecting more capital which ironically may just lower further return on equity for investors.

Mortgage Competition: The Australian Experience

In 1992 Australian banks were feasting on home loans at margins in the order of 400bps (4%), cross subsidizing the transactional services they provided for little to no fee. The home loan market was ripe for disruption. Enter John Symonds, one of seven children in a family of Lebanese immigrants. With hard knocks from the 11 schools he attended and a $10,000 loan from his older brother, Symonds set up Aussie Home Loans, offering a 24-hour underwriting service and drastically cheaper mortgages with the use of a new “technology”: securitisation funding (mortgage-backed securities).

Supported by a healthy mortgage broking ecosystem Aussie Home Loans and a cohort of imitators contributed to bank home loan margins collapsing in half. Competition from this non-bank sector has ebbed at times, such as during the GFC when the mortgage-backed securities market was gummed up. More recently, this was evident when the banks benefited from cheap government funding during Covid, however securitisation and brokers have structurally changed the market in the consumer’s favour.

The Australian mortgage market is once again being disrupted. With a highly digitized offering, the upstart this time is 55 year old Macquarie Group, attacking the banks from two angles. Without the overhang of an expensive branch network, to fund its growth Macquarie’s bank subsidiary is offering sharper deposit rates, including the radical move of offering interest on transactional (cheque) accounts. Most of the major banks have been reluctant to match this strategy given the cost it would impose on their large stock of on call balances. Using its funding advantage, Macquarie Bank is targeting profitable segments of the mortgage market with meaningfully lower rates. Two of the major banks, Commonwealth Bank and National Australia Bank, have started their own digital banks, Unloan and UBank respectively. The other two, ANZ and Westpac, have countered by moving towards Macquarie’s pricing, especially for mortgage lending.

Commerce Commission’s market study into New Zealand personal banking services

Learning from the Australian history, we examine competition in the New Zealand personal banking market.

We broadly agree with the Commerce Commission that New Zealand personal banking is not highly competitive. This is a feature of many industries in New Zealand where global comparisons with large scale operators are complex given the small relative size of the customer base in New Zealand. Of course we can do better in many areas. While the recommendations may benefit consumers, in our view consumers would benefit most from competition from new entrant digital banks or extended digital offerings from the existing regulated banks.

Taking the key recommendations in turn:

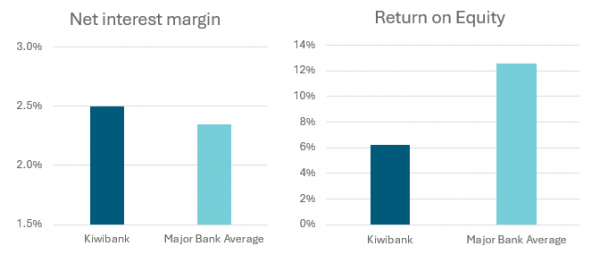

Improve the capital position of smaller providers and Kiwibank

Injecting capital into Kiwibank is the most headline-catching recommendation in the draft Commerce Commission report. As fund managers, naturally we would welcome Kiwibank’s public listing[1]. But we would only likely find a listed Kiwibank significantly attractive as an investment if it was competing to win consumers rationally and earning a cash profit significantly above its cost of capital. It is already earning a slightly higher net interest margin than the major banks. The real focus for investors investing in the bank sector is the prospective path for profitability and lifting return on equity into the double digits. Kiwibank recently has been reporting a return on equity in the 7-8% range. Banking benefits from scale given the significant fixed cost investment in technology and compliance. Further scale could take Kiwibank closer to required returns. The major banks experienced a return on equity of closer to 12% in their New Zealand businesses in 2023.

Borrowing from Australian learnings again, Gina Cass-Gottlieb, Chair of the Commerce Commission’s Australian counterpart recently noted that in Australia it is differentiated business models that create competition not necessarily a larger number of scale rivals.

This is our key assertion: to really create competition you need innovation and the challenge from a different business model. Capital itself doesn’t create innovation. To be fair to the Commerce Commission, they likely agree with this, however the Commission likely has limited influence.

Source: RBNZ Dashboard for each bank’s most recent financial year end.

Accelerate progress on open banking

Having legislated open banking in 2018, the UK provides a useful comparator. Our observation is that open banking can facilitate an improved customer experience (and provide banks useful risk management insights), but the competition benefits on the large profit pools of deposits and mortgage lending are less obvious. Open banking is often seen as a threat to local competition as it may benefit large global scale technology companies that are already the major competitors in our payments system.

We do however see significant potential in an adjacent avenue untouched by the market study: enabling a digital banking licensing regime.

Ensure the regulatory environment better supports competition

The Commerce Commission cites five areas where other regulators could cut the smaller banks some slack, giving them more scope to compete. Underpinning much of this logic, the Commerce Commission refutes the existence of a trade-off between competition and financial stability. To quote the report:

We query the Reserve Bank’s apparent view that under a risk-based approach, the smaller providers who are more heavily levied are likely to see a greater net benefit from the DCS [Depositor Compensation Scheme].

We think this query is misplaced. The demise of SVB last March provides clear illustration of the risk emanating from smaller, less-regulated banks. The subsequent deposit flight from smaller deposit taking institutions demonstrates that smaller banks do indeed benefit more from deposit insurance. Lending credence to this, new migrants favour big banks because they seek trust in established brands.

The Commerce Commission suggestions are likely to increase competition, but there is no free lunch.

Empower consumers

The Commerce Commission makes a further six recommendations aimed at reducing consumer friction. The recommendations make sense, but they butt against customer apathy. For most of us changing our bank accounts is a task we’d rather avoid, even if it was made marginally easier. The Australian Competition and Consumer Commission has recently made similar such recommendations with limited subsequent industry change.

Within the same category of recommendations, we would also caution against the unintended consequence of increasing the regulatory burden on mortgage brokers. Recent years have seen a marked increase in the penetration of mortgage brokers in New Zealand. The price discovery and negotiating power this sector provides is a friend to competition.

What change will the report actually bring about?

The Commerce Commission’s Australian counterpart (The ACCC) has recently probed both its local mortgage and deposits markets separately with limited subsequent impact. Instead, the sustained periods of banking competition we have observed can be attributed to new entrants adopting new technology.

While not providing any ‘silver bullet’ recommendations, we suspect in concert the recommendations would have some positive impact on banking competition (but at the potential cost of financial stability). Whether that is seen in practice when the final draft is delivered in August, will depend on how Finance Minister Nicola Willis takes the baton; it is difficult to envisage the Department of Internal Affairs relaxing anti-money laundering stipulations of its own volition. Rather than spreading her efforts across all 17 recommendations, we’d council Willis to court enhancing competition through innovation as opposed to just encouraging more capital into the banking system.

The final part of this series covering contemporary issues in the banking sector looks at the prospects for bank shares in light of strong recent performance. This will be published early next week.

[1] Kiwibank needn’t be listed to receive more capital and the recommendation isn’t explicit here. Using a taxpayer capital injection to pursue uncommercial lending may benefit its customers but would come at a deadweight loss to taxpayer shareholders.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.