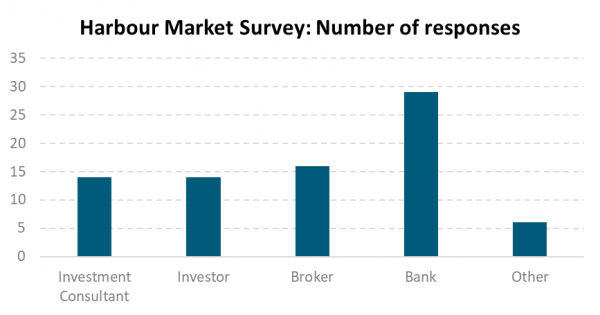

- In our inaugural Harbour Market Survey, we asked almost 80 investment consultants, investors, brokers and banks some key market questions.

- Most respondents felt it was a good time to fix your New Zealand mortgage and that NZDUSD was likely to appreciate over the next three months, but they only marginally favoured adding riskier assets to portfolios – implying some weakening in the recent strong relationship between NZDUSD and risk assets. NZDAUD views were mixed.

- Banks provided the gloomiest outlook with most in this group thinking: it is not a good time to fix your mortgage or add to riskier assets in portfolios, NZDAUD will depreciate and the greatest market risk is economic growth disappointing. In contrast, investors and consultants were generally more positive.

- A second wave of COVID-19 infections and disappointing economic growth were seen as the greatest market risks over the next six months.

We had almost 80 responses to our inaugural Harbour Market Survey, conducted from 2 to 10 July. Banks made up 40% of total responses. Investment consultants, investors, and brokers each represented about 20% of total responses. Totals are equally weighted. The key results are below and for full data, please download the linked excel file.

Source: Harbour Market Survey.

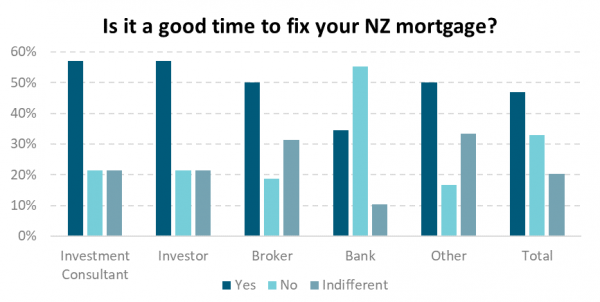

Interest rates: A good time to fix your mortgage

Source: Harbour Market Survey.

Most survey respondents felt it was a good time to fix New Zealand mortgages. It is difficult, however, to know whether this reflects the historically low level of mortgage rates, or expectations that short-term interest rates are likely to increase. Two-year special fixed mortgage rates, for example, have fallen 80 basis points this year to 2.7% versus an average of 4.6% over the previous two years. Banks were the notable exception, with most among this group, thinking it was not a good time to fix.

We think the prospect of lower short-term interest rates is material, as weak levels of economic output likely persist, unemployment rises towards year end and inflation falls close to zero in Quarter 1 2021. The Reserve Bank of New Zealand (RBNZ) continues to talk about the prospect of a negative Official Cash Rate (OCR) if the economic outlook warrants additional monetary policy stimulus. The central bank, however, has committed to an unchanged OCR until March of next year, largely to allow banks to prepare systems to be able to manage a negative OCR.

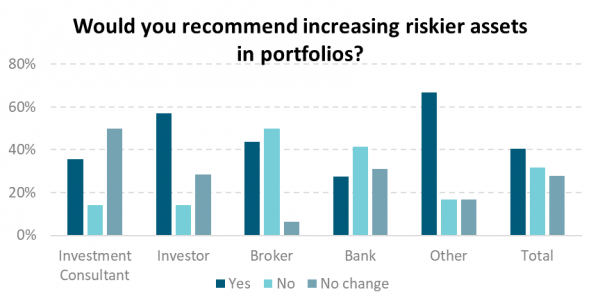

Risk appetite: Slight bias to increase riskier assets in portfolios

Source: Harbour Market Survey.

Appetite to increase riskier assets in portfolios was strongest amongst investor and other categories, with more than 50% of them recommending adding riskier assets in portfolios. Views elsewhere, however, were much more balanced and perhaps reflected the recent strong rebound in risk-sensitive assets. Global equities, for example, are more than 40% higher than their 23 March low, and 5% below all-time highs. Strongest views were found in the broker community with only 6% recommending no change.

In Harbour’s multi-asset portfolios, we have a similarly balanced view and recently trimmed our equity overweight given the sharp recovery in equity prices. However, we still retain a small growth overweight as equities continue to offer a good risk premium over bonds and are around fair value using normalised price to earnings measures.

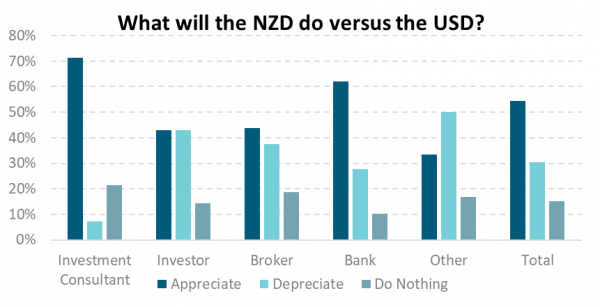

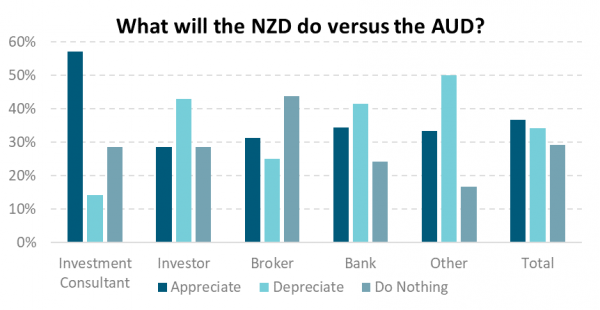

The NZD: To appreciate versus the USD but move sideways versus AUD

Note: Time horizon for these questions was the next three months. Source: Harbour Market Survey.

Responses from investment consultants and banks showed a clear view of NZD appreciation versus the USD over the next three months. Other survey participants, however, had a more balanced view. When it comes to NZD versus the AUD, views were mixed. Investment consultants had a strong view of NZDAUD appreciation, while most investors and banks think the opposite. Brokers, while most keen to opine on risk in portfolios, were the most neutral in this space.

We think NZDAUD depreciation is most likely over the next three months. Despite the recent pickup in COVID-19 cases in Victoria, Australian economic outcomes are likely to be better than in New Zealand given the less stringent COVID-19 lockdown and lower contribution of tourism to Gross Domestic Product (GDP). Most estimates of NZDAUD long-term fair value sit below current levels. However, we have added some foreign exchange (FX) hedging of our Australian equity exposure (25%) following the NZDAUD depreciation of almost 8% between March and May.

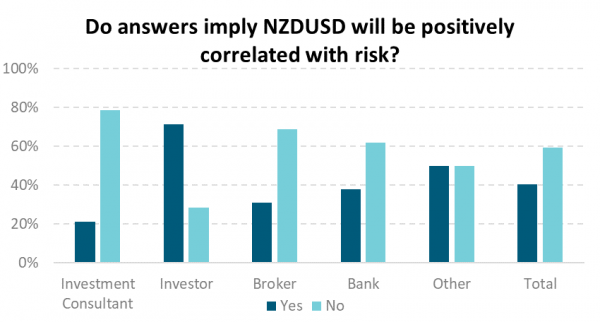

Note: To determine this we assume respondents believe NZDUSD will be positively correlated with risk if they answer in any of the following three ways: 1) Recommend increasing riskier assets and expect NZDUSD appreciation; 2) Don’t recommend increasing risker assets and expect NZDUSD depreciation; or 3) No change in riskier assets and expect NZDUSD to do nothing.

Source: Harbour Market Survey.

The NZD has recently shown a high correlation with risk sentiment (proxied by global equity returns, for example) but our survey results imply most do not expect this to continue (investors the notable exception).

Greatest market risks: Second COVID-19 waves and disappointing economic growth

Thinking about the next six months, respondents worried most about a second wave of COVID-19 infections and economic growth disappointing. These are also the key areas we are monitoring, along with the 3 November US election, where a likely victory (based on polls and betting odds) for Democratic candidate Joe Biden may result in higher corporate tax rates. Our own general election on 19 September is a further risk for markets.

Source: Harbour Market Survey.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.