- At some stage the world may learn to live with COVID-19 and, while that may be hard to believe in the middle of a local lockdown, this pandemic may eventually morph into an endemic.

- From an investment perspective, we need to accept that this is likely and it will allow markets to continue to swing attention to other risks like climate change, inflation, interest rates, disruption, regulation, innovation and corporate earnings.

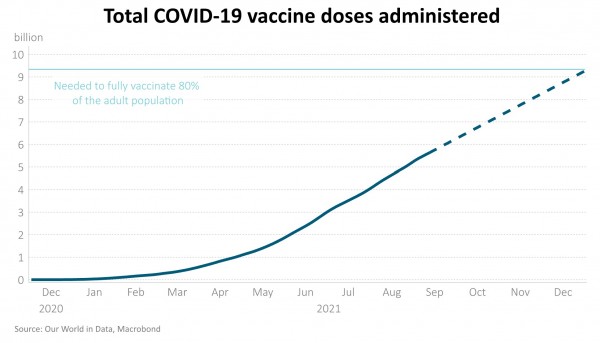

- That path may not be straightforward but two data points are encouraging. First the US and European rate of new COVID-19 infections looks to have peaked and, secondly, by the end of this year close to 80% of the world’s adult population are expected to be fully vaccinated.

In New Zealand today, it may seem impossible to imagine a world where COVID-19 isn’t the primary influence on society. This is because the Delta strain changed the picture on immunity thresholds as the estimates of the effective reproduction number gapped higher from about 3-4 to numbers likely in the 5-7 range. As a result, previous estimates of equilibrium vaccination thresholds were thrown out. A combination of potentially fading immunity, new strains of COVID-19 and population growth all point to developing new thinking around eventually living with COVID-19 and treating the disease as endemic – constantly present but limited to pockets of the global population, making the disease spread and rates predictable.

Developing those strategies is an easier task for countries with high vaccination rates. For instance, at the current rate, projections for the UK point to over 90% of those aged 18 years and older being vaccinated by December this year. Similar data points are evident for most European countries and several US states. Given the current acceleration in vaccination progress in New Zealand (and Australia), similar achievements also seem within reach by the end of this year.

Whilst the current noise is around where we stand in vaccination percentages today, and anecdotes around vaccine hesitancy, more work is underway. We are moving to consider what the world might look like when we reach vaccination rates approaching reasonable thresholds. Hence scientists are pressing governments on various testing regimes, perhaps booster shots, and limiting the circulation of unvaccinated people. Additionally, calculations regarding pressure points in hospitalisations and, especially ICU capacity, become critical in considering how and when we treat COVID-19 as endemic.

A change of mindset

Most travellers to Asia, particularly Japan, know that mask-wearing through influenza virus waves is a normal mindset. Each year influenza sadly kills close to 1% of the people that become symptomatically infected. Once we achieve near our maximum vaccination capability for COVID-19, and immunity to severe infection builds, it seems likely that a scientific and political consensus may arrive at how we live with COVID-19 without ongoing severe business and household disruption.

Already in Europe, the use of vaccine passports, rapid testing and masks in crowded circumstances have seen a significant rise in mobility between countries. It may seem hard to make the comparison between current trends in Europe and New Zealand given the totally different approaches to the pandemic response. However, at some stage from a comparative position of strength, New Zealand will need to consider a new equilibrium with COVID-19 treated as an endemic disease where vaccines and treatments become the fresh battle ground.

What about the economy as we shift to an endemic?

We have seen the V-shaped recoveries slow somewhat in recent months. Businesses have reported some excellent revenue and profit results, but many seem less confident about near-term growth. Most recent worries have focused on the likely default of Evergrande, China’s second largest and most indebted property developer. Of specific concern is the impact that may have on further slowing China’s economic growth via reduced property investment (for further discussion please see Implications of an Evergrande default, 17 September 2021).

In part, this slight pull back in confidence from very high levels reflects the information flow from some global indicators, which have stuttered to a slower growth rate. Some economies in Asia have seen various lockdowns, the consumer in the US has pushed the pause button in several less vaccinated states and ongoing bottlenecks have restricted global trade.

There is evidence in the US that hotel occupancy and flight bookings, along with consumer discretionary spending, took a back seat in August. Some employment indicators also disappointed. However, we expect US activity to regain momentum from October onwards, as offices re-open and business travel & entertainment gradually resumes. As the US economy moves into 2022, investors can also consider the combined likely impact of a lot more infrastructure and business stimulus along with perhaps less supportive monetary policy.

Similarly in New Zealand, many businesses are feeling more than just a pinch today. The reduction in alert levels for Auckland will be encouraging for some. However, large parts of the region’s economy are not operating and, while wage subsidies help retain staff, they don’t replace revenue. As New Zealand emerged from lockdown last year, household savings were high, and government support programmes were extensive, the housing market was roaring, and consumption lifted sharply. It seems less likely we will see the same enduring surge in the next few months and, to top it off, some monetary support is likely to be removed.

However, we need to begin to approach a new equilibrium, one where growth is not defined by huge and unsustainable fiscal packages, or near-zero interest rates that distort saving and investment decisions. Children need education, the unwell need full access to healthcare, and businesses need to consider their next investment decision.

A COVID-19 endemic equilibrium may require savers to temper expectations of investment returns. A well-diversified portfolio needs to consider a world where new risks of higher inflation and interest rates, and the challenge of disruption from climate change are greater influences on investment returns. To enter that new world, we first need one thing – to get vaccinated.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.