- Despite substantial increases in wholesale interest rates over the past 6 months, retail rates have mostly declined as the Reserve Bank of New Zealand has kept the Official Cash Rate unchanged and offered cheap bank funding through its Funding for Lending Programme.

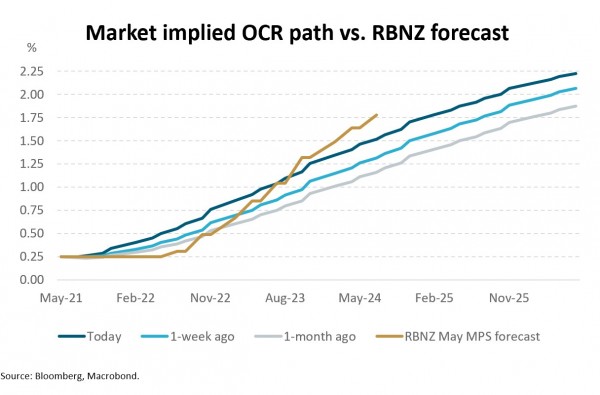

- The Reserve Bank of New Zealand is now more confident in the economic outlook and forecasts a larger amount of interest rate hikes than markets currently expect, beginning in Q3 next year.

- As financial markets price the prospect of earlier and more rate hikes, increasing banks’ wholesale funding costs, retail interest rates are likely to rise, starting with 2-year and longer mortgage rates over coming months, while meaningful increases in term deposit rates may happen later and be more gradual.

What have interest rates been doing recently?

Wholesale interest rates have been heading higher since October last year, when New Zealand 2- and 3-year swap rates bottomed at 0%. These are now 0.60% and 0.90% respectively. The increase reflects:

- Vaccinations allowing a re-opening of the global economy and unleashing consumers with large amounts of savings.

- Large global central banks that continue to dismiss inflation risks and keep monetary policy accommodative.

- Ongoing fiscal support. The US, Australia and New Zealand have all announced larger-than-expected spending plans this year. The US gained most attention with its US$1.9trn package taking the total amount of US Government stimulus provided since the COVID-19 pandemic began to almost 30% of GDP.

- A reversal in Official Cash Rate (OCR) projections from the Reserve Bank of New Zealand (RBNZ). Negative cash rates are now unlikely and rate hikes are expected if the economic recovery continues.

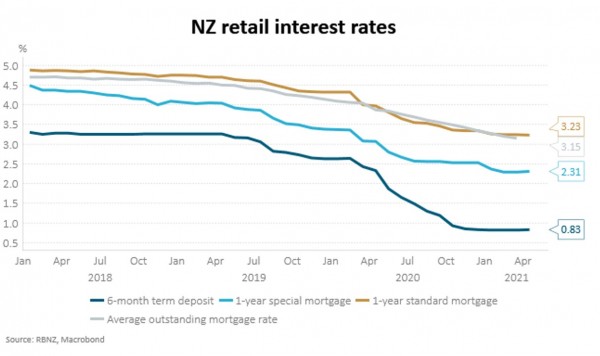

Retail interest rates, on the other hand, have mostly fallen slightly over this time. With the RBNZ keeping the OCR unchanged at 0.25% and the Funding for Lending Programme (FLP) providing banks 3-year funding at a floating rate equal to the OCR, average 6-month term deposit rates have fallen from 0.93% to 0.83% and 1-year mortgage rates dropped 0.20% to 2.3% (see chart below).

Why would retail interest rates start to rise in New Zealand?

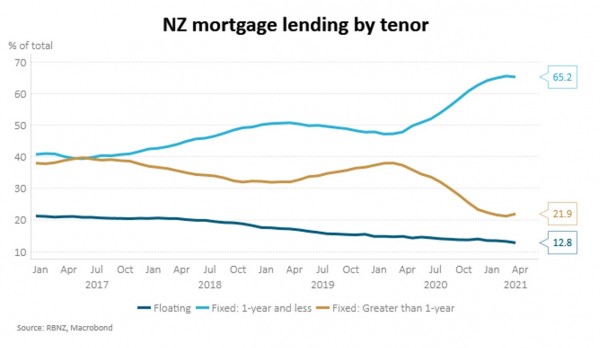

Some already have. In the past month, 5-year mortgage rates that had previously been below 3% are now about 0.40% higher. However, mortgages fixed for more than 1 year only make up 22% of total outstanding mortgages (see chart below). Some term deposit rates have also started to rise, with BNZ, for example, increasing its 12-month term deposit rate by 0.30% since the end of April.

In the RBNZ’s May Monetary Policy Statement, it recognised the better-than-expected state of the economy and improved outlook. It also felt confident enough to reintroduce an OCR forecast with the first 0.25% hike in Q3 next year and a further 1.25% of hikes to Q2 2024 – about 0.50% more than markets were pricing prior to the meeting (see chart below).

As financial markets price the prospect of earlier and more rate hikes, increasing banks’ wholesale funding costs, retail interest rates may also rise, with longer-term rates leading the way. Popular 6-month term deposit rates and 12-month fixed mortgage rates will rise more slowly and in line with actual rate hikes from the RBNZ. Access to the Funding for Lending program may also slow down the move. However, if we look 3 years into the future, deposit and mortgage rates could be 2 percentage points higher than at present.

What does that mean for housing?

Interest rates are only one driver of house prices and, historically, have been less important than population growth and the unemployment rate, according to our analysis.

Our housing model suggests that if population growth settles at its natural rate of 0.5% year-on-year (births less deaths), the unemployment rate remains at 4.7% and mortgage rates increase 1.00%, house prices will not necessarily fall (for more details on the model, please see How vulnerable is our housing market, 17 March 2020).

Recent Government and RBNZ measures to curb investor housing demand, removing the ability to deduct interest from taxable income, extension of the “bright-line” test for capital gains tax and lower Loan-to-Value Ratios (LVRs), are likely to create headwinds for house prices but the impact is uncertain. Additional uncertainty comes from the Government’s recent announcement to review New Zealand’s migration settings.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.