The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed interest, credit and equity markets.

- The New Zealand equity market (S&P/NZX 50 Gross with imputation) finished the month up 1.4%. The Australian equity market (S&P ASX 200) outperformed, rising 3.5% for the month (2.2% in NZD). The performance of global equities was also strong with the MSCI All Country World Index up 4.2% (+1.9% in NZD).

- Bonds generated a positive return, with the Bloomberg NZ Bond Composite Index up 0.7%.

- The US Earnings Season delivered strong results. At the time of writing 438 companies have reported, with 380 beating consensus earnings expectations.

- Vaccinations have gathered speed in the US and Europe; 45% of people in the US and 25% in large euro area countries have received at least one vaccine dose. The New Zealand vaccination programme has started and is expected to ramp up significantly in coming months. We will be watchful for key milestones.

Key developments

Strong economic data, a fall in bond yields and a positive US company reporting season saw equity markets continue to move higher. Longer term government bond yields fell, which may reflect rebalancing by pension investors from equities to fixed interest. New Zealand Government 10-year bond yield fell from 1.81% to 1.65% over the month. Globally, growth stocks, especially within the tech sector, bounced strongly, benefitting from falling rates. This helped the MSCI All Country World Growth index outperform the Value index by 2.9%.

The US quarterly earnings season gathered pace in April. At the time of writing 87% of companies who have reported had beaten consensus earnings expectations. The beats were most prominent in the financials sector, where we saw many banks pare back overly cautious loss provisions. 2021 earnings are now projected to be 13% higher than they were at the start of the year. Interestingly, the market attitude towards earnings announcements has been along the lines of “buy the rumour, sell the fact” with share price reactions muted after strong earnings results.

The global economic outlook continues to brighten as vaccine roll-outs have gathered pace and data have mostly beaten expectations. 45% of people in the US and 25% in large euro area countries have received at least one vaccine dose. US economic data have been particularly strong. The US economy is likely to grow by 6-7% this year, reaching above-trend output in H2. China is also expected to contribute meaningfully to the global recovery, likely growing 8-9% in 2021 as the Government appears more willing to support the recovery than markets had previously assumed.

New Zealand is now on a path to full border re-opening and a return of international tourists. The trans-Tasman travel bubble was opened on 19 April and one with the Cook Islands is due to be opened on 17 May. The outlook for the housing market has become less positive with the unexpected removal of interest rate deductibility for property investors likely reducing demand from this group. The change significantly reduces cash flow for incoming property investors who are already being targeted by the Reserve bank of New Zealand (RBNZ) via lower loan to valuation ratio (LVR) restrictions. From 1 May, no more than 5% of new lending can be to investors at LVRs greater than 60%. The RBNZ is also due to provide advice to the Government on additional tools to reduce risks in the housing market, including debt-to-income limits and restrictions on interest-only lending. The housing wealth effect is relatively strong in New Zealand with a 10% drop in house prices translating to a 1-1.5% drop in consumption.

Markets have increasingly focused on the prospect of rising inflation, as evidenced by US inflation-indexed bonds, which currently price in 2.5% inflation over the next ten years. Surging demand and supply bottlenecks have caused the prices of commodities, semi-conductors and many other parts to rise. Businesses across developed countries are showing clear intent to lift their prices.

What to watch

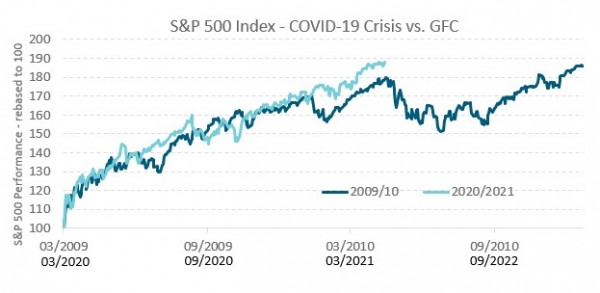

Where we are in the equity market recovery: The strong bounce back from equity markets from the lows experienced in March last year has been pleasing for investors. This bounce back so far has not been atypical relative to other market rebounds we have seen in the past as we can see below when comparing the bounce back from March 2020 lows to the global financial crisis. The first phase of the rebound was driven by a recovery in valuations, which had fallen to low levels during the market selloff. The second phase by forecast earnings upgrades and the last leg driven by actual earnings delivery. While we don’t think markets will track the exact same path from here, as record monetary and fiscal stimulus has put household and corporate balance sheets in a better relative position, the gains from here will be harder fought.

Source: Bloomberg

Market outlook and positioning

The combination of stronger-than-expected global growth, and central banks globally continuing to provide liquidity to support economic activity, has created a supportive framework for share market returns. The US equity market reporting season has generally been positive, with companies beating conservative expectations, supporting solid returns over the month. The March profit reporting season (the smaller of the quarterly reporting seasons) for the New Zealand and Australian equity markets is underway, with potential for earnings to beat conservative expectations. However, with valuations full for some parts of the market it’s time for earnings to do the heavy lifting to provide support for equity market returns.

Within equity growth portfolios over the past six months, we have reduced exposure to technology and smaller growth companies, as we saw potential for these companies’ share prices to fall under pressure as interest rate expectations reset. We increased cyclical weights (particularly financials and resources) and positions in quality growth companies, remaining generally constructive on the equity markets. The portfolios’ largest tilt remains into the healthcare sector, including some biotechnology names, in addition to our positions in retirement/aged care companies including Summerset, Ryman, and Oceania. The portfolios have continued to increase investment in Australian stocks as Australian market earnings revisions have been positive for 8 months straight; the longest streak in over two decades. Our research suggests there may be more to come. Importantly, we are seeing a greater number of attractive stock specific investment opportunities in the Australian market than we have for some time.

Within fixed interest portfolios, our investment strategy continues to reflect the medium-term view that global economies will recover, with the increasing probability that inflation rises persistently above 2.5%. In this regard, we differ from the RBNZ and US Federal Reserve, which both see a near-term rise in inflation as temporary. We continue to see activity data exceed market forecasts, with businesses increasingly indicating a strong intention to raise prices and restore profit margins in the face of rising costs. Bottlenecks, partly caused by pressure on global shipping are behind most of the price rises. Shipping pressure may prove to be temporary; businesses and consumers are sustaining demand at present and shortages in semiconductors, electrical parts and building supplies may continue. Re-opening economies, stimulated aggressively by governments and central banks is bringing surging consumer demand. Our judgement is that there may be a behavioural aspect that develops as prices rise. Inflation might beget more inflation. In portfolios, the strategy for protecting investors from the negative impact of rising yields are clear. Our strategy is to be short duration and continue to hold inflation-indexed bonds. We are also cautious about corporate bonds issued by firms that may be pressured by rising re-financing risks.

Within the Active Growth Fund, the fund is modestly overweight equity securities. The Fund holds significant positions in real estate and global listed infrastructure, both sectors where there is scope for loss provisions put in place last year to be unwound. The Fund still holds an underweight position to bonds; while the better yield on bonds gives them more scope for downside protection, in the nearer term we still see inflation pressures continuing.

The Income Fund has held an equity exposure close to neutral. The rise in long term bond yields has encouraged us to invest more in longer dated fixed interest securities, but this is off a very low base. We continue to hold a large exposure to inflation-indexed bonds, which provide the Fund with some protection in the event of large upward inflation surprises. Strategy has been focused on capturing the potential gains from equity earnings growth, while keeping the core of our equity holdings in stable, dividend producing companies.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.